The cleanest way to understand Plasma is to stop treating it like another general-purpose Layer 1 and instead read it as a stablecoin settlement rail that happens to be EVM compatible. Most chains market throughput and hope payments “fit” later. Plasma starts from the realities of moving USDT at scale, fee friction, operational finality, and audit trails, then designs the chain around those constraints first. That’s why its choices feel less like crypto experimentation and more like a payments network that was rebuilt with programmable settlement as the default.

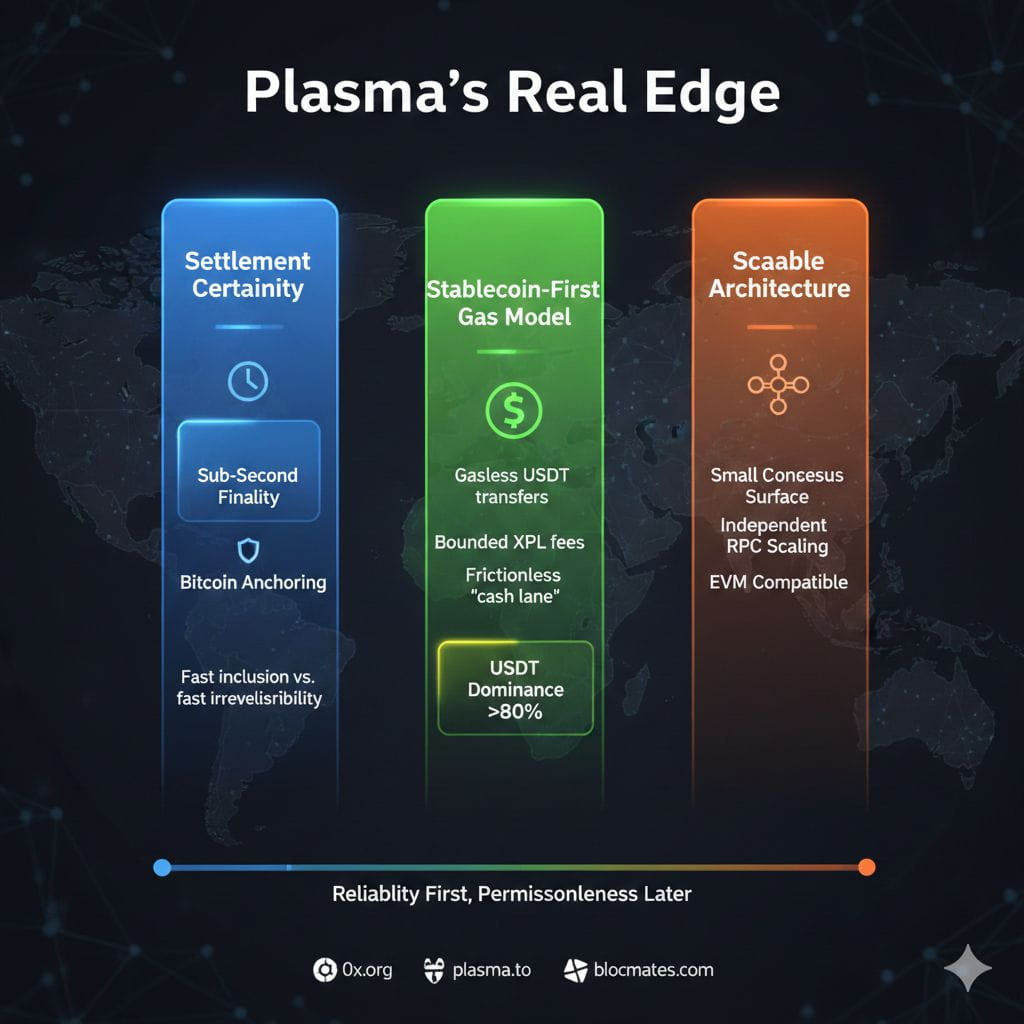

PlasmaBFT is the centerpiece, and it’s telling that Plasma frames it as a payments-optimized, HotStuff-derived BFT design rather than a flashy new consensus brand. � What matters even more is the surrounding node architecture. Validators run a Consensus Layer node to propose and finalize blocks, paired with an Execution Layer node to execute transactions and serve state, while non-validator nodes can follow finalized blocks and scale RPC capacity without joining consensus. � That design is a quiet admission that “high performance” is not only about block production, it’s about keeping the consensus surface small, predictable, and operationally clean while letting access scale independently.

