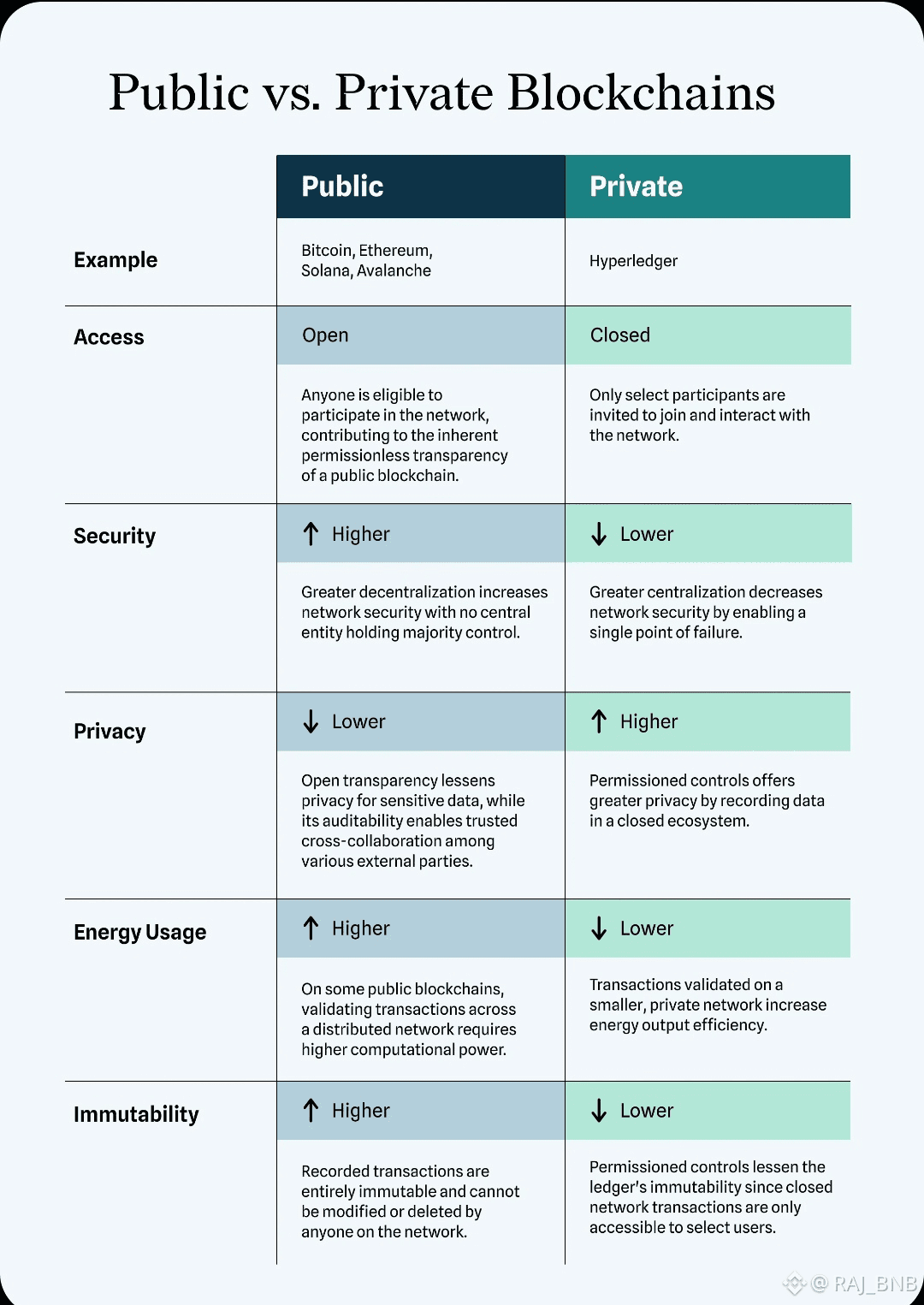

Blockchain adoption in regulated finance has never been blocked by technology alone — it has been blocked by misaligned design priorities. Public chains optimized for openness created transparency, but transparency without control introduced new risks: strategy leakage, unstable execution, unpredictable fees, and regulatory friction. Financial institutions do not reject blockchain; they reject systems that expose them to unnecessary operational and compliance risk. This is precisely the gap Dusk Foundation was designed to close.

Settlement Is Not Just Speed — It Is Certainty

In real markets, settlement quality is defined by certainty, not raw speed. Dusk’s settlement evolution shows a deliberate reduction in finality time paired with rising auditability. This matters because institutions must be able to prove how and why a transaction occurred long after it settles. Instead of treating compliance as an external reporting layer, Dusk embeds auditability directly into the settlement process. The result is execution that is fast enough for markets, but structured enough for regulators.

Why Predictable Fees Matter More Than Low Fees

Retail narratives focus on cheap transactions. Institutions focus on predictable transactions. Fee volatility breaks risk models, accounting systems, and operational planning. Dusk’s architecture prioritizes fee stability, allowing institutions to model costs with confidence. Combined with fast finality, this creates a settlement environment where financial activity can scale without introducing hidden operational risk.

Supply Discipline as Infrastructure Design

Speculative systems often treat token supply as a growth lever. Infrastructure systems treat supply as a stability tool. Dusk’s clearly defined maximum, circulating, and remaining supply supports long-term network security through staking, while preserving governance credibility and economic transparency. For regulated participants, this clarity is essential — uncertainty in supply translates directly into uncertainty in risk exposure.

The Hidden Cost of Public Transparency

Public settlement leaks intent. Visible transactions expose position sizes, timing, and strategy, enabling front-running and adverse market reactions. Over time, this leads to wider spreads, higher slippage, and reduced execution quality. Dusk addresses this problem through controlled privacy, ensuring that transactions remain confidential during execution while still allowing selective disclosure when compliance or audits require it. This protects both market integrity and regulatory trust.

A Middle Path the Market Actually Needs

The blockchain landscape is polarized: transparent public chains on one side, unregulated privacy coins on the other. Regulated finance cannot fully use either. Dusk occupies the missing middle layer — privacy with accountability. Confidentiality is preserved, but audit paths exist. Execution is protected, but compliance is never compromised. This balance is not ideological; it is operational.

Adoption Looks Quiet — Until It Becomes Standard

Infrastructure does not announce itself with hype. It proves itself through reliability. Dusk’s settlement model, compliance-first design, and controlled privacy do not aim to disrupt finance overnight. They aim to integrate with it. If successful, Dusk will not feel like a revolution. It will feel like the system institutions expected blockchain to be in the first place.