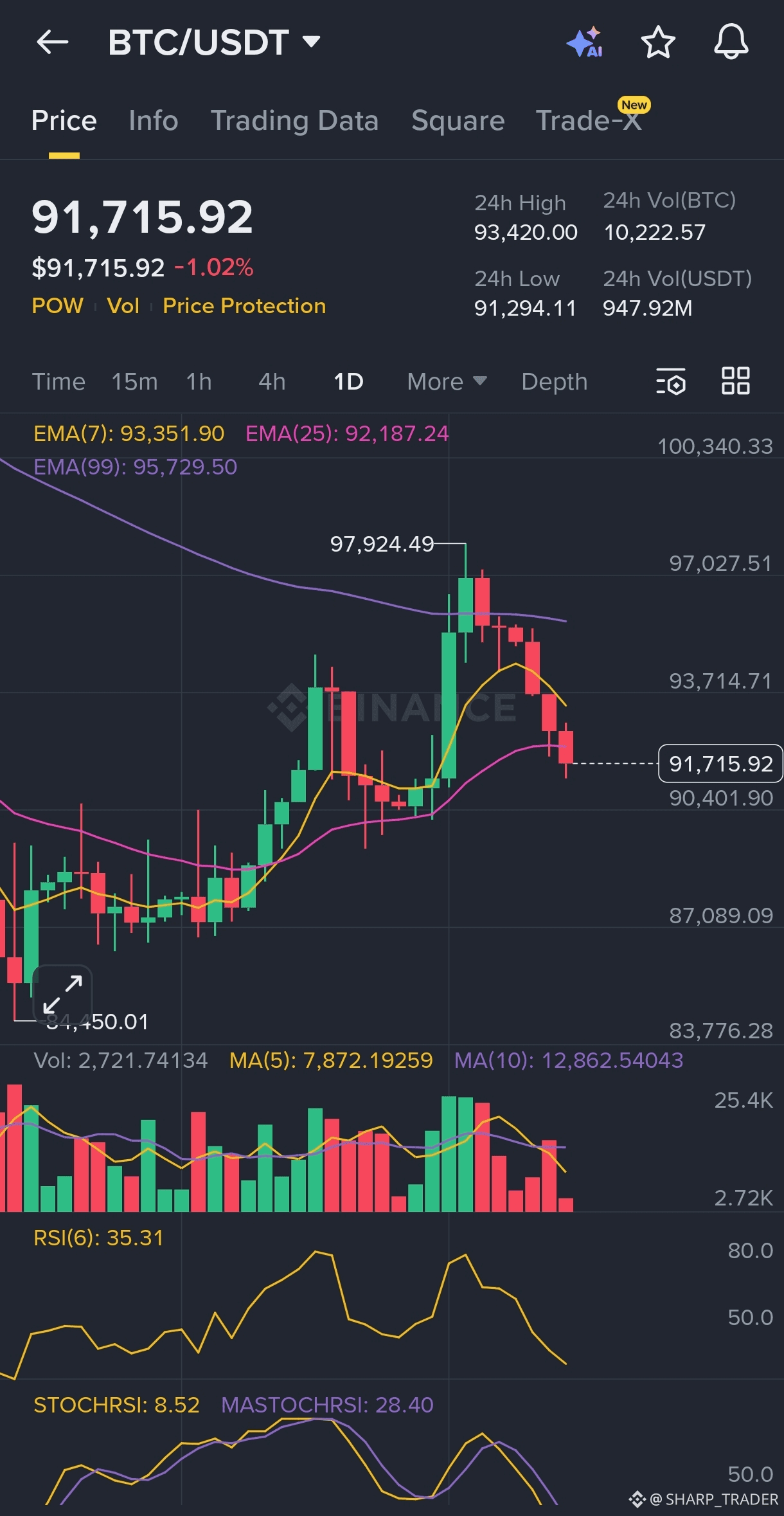

Bitcoin is currently trading at $91,715.92 and remains in a short-term bearish trend. Price is trading below EMA 7, EMA 25, and EMA 99, which clearly shows sellers are still in control. Although the EMAs are stacked bullishly (EMA 7 > EMA 25 > EMA 99), price being below all of them means these EMAs are acting as dynamic resistance zones rather than support.

