For years blockchain has faced a false choice: privacy or regulation.

Public chains sacrificed confidentiality. Privacy chains struggled with compliance. Institutions stayed on the sidelines.

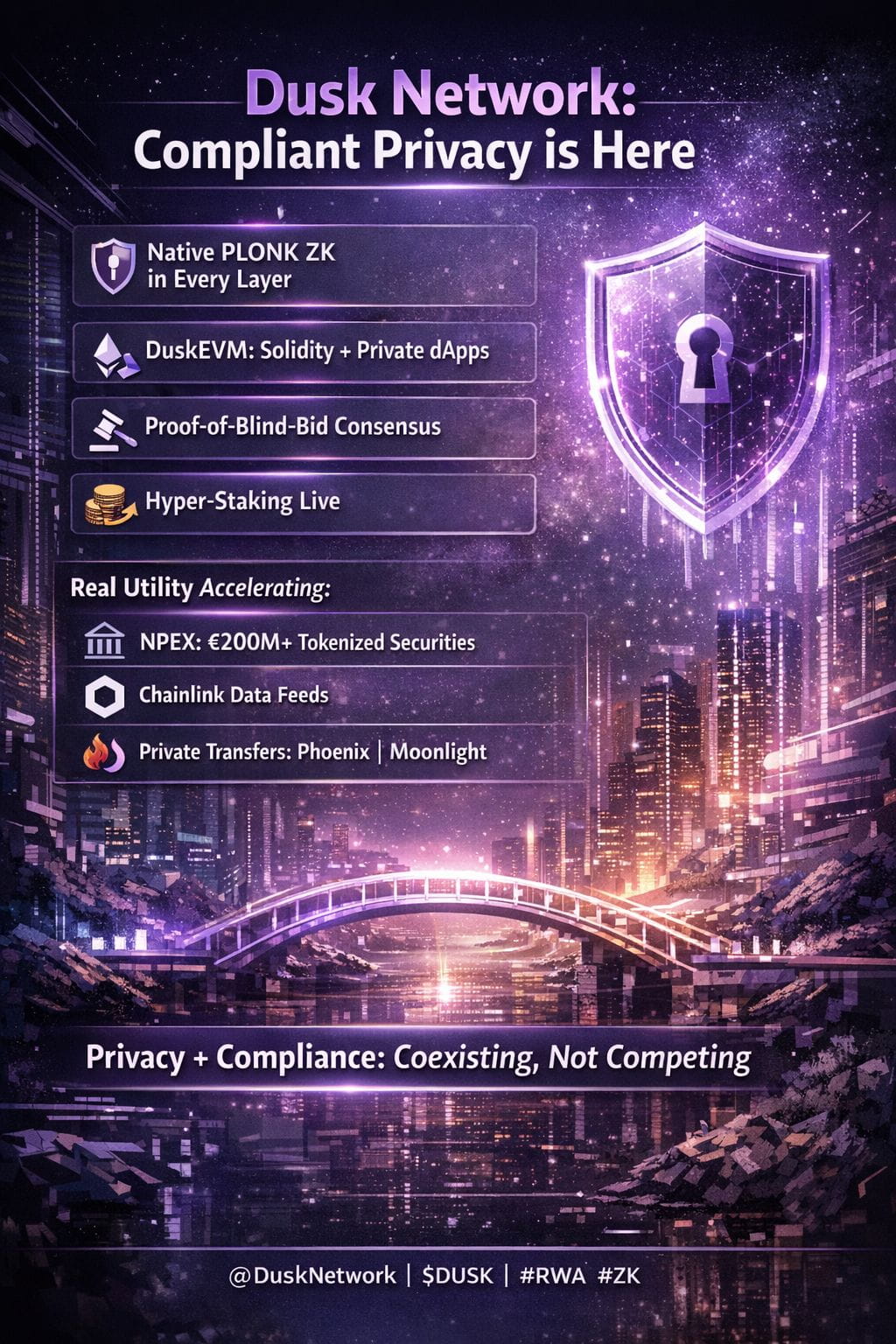

Dusk Network was built to end that tradeoff.

Privacy Is Native Not an Add-On

@Dusk is a Layer 1 designed from day one with native PLONK zero-knowledge proofs across every layer of the stack. Confidentiality isn’t patched in later or delegated to side systems.

Smart contracts on Dusk can privately execute:

Asset issuance

Trading and order matching

Settlement and transfers

All while preserving auditability and regulatory controls.

This matters because most “private DeFi” solutions still leak metadata, rely on bridges, or collapse under scale. #Dusk avoids this by keeping privacy inside the core protocol.

DuskEVM Is Live: Ethereum Compatibility Meets Native Privacy

With DuskEVM now live on mainnet, Ethereum developers can deploy Solidity smart contracts with minimal changes but gain something Ethereum itself cannot offer:

Regulation ready, native privacy.

This lowers the barrier dramatically for teams building:

Tokenized securities

Permissioned DeFi markets

Institutional settlement layers

Privacy-preserving RWAs

No wrapping assets across chains.

No fragmented liquidity.

No complex privacy middleware.

Execution remains low-fee, high-throughput, with sub-10 second finality on a single unified network.

Fair Consensus by Design: Proof-of-Blind-Bid

Most PoS systems suffer from validator coordination, front-running, and whale dominance.

Dusk’s Proof-of-Blind-Bid consensus removes bid visibility during validator selection. Validators submit bids blindly, preventing:

MEV-style manipulation

Validator cartels

Predictable leader dominance

The result is a more decentralized validator set with sustainable rewards without relying on hyperinflation to attract participation.

Hyper-Staking: Yield Without Surveillance

Dusk’s hyper-staking is now live, allowing users to stake DUSK while preserving privacy at the protocol level.

This is a critical shift:

Participants no longer need to choose between earning yield and exposing their on-chain financial behavior.

For institutional and high-net-worth participants, this is a requirement not a luxury.

Real-World Adoption Is No Longer Theoretical

Dusk’s roadmap is translating into real pipelines:

NPEX partnership a Dutch regulated exchange working to bring €200–300M worth of tokenized securities on-chain

Chainlink integration enabling trusted data feeds, oracles, and interoperability

Private transfers live on mainnet users can choose:

Phoenix (shielded, confidential mode)

Moonlight (public, transparent mode)

This optionality is key. Compliance does not mean total transparency it means controlled disclosure when required.

MiCA Changes Everything

As MiCA enforcement tightens in Europe and RWAs move from pilots to production, infrastructure requirements are changing.

Institutions need:

Privacy for counterparties

Confidential settlement

Selective disclosure for regulators

Legal clarity

Public-by-default chains struggle here.

Pure privacy chains are non-starters.

Dusk’s core thesis becomes unavoidable:

Privacy and compliance do not compete — they coexist.

From Quiet Build to Market Recognition

Dusk spent years building where others marketed. Now, sentiment is catching up.

Industry voices increasingly frame Dusk as:

A bridge between TradFi and DeFi

A foundation for compliant RWA tokenization

A long-term infrastructure play for regulated markets

The narrative shift is clear: Quiet build → institutional relevance → broader market attention.$DUSK