If you spend enough time studying why regulated assets have been slow to migrate on-chain, you eventually realize the bottleneck isn’t tokenization itself. Representing assets digitally is trivial. The hard part is settlement. In crypto, settlement is instantaneous and final. In regulated markets, settlement is layered, controlled, reversible in certain windows, and legally anchored. Dusk’s architecture exists at the intersection of these two worlds, acting as the bridge between crypto’s economic finality and regulation’s legal finality.

If you spend enough time studying why regulated assets have been slow to migrate on-chain, you eventually realize the bottleneck isn’t tokenization itself. Representing assets digitally is trivial. The hard part is settlement. In crypto, settlement is instantaneous and final. In regulated markets, settlement is layered, controlled, reversible in certain windows, and legally anchored. Dusk’s architecture exists at the intersection of these two worlds, acting as the bridge between crypto’s economic finality and regulation’s legal finality.

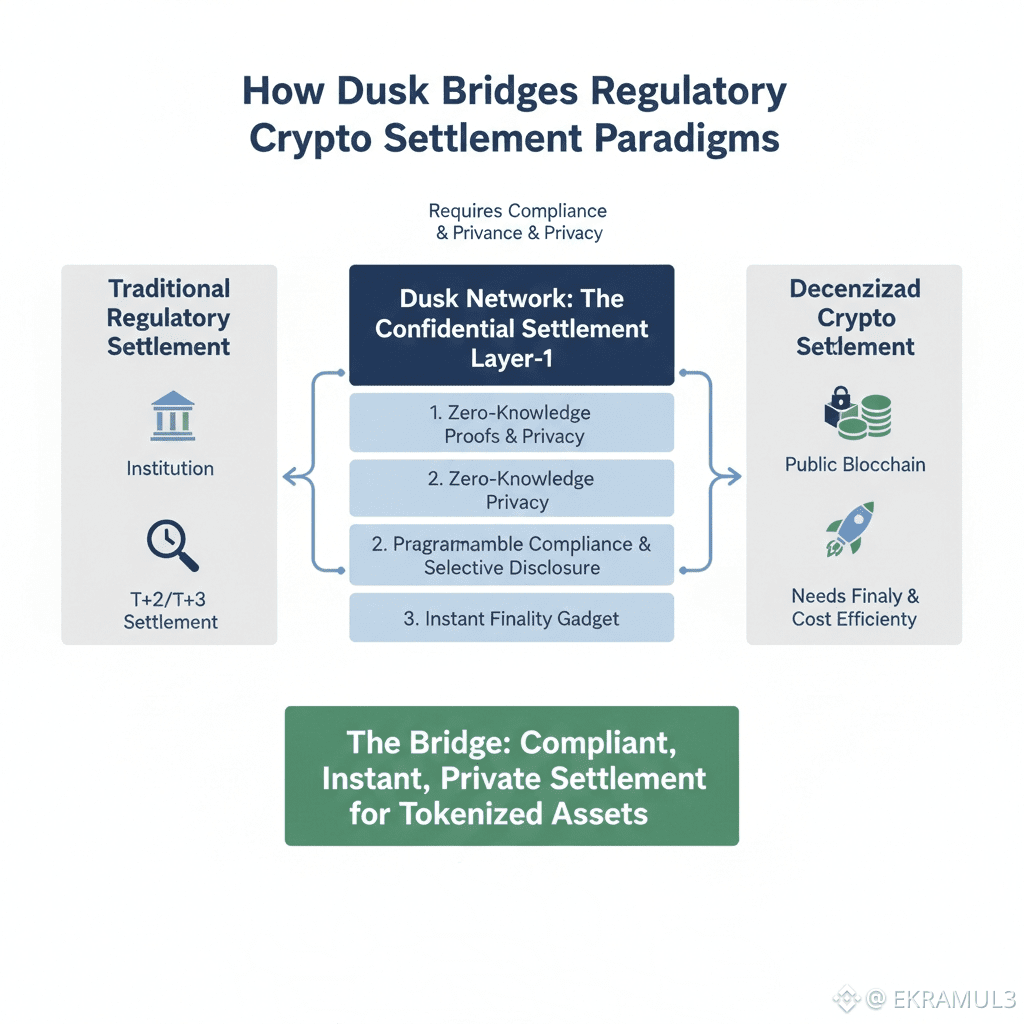

Two Settlement Models, One Collision Point

Crypto settlement started with a pretty simple idea: once a block gets confirmed, the value moves, and that’s final. It’s fast, sure, but it just doesn’t fit with the way regulated systems work. In those places, you don’t really own something until it’s cleared, you’ve passed compliance checks, and everything’s legally signed off. Banks and other institutions need settlement processes that make sure everyone’s eligible, all the disclosures are in place, and reporting rules get followed. Crypto networks usually skip all that most blockchains act like the transfer itself is all that matters. But in regulated markets, the actual transfer comes at the very end of a much longer process.

Dusk Treats Settlement as a Legal Workflow, Not Just a Transaction

Dusk stands out because it doesn’t just see settlement as a simple data update. It treats settlement like a whole workflow one that has to jump through regulatory hoops before anything’s final. With this setup, confidential smart contracts can actually build in things like eligibility checks, transfer limits, audit trails, and even selective disclosure. They pull this off without exposing private market activity to everyone. And the best part? You don’t need third parties to enforce these rules. Dusk bakes them right into the protocol itself.

Instant Technical Finality Meets Delayed Legal Finality

Markets often require a structure where technical finality and legal finality do not occur at the same moment. A tokenized bond might settle instantly on-chain, but legal beneficial ownership may only transfer after supervisory approval or reporting obligations are satisfied. Dusk introduces the ability for assets to enter a pending legal state while maintaining confidential settlement guarantees. This dual-state construct is unusual in crypto but normal in securities markets, and it is what makes Dusk suitable for issuance, secondary trading, and redemption of regulated assets.

