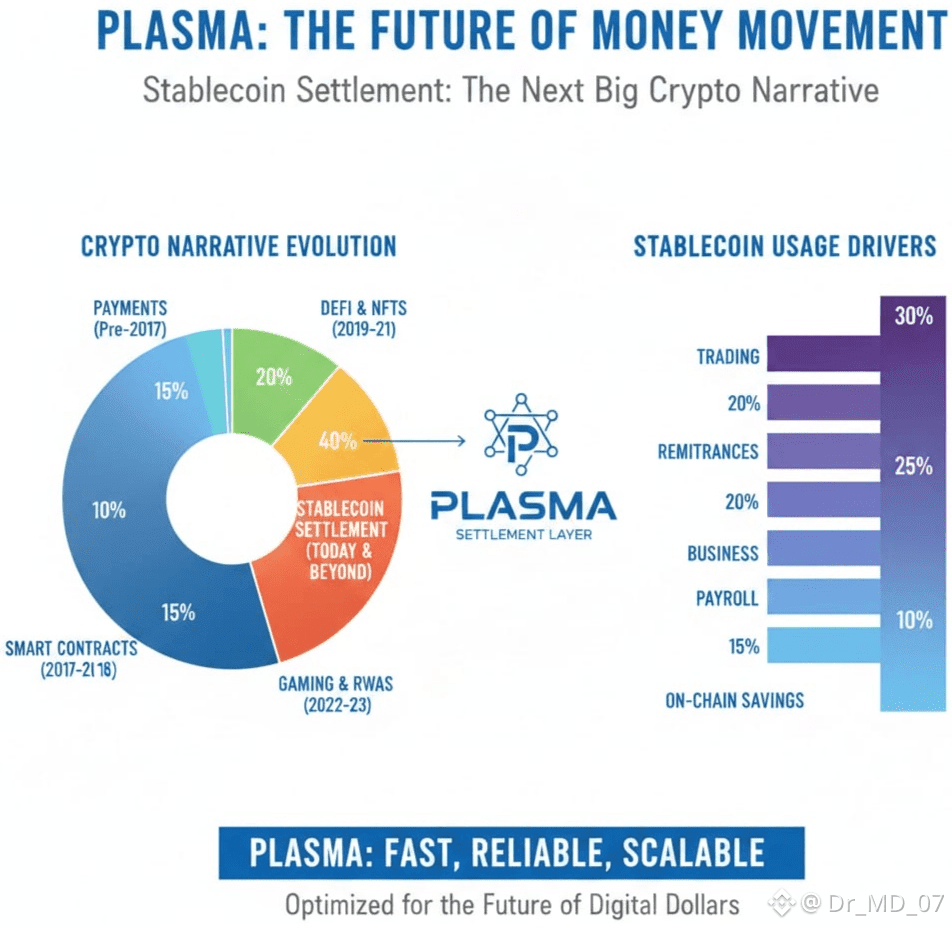

For years, crypto narratives have moved in cycles. First it was payments, then smart contracts, then DeFi, NFTs, gaming, and now real-world assets. But beneath all these trends, one use case has quietly continued to grow: stablecoins. Today, stablecoins are not just a side product of crypto markets they are becoming the backbone of on-chain value transfer. This is exactly where Plasma enters the picture, positioning itself around one powerful idea: fast, reliable, and scalable stablecoin settlement.

The Growing Importance of Stablecoins

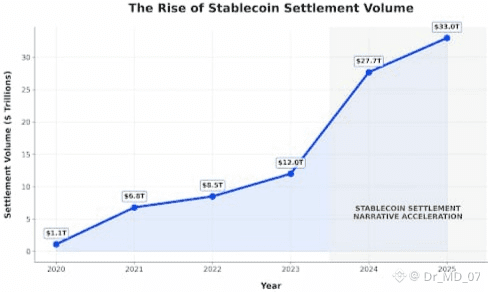

Stablecoins have already proven product market fit. Billions of dollars move daily through USDT, USDC, and other stable assets, not only for trading but also for remittances, payroll, cross-border business payments, and on-chain savings. In many emerging markets, stablecoins are used more frequently than local banking rails for international transfers.

However, most blockchains were not designed specifically for this scale of stablecoin usage. Congestion, unpredictable fees, and security trade-offs still exist. As stablecoin volume grows, the industry needs infrastructure that treats settlement as a core function, not a secondary feature.

