In the fast-evolving world of blockchain, most chains aim to be all things at once—from DeFi to NFTs to gaming. This flexibility, while useful for developers, introduces variability in performance, especially when moving large amounts of stablecoins. For institutions and high-volume traders, unpredictability in settlement is risk, not innovation. Plasma approaches this differently: it is designed primarily for settlement, not speculation, focusing on reliability, speed, and predictability.

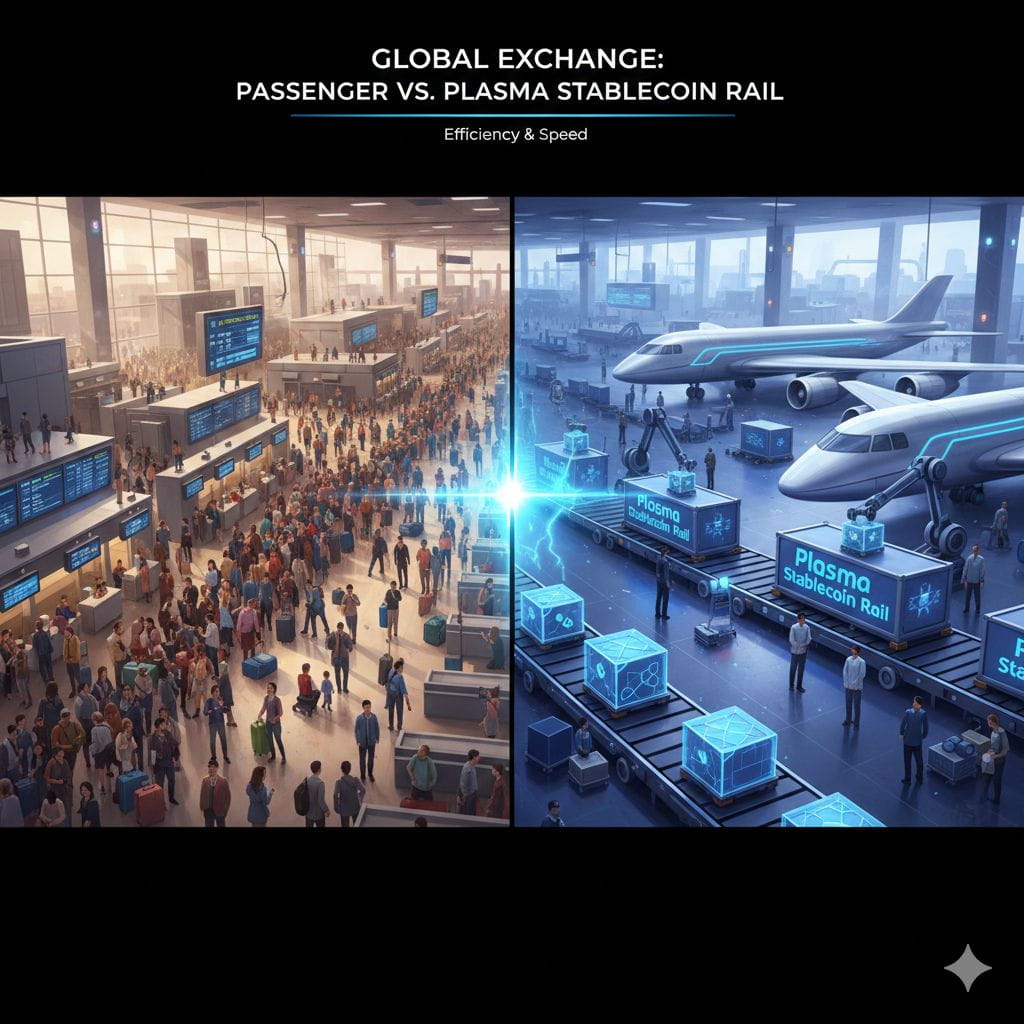

Stablecoins represent a massive share of on-chain value, yet most general-purpose chains are not optimized for high-frequency, high-volume transfers. In practice, traders sometimes see transactions appear completed while funds remain effectively frozen, creating friction and inefficiency. Plasma treats this like a dedicated freight terminal at an airport, routing stablecoins through optimized rails rather than mixing them with all traffic. This ensures smooth flow even under stress, without unnecessary delays or surprises.

