Modern financial markets don’t fail because of lack of speed — they fail because systems cannot balance efficiency, privacy, and regulatory accountability at the same time. Most public blockchains were designed for openness first, assuming transparency alone would create trust. In reality, transparency without control creates new risks: information leakage, front-running, unpredictable fees, and regulatory uncertainty. This is where Dusk Foundation takes a fundamentally different path by designing settlement infrastructure specifically for regulated finance.

Settlement Performance That Improves With Compliance

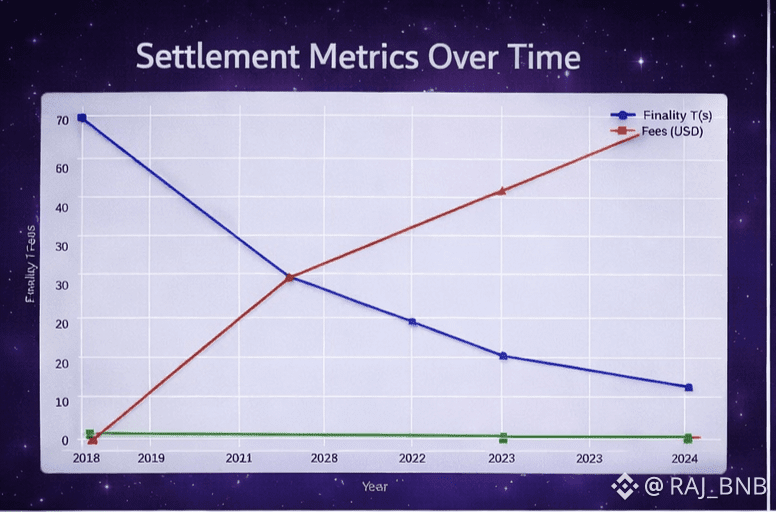

The evolution of Dusk’s settlement metrics shows a deliberate architectural choice. Over time, finality becomes faster and more predictable, while auditability increases instead of being sacrificed. In traditional public chains, faster settlement often means less oversight or more complexity added off-chain. Dusk integrates auditability directly into the settlement layer, allowing transactions to finalize efficiently while remaining verifiable when required. This makes settlement suitable not just for crypto-native activity, but for real financial workflows where every transaction may later need to be reviewed, justified, or audited.

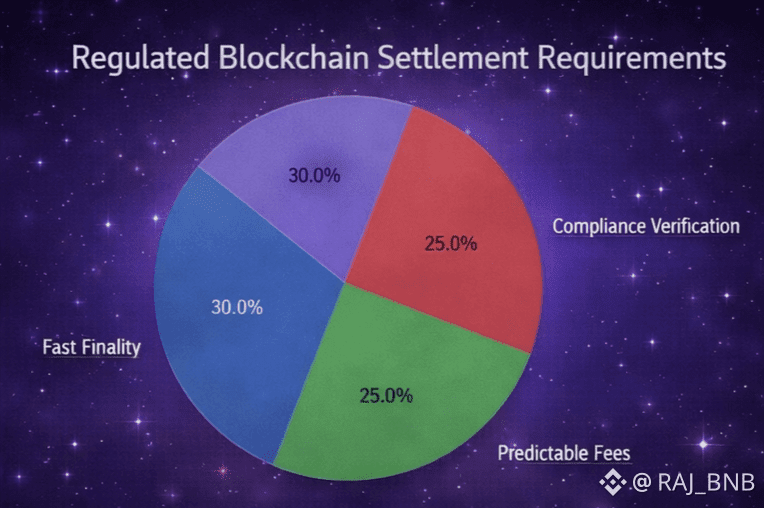

What Institutions Actually Prioritize

When institutions evaluate blockchain infrastructure, they don’t optimize for hype metrics. They prioritize fast finality, predictable fees, compliance verification, and auditability. These factors explain why Dusk’s design choices differ from speculative or retail-focused chains. Predictable fees allow accurate cost modeling. Fast finality reduces counterparty and settlement risk. Compliance verification ensures regulatory alignment. Auditability provides legal defensibility. Together, these features form a settlement layer that institutions can trust under real-world constraints.