0x.org

plasma.to

This is where Plasma’s sub-second finality becomes institutionally meaningful, because the real distinction is fast inclusion versus fast irreversibility. A chain can feel instant and still be operationally messy if the settlement moment is ambiguous under stress. Plasma is trying to compress settlement into a deterministic window that a treasury team can book without footnotes, and the progressive validator rollout described in its own operator model reinforces the philosophy: reliability first, permissionlessness later. � That tradeoff is unpopular with maximalists, but it mirrors how production payment infrastructure is actually deployed.

plasma.to

The stablecoin-first gas model is the second pillar, and the detail that matters is how deliberately bounded it is. Yes, simple USDT transfers can be gasless, so a user can move dollars without buying a volatile native token first. � But Plasma is explicit that only basic USDT sends are sponsored, while other transactions still incur fees paid in XPL to validators. � That boundary is not a compromise, it’s the mechanism that keeps a “cash lane” frictionless without turning the entire chain into a free-riding spam magnet. In practice, it’s a protocol-level separation between everyday money movement and everything else that should remain metered.

0x.org

plasma.to

Bitcoin anchoring is the third lever, and the right mental model is finality insurance. By periodically anchoring Plasma’s state to Bitcoin, Plasma makes deep reorganizations economically and socially unrealistic after the anchor confirms. � For regulated settlement, the value is less “Bitcoin is strong” and more “the ledger gets an external, globally neutral timestamping layer” that risk teams can explain and auditors can reference. That’s a different security posture than “trust our validator set forever,” and it aligns with Plasma’s broader pitch toward neutrality and censorship resistance without sacrificing day-to-day speed.

blocmates.com

The early on-chain signals match the thesis rather than looking like an idle chain waiting for narrative traction. Plasmascan’s mainnet dashboard shows about 142.53M transactions with roughly 1.00 second blocks, and the public testnet already sits above 2.27M transactions. � On the asset side, DefiLlama tracks roughly $1.93B in stablecoins on Plasma with USDT dominance above 80%, which is exactly what you’d expect from a chain that is intentionally stablecoin-gravitational. � Even if incentives shape part of the curve, the composition is the signal: Plasma is pulling the asset it was engineered for.

Plasma Chain Mainnet Explorer +1

DeFi Llama

Tokenomics also read like infrastructure planning, not hype. Plasma targets an initial 10B XPL supply at mainnet beta, allocates 40% to ecosystem and growth, 25% to team, 25% to investors, and 10% to the public sale. � Validator emissions only activate when external validators and delegation go live, then inflation starts at 5% and steps down toward 3%, while base fees are burned via an EIP-1559-style mechanism. � The overlooked implication is that Plasma is time-phasing its security budget and betting that real payment volume can eventually offset dilution pressure instead of assuming perpetual inflation is acceptable.

plasma.to

plasma.to

My forward view is that Plasma wins if stablecoin payments converge on a small number of rails that feel boring in the right way: predictable finality, predictable costs, and minimal UX friction. Sub-second settlement, a gasless USDT lane, familiar EVM tooling, and Bitcoin-anchored history is a stack that reduces integration entropy for fintechs and institutions at the same time. The biggest competitive risk is not another Layer 1 out-TPSing it, it’s issuers and processors building closed settlement networks where they control policy and pricing. Plasma’s defense is neutrality plus composability: if it keeps making “digital dollars moving” feel like a default primitive instead of an app-layer hack, it can become the kind of chain you don’t hype, you quietly route volume through.