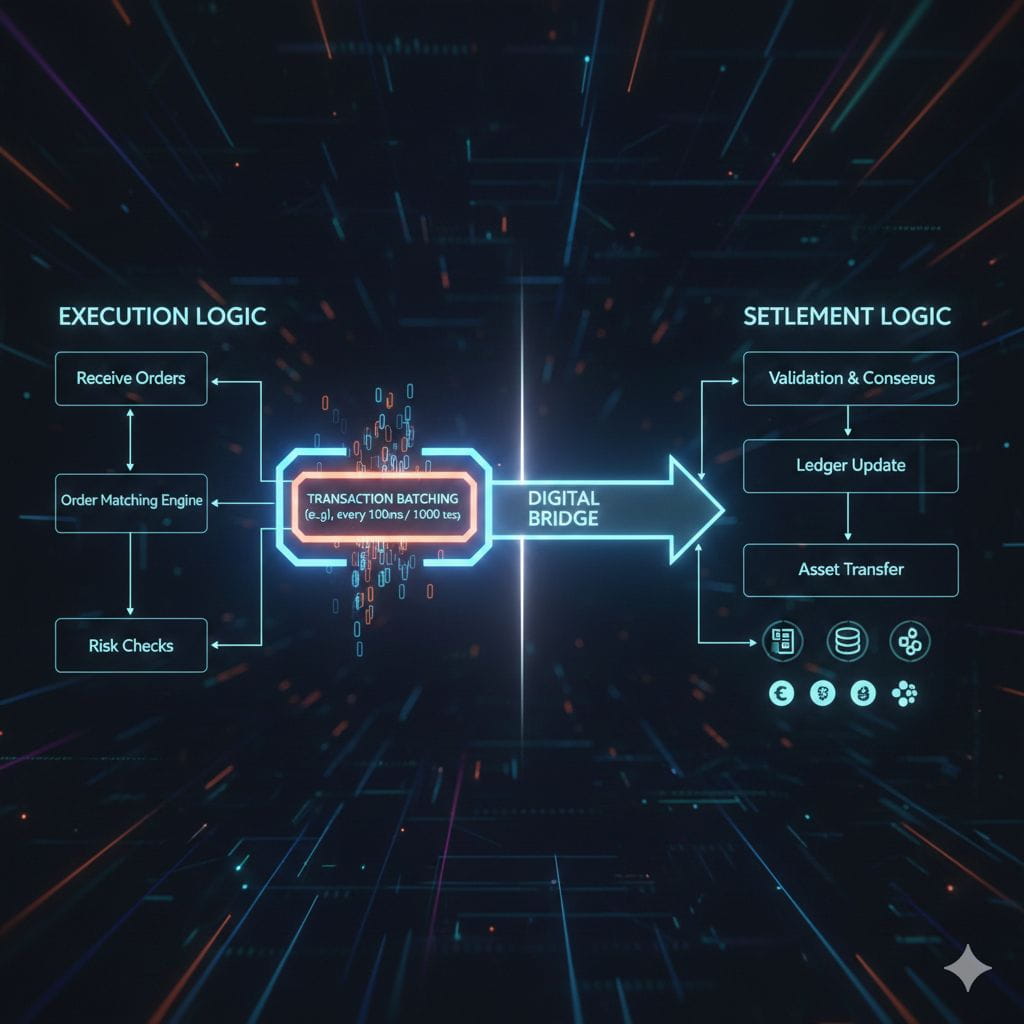

A key technical advantage of Plasma is the separation of execution and settlement logic. This design allows throughput to scale without constantly reworking consensus assumptions. Transactions are batched and finalized deterministically, reducing volatility and ensuring predictable confirmation times. Another feature is predefined fee parameters, which prevent spikes and maintain economic stability for users moving large sums. These mechanisms reflect infrastructure-first thinking, prioritizing flow over hype.

The token XPL serves as more than a speculative asset; it is a coordination and security instrument within the Plasma network. Validators stake XPL to align incentives and govern parameters like settlement thresholds, ensuring that the rail remains secure and predictable. Its value is directly tied to network usage, not abstract narratives or short-term speculation, reinforcing that Plasma’s strength comes from functionality, not hype.