This structure suggests that any upward move is likely to face strong selling pressure near the EMA levels unless volume increases significantly.

---

🔹 Momentum Indicators (Deep Explanation)

RSI (6) at 35.31 indicates the market is close to the oversold zone but has not fully reached extreme panic selling. This means downside is slowing, but confirmation of reversal is still missing.

Stochastic RSI at 8.52 is deeply oversold, which often happens near local bottoms. The Stoch RSI moving far below its MA (28.40) suggests sellers may be losing momentum, increasing the probability of a technical bounce.

However, oversold conditions alone do not guarantee reversal — price action and volume confirmation are essential.

👉 Conclusion: Momentum is weak but selling pressure looks exhausted, opening the door for a relief bounce.

---

🔹 Key Support & Resistance (Why These Levels Matter)

$90,401 is the immediate local support where buyers previously defended price. If this level breaks with strong volume, it indicates panic selling continuation.

$87,089 is a major structural support and previous reaction zone. Losing this level would confirm a bearish continuation phase.

$92,187 (EMA 25) is the first critical resistance. Reclaiming and holding above this level would be the first bullish signal.

$93,351 (EMA 7) is a short-term rejection zone where sellers are likely to step in again.

These levels should be treated as decision zones, not exact price points.

---

🔹 Volume & Volatility Insight

Current trading volume (2,721.74) is below both MA(5) and MA(10), showing a lack of strong participation from buyers. Declining volume during consolidation usually means:

Market is waiting for a catalyst

Breakouts without volume are high risk and unreliable

⚠️ Any move (up or down) without volume expansion should not be trusted.

---

🔹 Chart Structure & Price Behavior

BTC is currently moving sideways after a sharp drop, which typically forms a bearish consolidation range. This can lead to:

1. A relief bounce due to oversold conditions

2. OR another impulsive breakdown if support fails

The next big move will likely come from a range expansion, so traders should stay alert.

---

🔮 Price Prediction (Detailed Outlook)

⏱ Short-Term (1–3 Days)

Price is likely to retest $90,401.

If this level holds, a technical bounce toward $92,187 – $93,351 is possible.

If $90,401 breaks with volume, price may quickly slide toward $87,089.

---

📆 Medium-Term (1–2 Weeks)

Trend remains bearish unless BTC reclaims EMA 25 ($92,187) and holds above it.

A confirmed breakdown below $87,000 can accelerate selling toward $83,776.

Bullish structure only returns above $94,000+ with volume.

---

📊 Trade Plan (With Logic)

🔥 Scenario 1: Bounce Trade (Aggressive)

This setup is based on oversold momentum, not trend reversal.

Entry Zone: $90,400 – $90,800

Confirmation Needed:

RSI bullish divergence

Stoch RSI cross above 20

Stop Loss: $89,900 (tight due to volatility)

Targets:

🎯 $92,200 (EMA 25 – first sell zone)

🎯 $93,350 (EMA 7 – strong resistance)

Risk–Reward: ~1:2

👉 Quick profit booking recommended.

---

🧊 Scenario 2: Breakdown Sell (Conservative)

This setup follows the trend continuation logic.

Entry: Strong candle close below $90,400 with increased volume

Stop Loss: $91,200

Targets:

🎯 $87,089

🎯 $83,776

Risk–Reward: ~1:3

👉 Best setup if fear enters the market.

---

🛡 Scenario 3: Confirmation Trade (Safest)

Long Trades: Only if price reclaims and holds above $92,187 with RSI above 40

Short Trades: Look for clear rejection near $93,351 with weak volume

👉 Ideal for low-risk traders.

---

⚠️ Risk Management Notes

Always use stop-losses 🛑

Avoid over-leverage during consolidation phases

Volume confirmation is mandatory

BTC volatility can spike suddenly — trade small, trade smart 🧠

TRADE FROM HERE FOR SPOT👉$BTC

---

Trade For future 👇