What Plasma Is Building

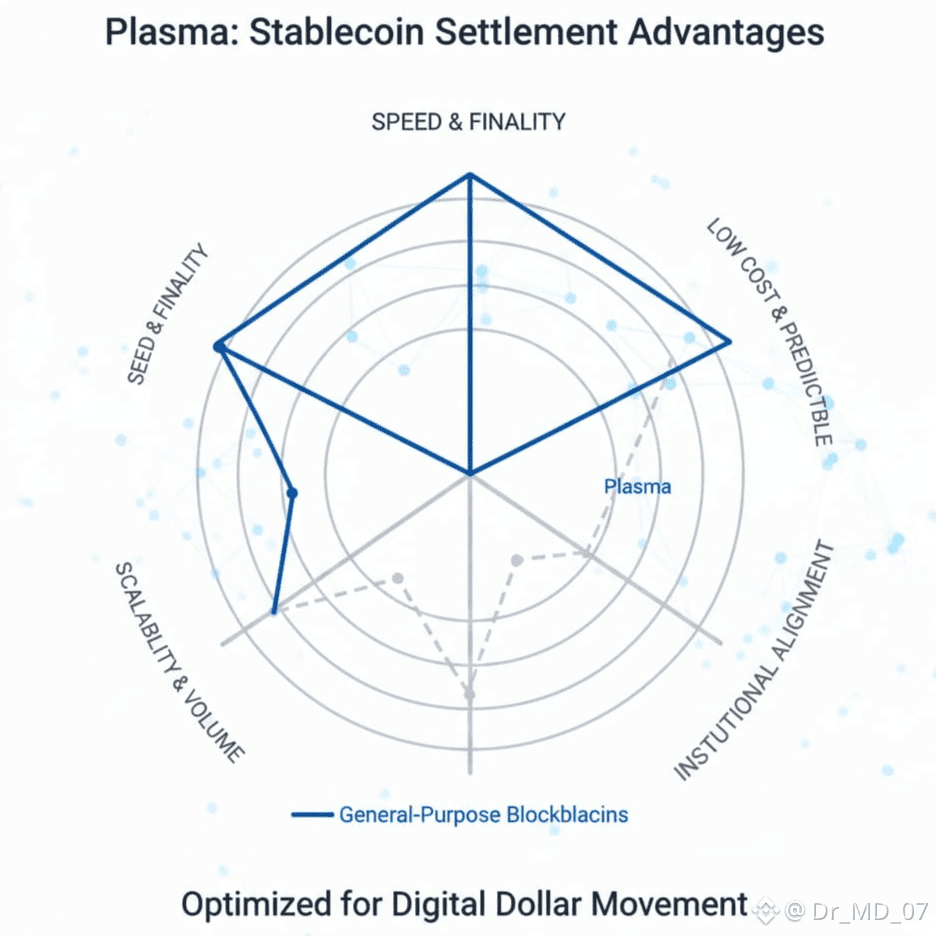

Plasma is designed with a clear focus: becoming a settlement layer optimized for stablecoins. Instead of trying to do everything at once, Plasma prioritizes what matters most for large-scale value transfer speed, low cost, and reliability.

The project is closely aligned with the needs of issuers and institutions that already operate at massive scale. By focusing on stablecoin-native design, Plasma aims to reduce friction for both on-chain and off-chain users. This includes efficient transaction processing, predictable fees, and infrastructure that can support high-frequency settlement without performance bottlenecks.

In simple terms, Plasma is not trying to reinvent money. It is trying to move digital dollars better.

Why Settlement Is Becoming the Narrative

Crypto narratives usually shift when real usage overtakes speculation. Stablecoin settlement fits this pattern perfectly. While token prices fluctuate, stablecoins quietly power exchanges, OTC desks, fintech apps, and global payments.

As regulation becomes clearer in many regions, institutions are more comfortable using blockchain rails but only if those rails are purpose-built. Settlement-focused networks like Plasma reflect this maturity phase of crypto. The question is no longer “Can blockchain work?” but “Which blockchain works best for real-world money movement?”

Settlement is also where long-term value lies. Every financial system depends on settlement layers, from SWIFT to ACH to card networks. Crypto is now building its own version, and stablecoins are leading that transformation.

Plasma’s Strategic Advantage

One of Plasma’s strongest advantages is its narrative clarity. Instead of competing directly with general-purpose smart contract chains, Plasma aligns itself with a specific, growing demand. This makes adoption more realistic and messaging more focused.

Another key factor is scalability. Stablecoin settlement requires consistency, not just peak performance. Networks that struggle during high activity lose trust quickly. Plasma’s architecture is designed to handle sustained volume, which is far more important than short-term benchmarks.

From a market perspective, this focus could attract payment providers, exchanges, and enterprise users who care less about speculation and more about efficiency.

My Perspective as a Market Participant

From my point of view, stablecoin settlement feels like one of the most undervalued narratives in crypto today. Traders often chase hype cycles, but infrastructure projects that support real economic activity tend to win over time. Plasma fits this profile.

What stands out to me is that Plasma is aligned with how crypto is actually used today, not how it was imagined years ago. Most users are not minting NFTs or deploying smart contracts they are moving stable value across borders. A network optimized for that reality has strong long-term relevance.

If adoption continues in this direction, settlement-focused chains could become the quiet winners of the next cycle.

Final Thoughts

Plasma represents a shift in crypto thinking from experimentation to execution. As stablecoins continue to bridge traditional finance and blockchain, the importance of efficient settlement will only increase. Projects that understand this shift early are positioning themselves at the foundation of the next phase of crypto adoption.

Stablecoin settlement may not be the loudest narrative, but it could easily become the most important one.