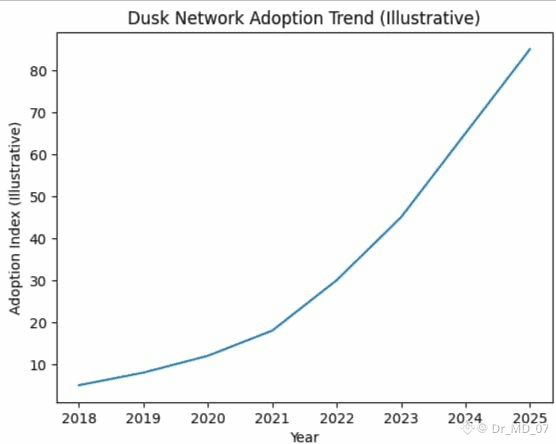

For years, crypto has promised to transform finance, yet the biggest players in the world still struggle to use it. Banks and regulated institutions can’t place sensitive customer data on fully transparent blockchains, and at the same time they can’t ignore compliance requirements. This tension between privacy and regulation has slowed real adoption more than any technical limitation. Dusk was created to solve this exact problem. Founded in 2018, Dusk Network is a layer-1 blockchain built specifically for private and regulated finance, with privacy, compliance, and auditability designed into the core of the protocol. Instead of chasing trends, Dusk focuses on a single mission: making blockchain practical and trustworthy for real financial institutions.

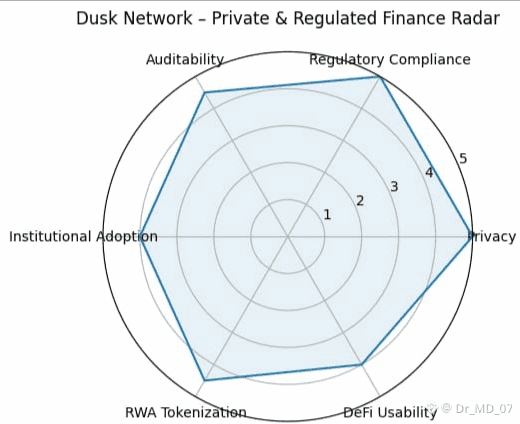

What makes Dusk different is its mindset. Rather than building first and worrying about regulation later, Dusk was designed with compliance in mind from the very beginning. Using zero-knowledge technology, it allows financial data to remain confidential while still being provable and auditable when required. This means institutions can protect their customers’ information, and regulators can still verify that everything is being done correctly. In simple terms, Dusk brings decentralization and regulation together instead of forcing one to sacrifice the other, creating a network that both innovators and regulators can trust.

This approach unlocks the most important use cases in crypto. On Dusk, real-world assets such as stocks, bonds, funds, and real estate can be tokenized with privacy and compliance built in. DeFi platforms can offer lending, trading, and settlement services without exposing user data on a public ledger. Financial institutions can build digital securities and settlement networks that meet real regulatory standards rather than experimental ones. These are not small opportunities they represent trillions of dollars in traditional finance that are slowly moving on-chain. Dusk is positioning itself as the foundation that regulated finance will actually use when blockchain adoption becomes mainstream.

For traders and investors, this is where the story becomes compelling. Regulation is becoming unavoidable, institutions are entering crypto, and real-world asset tokenization is accelerating. Dusk sits exactly at the intersection of these three trends. Every partnership, product launch, and tokenized asset strengthens the long-term fundamentals of the DUSK token. In the short term, these milestones create trading opportunities around major catalysts. In the long term, they build a strong investment thesis based on real adoption, not speculation. This is how conviction is built by understanding where the industry is heading and positioning early.

Of course, there are risks. Regulation moves slowly, institutional adoption takes time, and competition in the compliance-focused blockchain space is real. But that is precisely what creates the opportunity. The reward is exposure to one of the most important shifts in crypto: bringing real, regulated finance on-chain. If even a small portion of traditional financial markets moves to blockchain, the networks designed for that future will benefit first. Dusk is quietly building that bridge today. The takeaway is simple: Dusk isn’t about short-term hype. It’s about making blockchain work for the real financial world and that’s where the next big opportunity lies.