From a market perspective, Plasma is competing in a fiercely competitive space. Stablecoins settle trillions annually, often exceeding major payment networks in daily volume. Capturing even a fraction of that flow requires trust, reliability, and repeated execution, which Plasma aims to deliver quietly and efficiently. Institutions will evaluate it based on performance under load, not marketing slogans—a reminder that robust infrastructure earns credibility through consistency.

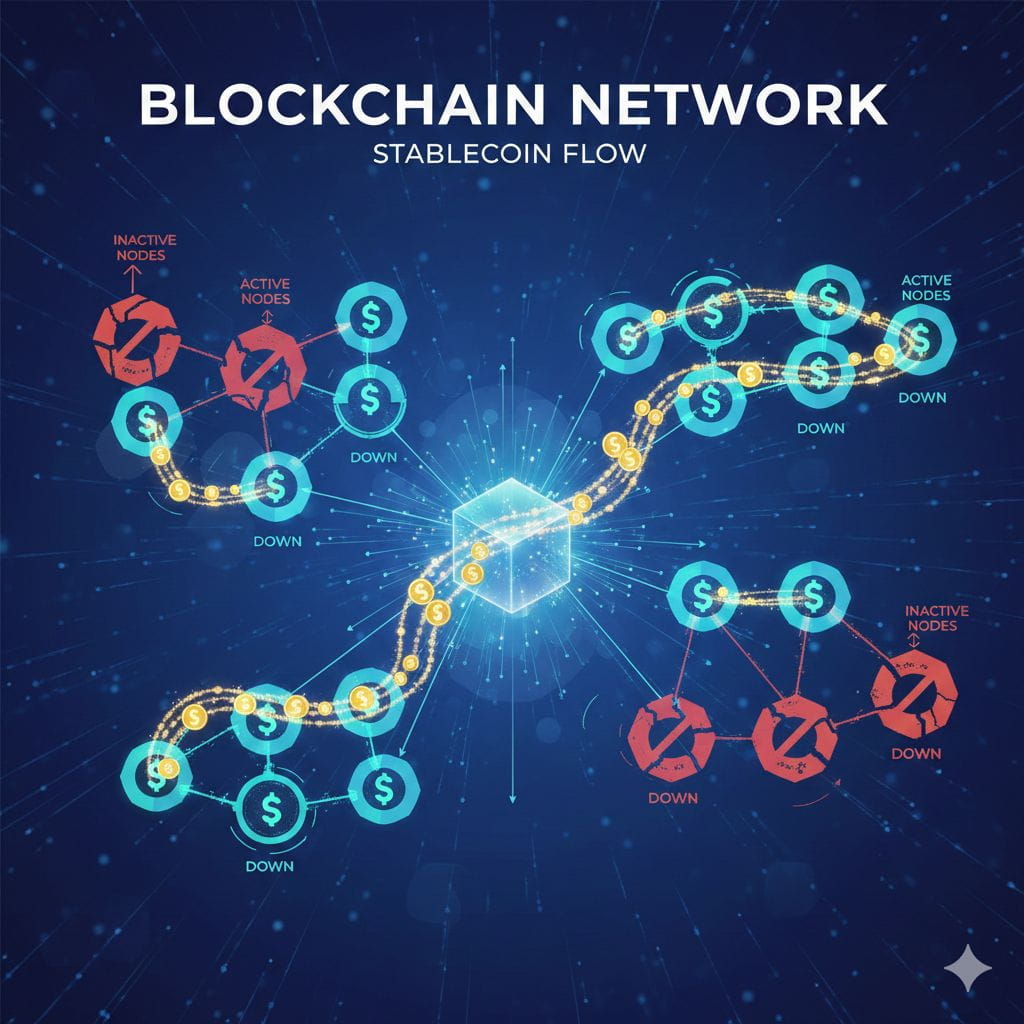

Despite its strengths, risks remain. Prolonged validator downtime during market shocks could halt settlement and erode trust. General-purpose chains continue to evolve, and modular solutions may compete for adoption. Plasma’s design mitigates these risks by prioritizing core settlement functions, but the network’s success ultimately depends on institutional adoption and repeated, frictionless performance.

In conclusion, Plasma represents a shift in blockchain thinking: from speculative, multi-purpose chains to settlement-first rails. XPL enables governance and security, but the network’s true value emerges from reliable, predictable infrastructure. If successful, most users will never notice it—and that, paradoxically, is the ultimate proof of its relevance.