For many years crypto has talked about changing the financial system. We heard big promises about faster payments open access and global markets. Yet when you look at how banks and regulated institutions actually work today there is a big gap between the vision and reality. Most blockchains are open and transparent by design. That is great for experimentation but it creates a serious problem for real finance. Banks must protect customer data. Asset managers must follow strict rules. Regulators must be able to audit activity. This is where many projects struggle. Dusk was created to close this gap and make blockchain usable for real financial institutions.

The Problem Real Finance Faces with Blockchain:

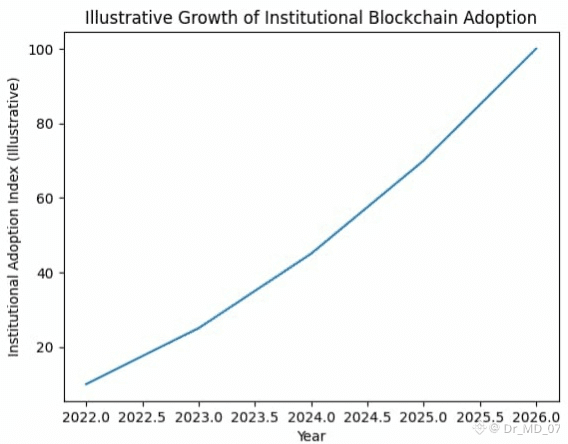

Traditional finance is built on trust privacy and regulation. When a bank processes a payment or issues a security the details are not visible to the whole world. Customer information is protected by law. At the same time regulators need to know that everything is done correctly. Public blockchains do the opposite. They show every transaction and balance to anyone. This creates a conflict. Institutions cannot risk exposing sensitive data yet they also want the speed and efficiency that blockchain offers. As a professional creator who follows this space closely I see this as the biggest reason why institutional adoption has moved slower than many expected. The technology is ready but the structure is not. Dusk focuses exactly on this missing piece.

How Dusk Brings Banks and DeFi Together:

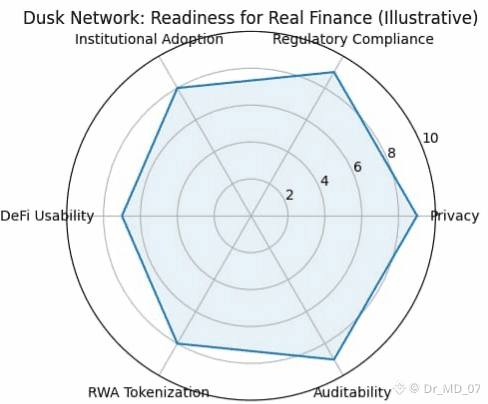

Dusk is a layer one blockchain designed for private and regulated finance. Instead of trying to serve every possible use case it focuses on one clear goal. Make blockchain safe and practical for real financial institutions. Dusk uses privacy technology so financial data can stay confidential while still being verifiable. In simple words users keep their privacy and regulators can still check that the rules are followed. This makes it possible for banks fintech companies and regulated DeFi platforms to build on a public blockchain without risking customer trust. That is why Dusk is often described as the bridge between traditional finance and decentralized finance.

Why This Matters in Today’s Market:

In 2026 the crypto market is entering a new phase. Regulation is no longer a question of if but when and how. Institutions are not asking whether they should use blockchain anymore. They are asking which blockchain fits their needs. At the same time tokenized real world assets are becoming one of the strongest narratives in the market. Stocks bonds funds and even real estate are starting to move on chain. This trend needs privacy and compliance to work at scale. Dusk is built exactly for this moment. It is not chasing short term hype. It is positioning itself for the long term shift where real finance moves on chain.

Real Use Cases That Show Progress:

Dusk is not just a concept. It is built to support real financial products. One of the most important areas is tokenized real world assets. This allows traditional assets to be issued and traded on blockchain with clear rules and privacy. Another area is compliant DeFi. Lending trading and settlement platforms can operate in a regulated way without exposing user data. For institutions this is a major step forward. They get the efficiency of blockchain and keep the trust of their customers. As someone who follows institutional adoption closely I see this as the type of progress that creates lasting value not just temporary price spikes.

Why Traders and Investors Are Watching DUSK:

From a trading point of view DUSK is interesting because it sits at the center of three strong trends. Regulation institutional adoption and real world asset tokenization. When these trends grow the infrastructure that supports them benefits first. Each new partnership product launch or institutional pilot adds to the long term story of the network. In the short term these milestones create clear catalysts for price movement. In the long term they build a strong foundation based on real usage. This is how serious conviction is built. Not by chasing noise but by understanding where the market is heading.

Personal Perspective as a Creator:

When I look at projects I always ask one simple question. Does this solve a real problem. Dusk does. It does not try to replace every blockchain. It focuses on making blockchain work for real finance. That clarity is rare. In a market full of loud promises Dusk quietly builds what institutions actually need. Privacy compliance and trust. This is why it keeps appearing in conversations about the future of regulated DeFi and tokenized assets. For creators and traders this is exactly the type of project worth paying attention to.

What to Watch Going Forward:

The next phase for Dusk will be shaped by real adoption. Watch for institutional partnerships. Watch for tokenized asset launches. Watch how regulators respond to compliant blockchain infrastructure. These signals matter more than short term price action. They show whether the network is becoming part of the real financial system. In my view this is where the strongest long term opportunities are formed.

Conclusion:

From banks to DeFi the future of finance needs a bridge. Dusk is building that bridge with privacy compliance and real world usability at its core. In a market that is moving toward regulation and institutional adoption this approach is not optional. It is essential. DUSK is not just another crypto token. It represents the infrastructure that can connect traditional finance with blockchain in a way that works for everyone. For traders investors and creators who understand where crypto is going next this is a story worth following closely.