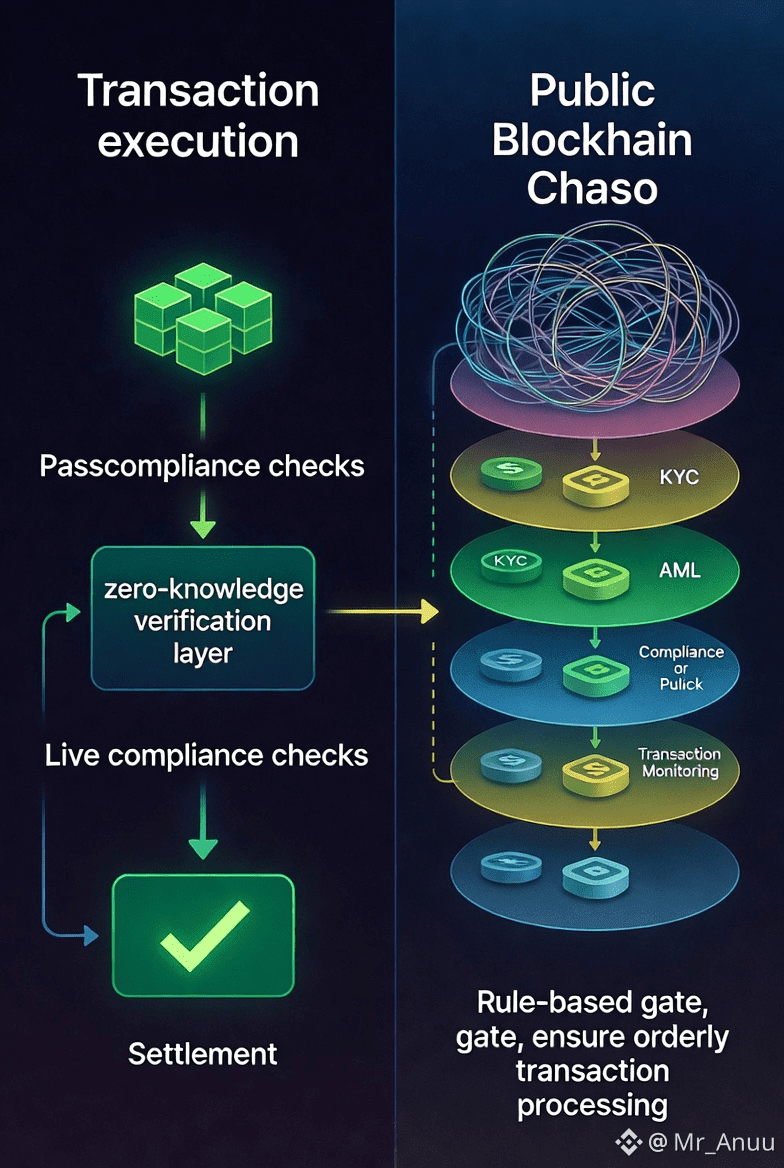

1. The Problem with Permissionless Chaos

Most blockchains glorify open access, but real finance cannot survive chaos. Static rules, opaque identities, and optional auditability make traditional compliance impossible. Speculation thrives in such systems, but regulated finance collapses under uncertainty. Institutions need environments where rules can be enforced dynamically and accountability is guaranteed.

