Former President Donald Trump’s renewed threats to impose tariffs on eight European nations—including Germany, France, and the UK—have sparked fresh trade tensions and market volatility. The proposed levies, starting at 10% in February and potentially rising to 25% by June, have prompted swift preparations for EU countermeasures, including potential retaliatory tariffs and trade restrictions. As economic uncertainty grows, the Euro and British Pound face downward pressure against the U.S. Dollar, with investors closely monitoring both political developments and key technical levels for both currency pairs.

Major Points :

Renewed Trade Tensions: Trump has threatened tariffs on eight European allies, beginning at 10% in February and escalating to 25% by June if no agreement is reached over Greenland.

EU Preparing Retaliation: European leaders are urgently considering countermeasures, including using the EU’s “anti-coercion” tool and reinstating €93 billion in retaliatory tariffs.

Economic Impact: Analysts warn European GDP could shrink by 0.25% in 2026, with U.S. firms already slowing hiring due to uncertainty.

Currency Market Reaction:

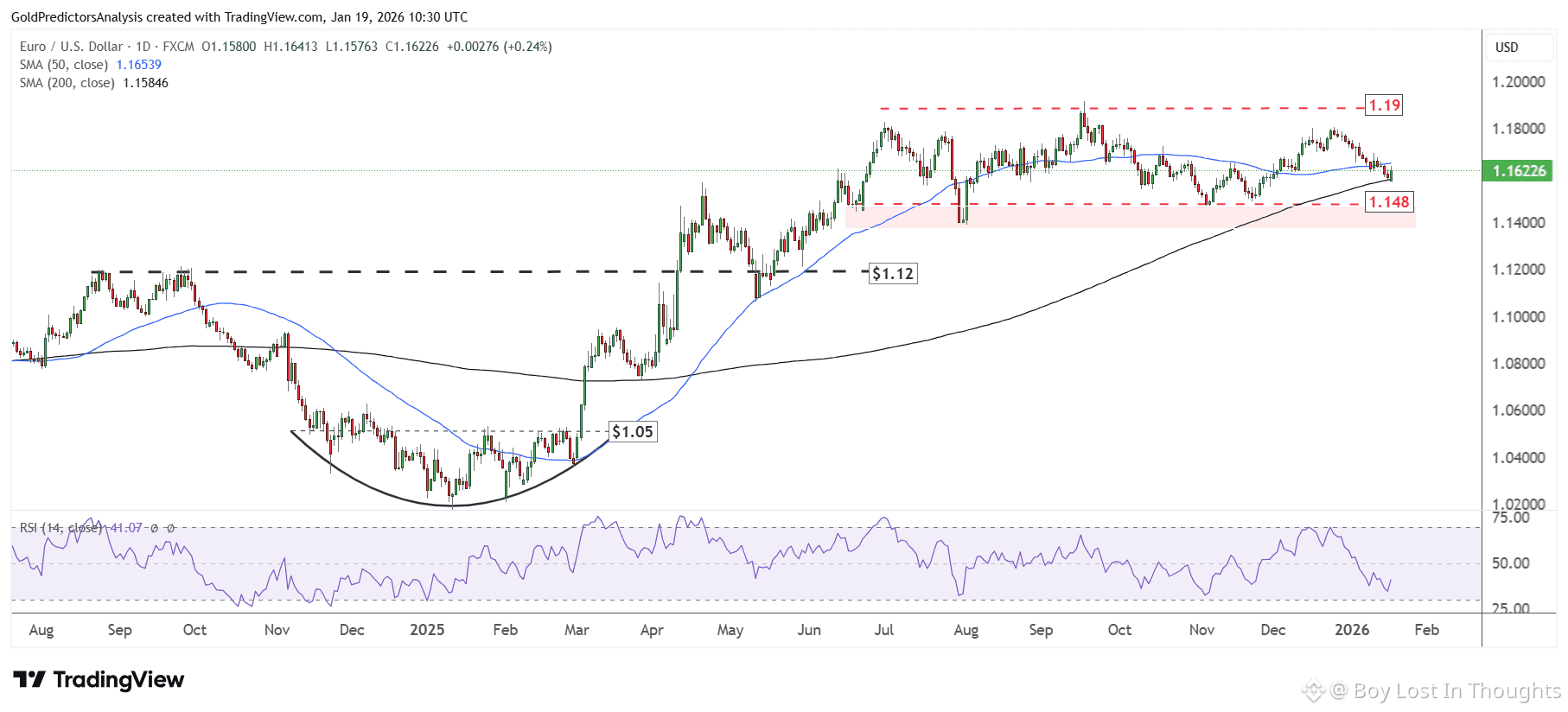

EUR/USD: Trading between 1.148 and 1.19; a break above 1.19 could signal a rally, but trade fears weigh on the Euro.

