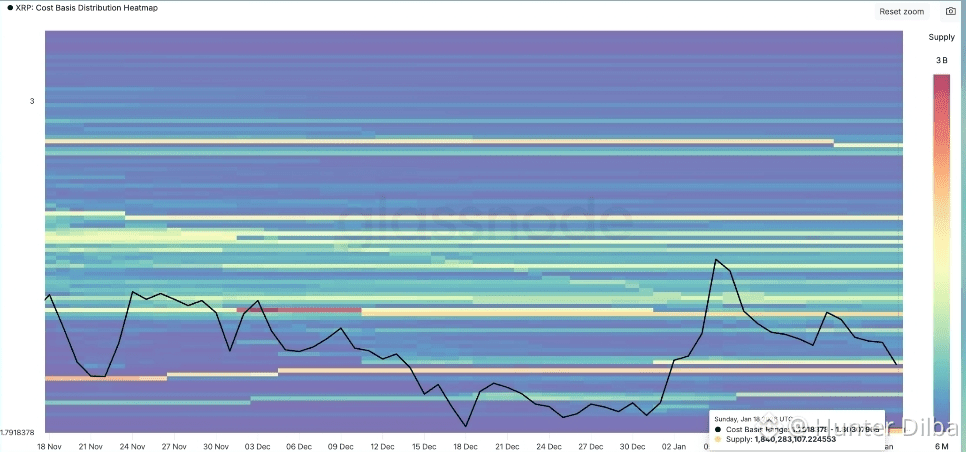

This also explains why XRP fell below the psychologically important barrier of $2, which is the trigger for many traders and long-term holders, and why the increase positive ETF and XRP Ledger activity is often considered bullish.

This divergence between price and fundamentals reflects the current complexity and uncertainty of the crypto market.

Price Action: A Key Support Breaks

For a couple of weeks, $2 functioned as a strong support barrier for XRP. However, consistent selling pressure across the wider crypto markets forced an XRP price collapse. Once 2 dollars was lost, short-term traders left their positions, contributing to the negative momentum.

XRP is now trading at $1.95-1.98 which has become a $2-1.98 battleground for buyers and sellers. A sustained lack of positive pressure to recapture $2 will invite more negative pullbacks to $1.80, a support barrier that has historical significance, and ensure that $1.98 will become the new barrier once support is lost.

ETF Demand Remains the Same

Perhaps the most interesting of all issues to consider regarding XRP in its ongoing state of activity is that which purports the ongoing demand for XRP related ETFs in the spaces. There is consistent inflow data that is representative of continued institutional demand for ETFs. Demand is steady, which in the context of XRP, is enough complexity to recognize the demand for related ETFs is counter to the general satellite institutional flow.

Currently, XRP ETFs have received a total of over $1 billion in cumulative investments. This shows that large investors believe XRP is a worthy long-term asset. Under most circumstances, this level of investment would normally guarantee XRP a solid level of price support. However, at this time, ETF investments have not been able to compensate for losses due to negative market trends.

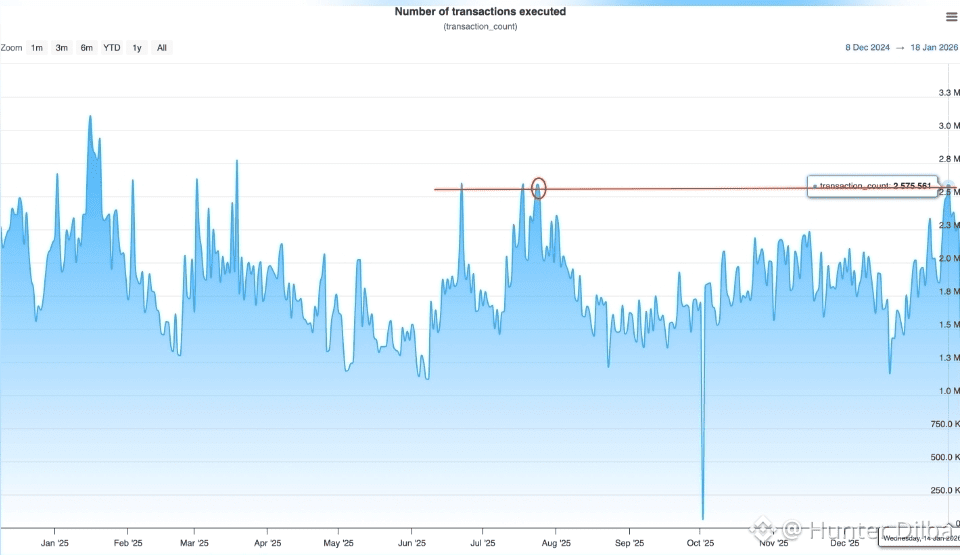

XRP Ledger most recent activity shows Multi-Month High.