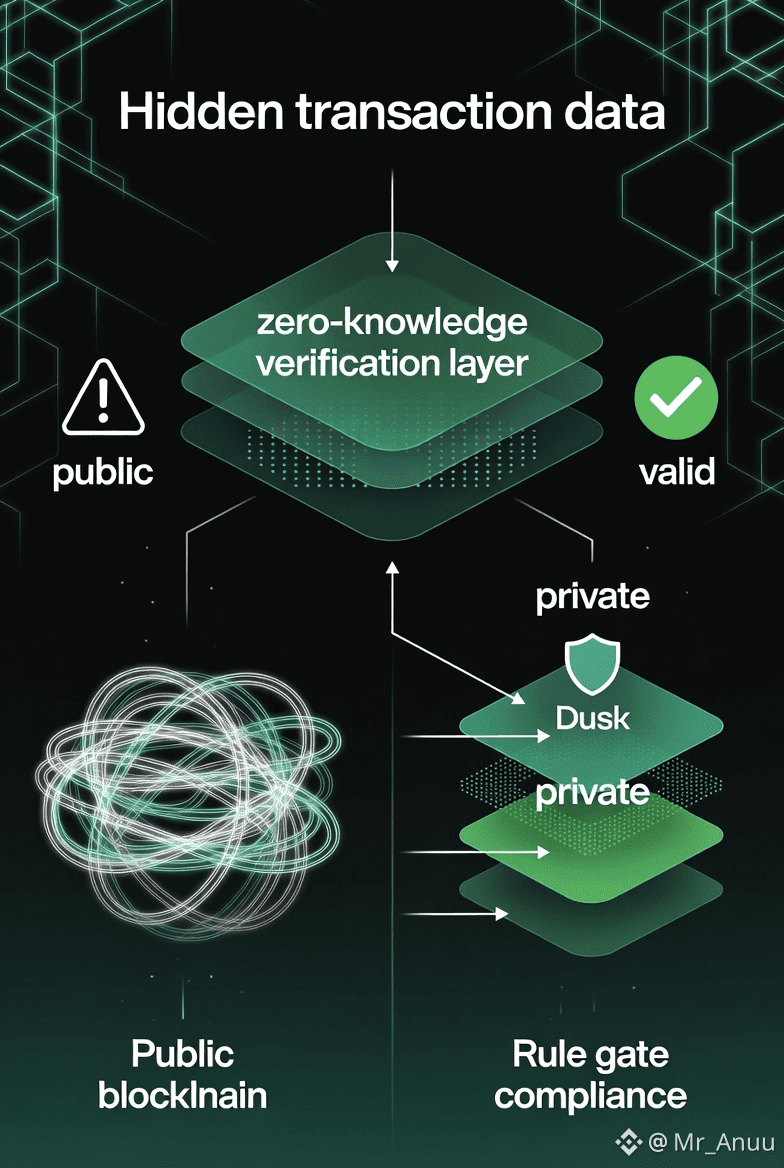

2. Privacy That Preserves Legitimacy

2. Privacy That Preserves Legitimacy

Dusk does not treat privacy as concealment. Instead, it separates confidentiality from correctness. Transactions remain private, yet their validity can be cryptographically proven. This allows financial actors to protect sensitive data without sacrificing legal legitimacy.

3. Compliance Built Into Execution

3. Compliance Built Into Execution

Unlike chains that add compliance after the fact, Dusk validates permissions during execution. Rules are checked in real time, preventing unauthorized actions before they occur. This aligns blockchain behavior with real-world financial law.

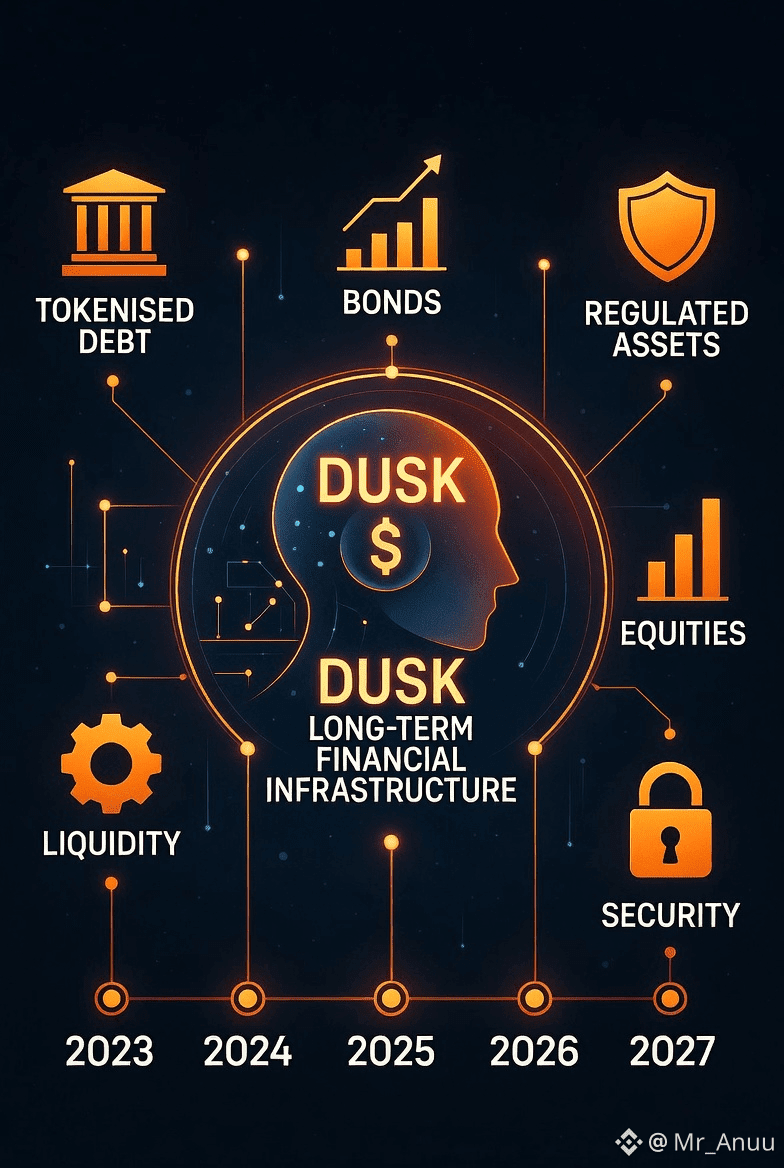

4. Infrastructure for Financial Longevity

Dusk is engineered for decades, not hype cycles. Predictable settlement, legal clarity, and privacy guarantees make it suitable for securities, tokenized assets, and institutional DeFi.