Selective Disclosure as a Compliance Escape Valve

Regulated settlement needs to be auditable, but that doesn’t mean everyone has to see everything. Dusk handles this by letting regulators and auditors access just the info they need to do their jobs nothing more. Meanwhile, people in the market keep details like who they’re trading with, how big their positions are, their inventory, and execution details private. It’s pretty much the same way clearing houses work now: they share data only with those who actually need it, not with the whole market.

A Settlement Asset Designed for Institutional Liquidity Flows

Dusk changes how settlements work by making DUSK the cash side for Delivery-versus-Payment (DvP). In regulated markets, you can’t really say an asset’s transferred until the cash moves too. Most tokenization pilots run into trouble because they still need off-chain fiat to settle things, which kind of defeats the point. Dusk gets rid of that problem. Both the tokenized asset and its cash leg stay inside the same compliant system, so there’s no need for messy reconciliation or waiting around for settlements. It just works, faster and safer.

From Proof-of-Work Finality to Proof-of-Compliance Finality

Crypto systems achieve finality when the network confirms a block. Regulated systems achieve finality when compliance obligations are met. Dusk effectively merges these two definitions by aligning its settlement logic with three layers:

1. Cryptographic Validity (is the transaction correct?)

2. Regulatory Validity (is the transaction compliant?)

3. Legal Finality (is the transfer enforceable?)

Only when all three align does ownership truly transfer. This is exactly how clearing and settlement functions in custodial markets today Dusk simply compresses it into protocol logic.

Making Tokenization Operational, Not Experimental

Most tokenization attempts fail because they ignore what happens after issuance. Issuance without compliant settlement is just a demo. Settlement without regulatory legitimacy is useless. Dusk bridges the two by enabling regulated financial products bonds, funds, structured instruments, and tokenized credit to close the settlement lifecycle entirely on-chain without breaking the legal stack that governs them.

The Strategic Implication

If regulated assets migrate to blockchains, they will require systems that behave like securities infrastructure, not public ledgers. Dusk’s architecture acknowledges that regulated finance will not adopt crypto because of speed or decentralization alone. It will adopt crypto when settlement guarantees become compatible with compliance, audit, and legal enforceability.

That is how Dusk bridges the two paradigms:

by making regulated settlement programmable and crypto settlement legally relevant.