Surging activity is once again justified in the on-chain data. Transaction counts on the XRP Ledger have once again reached Multi-Month Highs. This shows expanding service users for the aforementioned network.

As is the case with most over-sold assets, there is a reasonable expectation that fundamental XRP activity will increase. However, as the price demonstrates, this will not guarantee investment XRP: with bearish market conditions, this will not guarantee the XRP investment.

Why fundamentals investment in XRP is not reflected in the price

A number of factors indicate why the price of XRP is not performing in response to highly favorable indicators.

1.The Overall Market is Weak

As the markets have switched to a higher level of volatility, both Bitcoin and the other large altcoins begin to attract a higher level of investor risk. Their level of positive market equity and the investment in strong fundamentals begin to decrease. This will make the large, widely utilized assets lose equity.

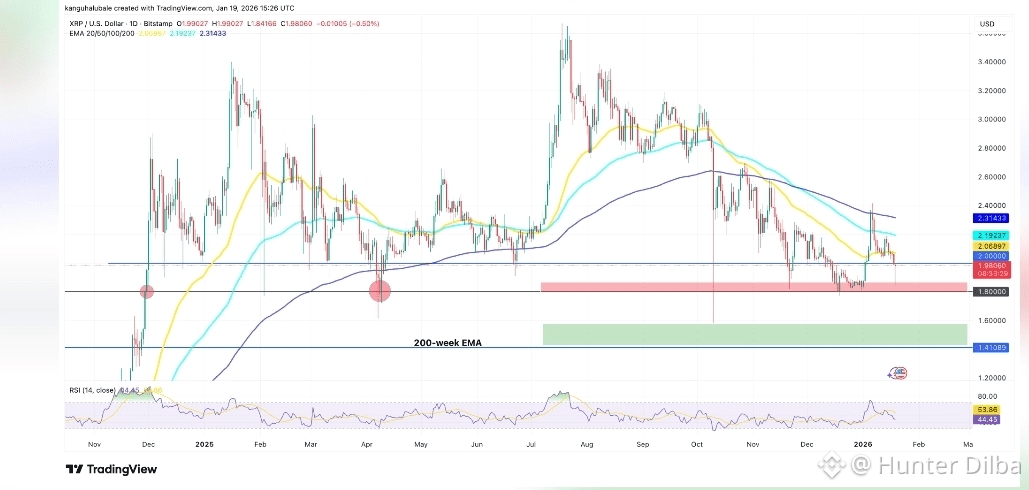

2.Technical Structure

After XRP lost the $2 support, a combination of automated selling, triggering of stop losses, and short-term bearish momentum, overpowered the fundamental demand, albeit temporarily.

3.Profit-Taking and Rotation

There is selling pressure in the short-term because some investors may be taking profit after previous XRP gains and some may be rotating capital to other sectors.

Key Levels to Watch

Technically, there are several important price levels:

Resistance: $2.00 - If there are daily closes above this level, it will signal strength and possibly re-instate bullish momentum.

Support: $1.95 and then $1.80 - If these are broken, it will give more downside.

Pivotal momentum RSI and seasonal volume patterns will act as a signal for caution, but also more sideways is possible if the buyers start to materialize, and will act as a signal for more upside.

Outlook: Short-Term Pressure, Long-Term Questions

In the short-term, unless XRP can reclaim some lost support, it will be vulnerable to even further downside. However, ETF inflows appear to be consistent and there is sustained strong network usage, which signifies that long-term interest does exist.

As for now, this example represents the entire crypto market - one that is dominated not only by fundamentals, but also by sentiment, liquidity, and an overall structure. There is a lag between the price and the crypto market, and, even though there is a sustained network demand, it will take some time for the lag to be closed.