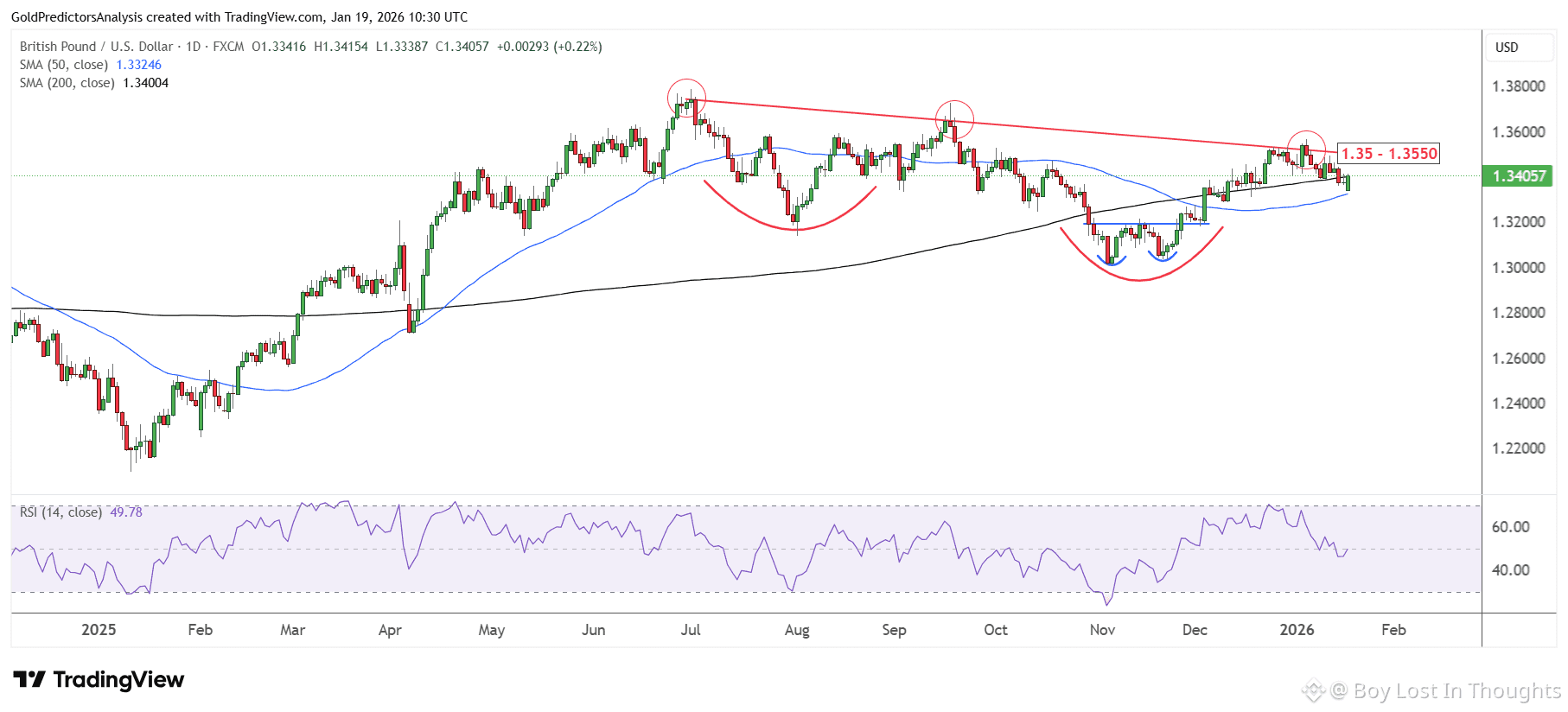

GBP/USD: Pressured by direct UK inclusion in tariff threats; key resistance lies at 1.35–1.3550, with support at 1.3180.

Broader Risks: The move threatens long-standing U.S.–EU trade and defense ties, with a major trade deal now unlikely in the near term.

Outlook: Heightened volatility is expected for both currency pairs as trade negotiations unfold, keeping traders focused on headlines and policy responses.