Natural gas is rallying sharply as freezing temperatures drive immediate heating demand, while traders anticipate further cold later in January. However, ample inventories are expected to temper long-term gains, making the move highly dependent on the severity and duration of coming winter weather.

Key Points :

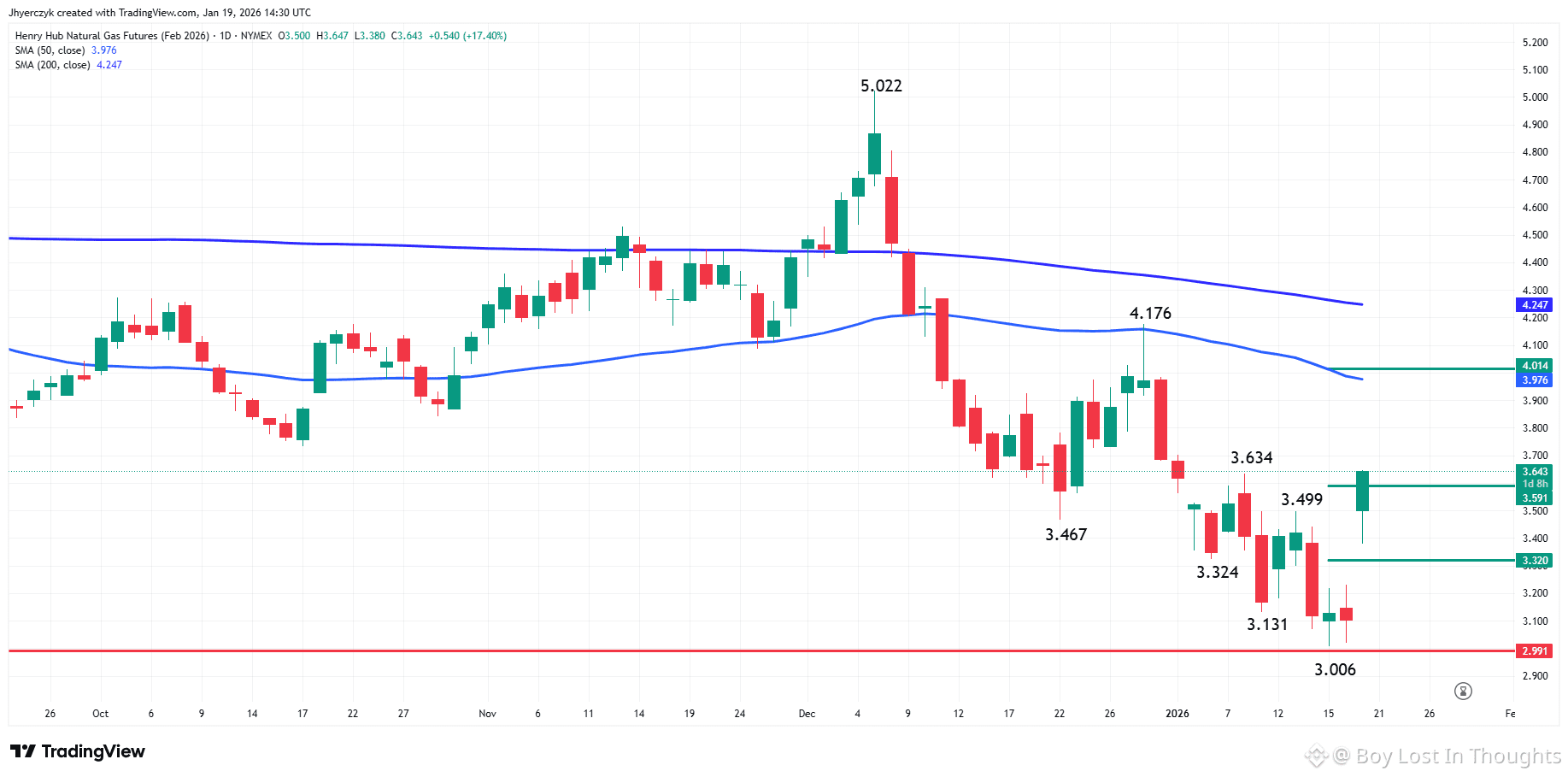

🚀 Prices Gap Up Sharply: Natural gas futures surged more than 16%, gapping higher on the daily chart as a severe cold front sweeps across the U.S., reaching as far south as Florida.

❄️ Unexpected Demand Spike: A winter storm warning has expanded forecasts, driving hazardous wind chills from the Midwest to the East Coast and boosting heating demand beyond earlier expectations.

📈 Late-January Arctic Intrusion: Traders are eyeing forecasts for January 26 – February 1, which predict another strong cold wave that could further lift demand and increase storage withdrawals.

📊 High Inventories Cap Gains: Despite the demand spike, storage levels remain well above the five-year average, limiting sustained price increases and suggesting rallies may be short-lived unless prolonged cold sets in.

⚖️ Technical Breakout in Play: Prices are testing key resistance near $3.634. A break above could target the 50-day moving average around $3.976, with the 200-day average near $4.247 as a longer-term hurdle.