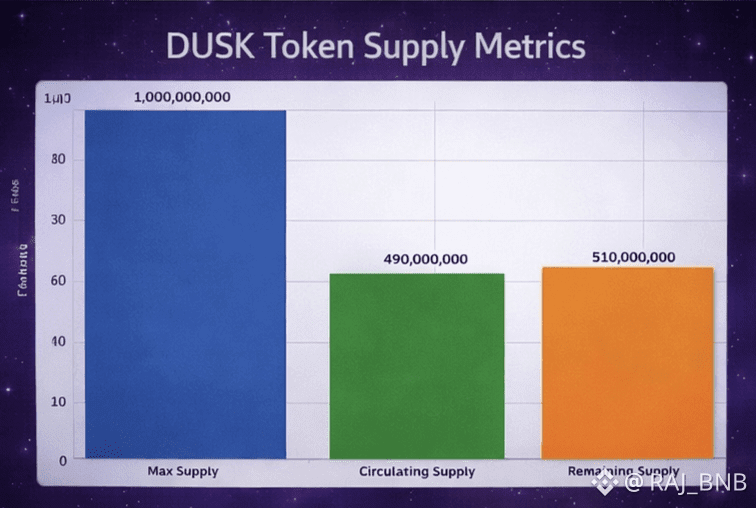

Token Supply Designed for Long-Term Stability

Infrastructure requires economic stability, not constant uncertainty. Dusk’s token supply structure reflects this requirement by clearly separating maximum supply, circulating supply, and remaining supply. This clarity supports staking security, governance participation, and long-term network sustainability without relying on excessive inflation or opaque emissions. For regulated participants, understanding supply dynamics is essential — not for speculation, but for risk management and long-term planning.

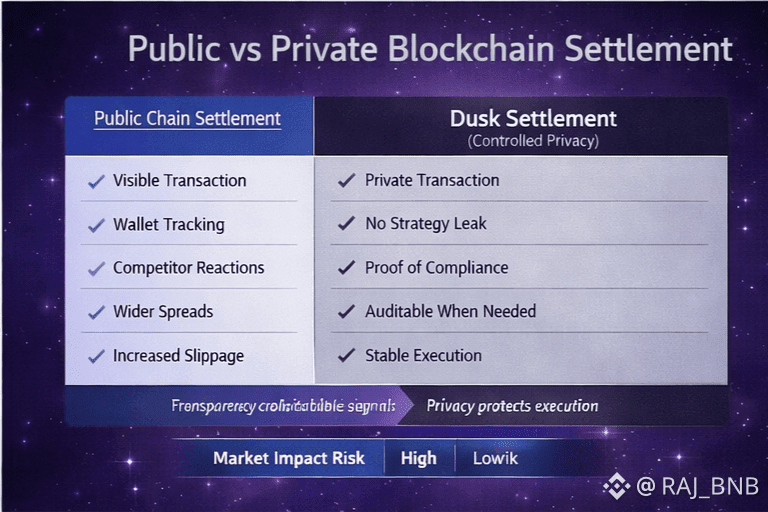

Privacy Without Market Damage

Public blockchains unintentionally broadcast sensitive information. Visible transactions expose wallet behavior, trading intent, and execution strategies, allowing competitors and arbitrageurs to react instantly. This leads to wider spreads, increased slippage, and higher market impact. Dusk addresses this through controlled privacy. Transactions remain private by default, protecting execution strategies, while still allowing proof of compliance and auditability when required. This removes the false trade-off between privacy and regulation.

Positioning Between Public Chains and Privacy Coins

Purely transparent blockchains offer auditability but leak information. Privacy coins protect confidentiality but lack regulatory acceptance. Dusk occupies the critical middle ground: regulated privacy. It enables confidential execution while maintaining an auditable pathway for regulators and authorized parties. This positioning is not ideological — it is practical. Regulated finance needs both confidentiality and accountability, not one at the expense of the other

Infrastructure, Not Speculation

Dusk is not designed to be loud. It is designed to be reliable. Its settlement model, privacy controls, token economics, and compliance-first architecture all point toward a single goal: making blockchain usable for real financial markets. If Dusk succeeds, it won’t look revolutionary. It will look normal — predictable settlement, stable execution, controlled privacy, and clear audit paths. That normality is exactly what institutions require.