In crypto, “safe” is a strange word. Nothing is risk-free. Markets move fast, narratives change faster, and many projects disappear as quietly as they arrived. So when I say Walrus Protocol feels safer than most DeFi projects, I’m not talking about price stability or short-term returns. I’m talking about something deeper: structural reliability.

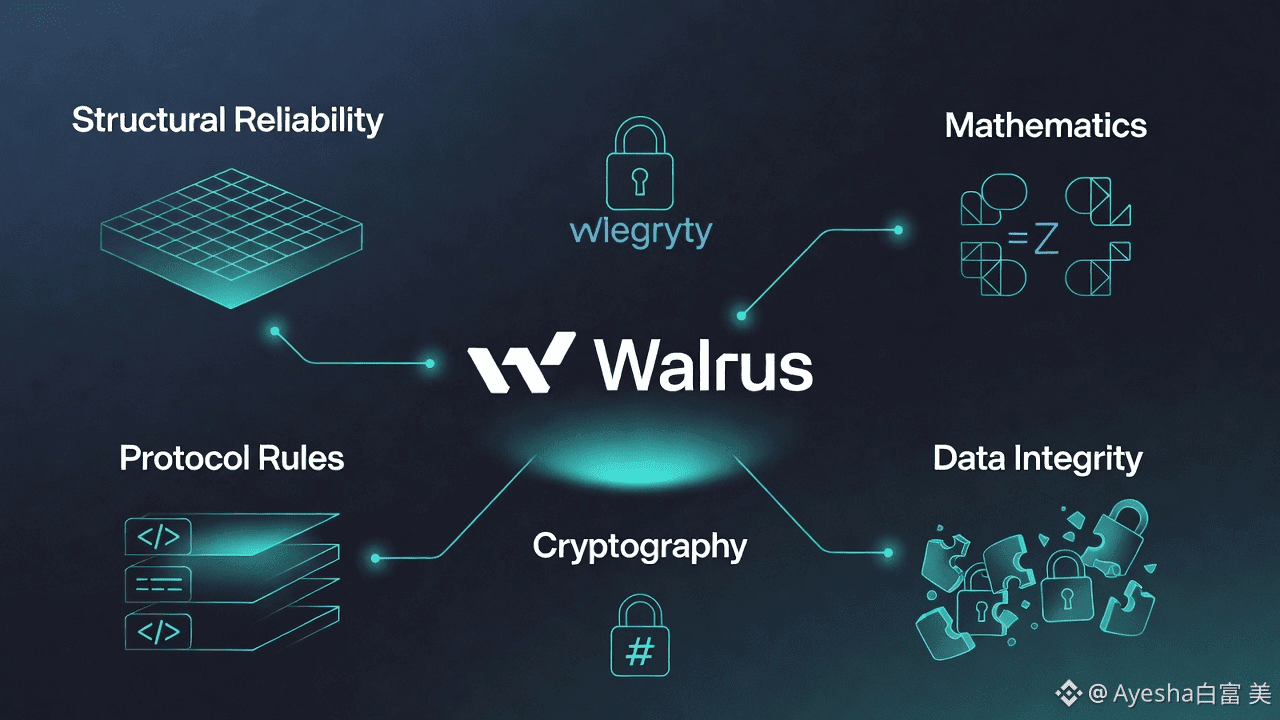

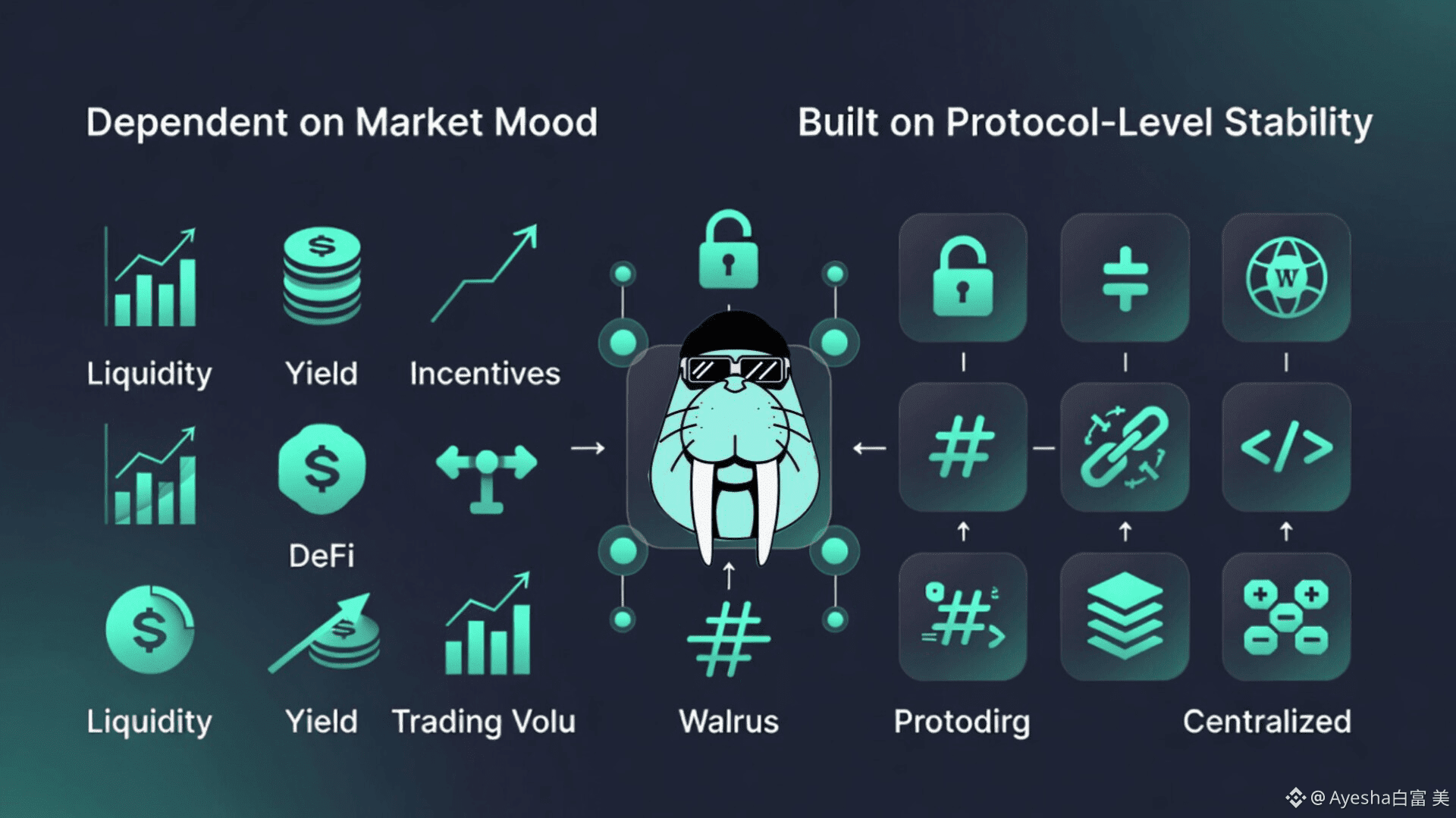

Most DeFi projects are built around financial activity first. Liquidity, yield, incentives, volume. All of that depends heavily on user behavior and market mood. When incentives slow down or sentiment turns negative, activity drops, and the protocol starts to feel fragile. Walrus Protocol is different because it doesn’t depend on excitement to function. It depends on math, cryptography, and protocol-level rules.

Walrus Protocol is not trying to be a financial product. It is building a decentralized data availability and storage layer designed to work even when conditions are not ideal. That distinction matters more than it sounds.

At its core, Walrus Protocol is about one simple question:

What happens to data when things go wrong?

In many decentralized systems, data availability is assumed rather than guaranteed. Files are uploaded, nodes store them, and everyone hopes the system keeps running smoothly. Walrus Protocol doesn’t rely on hope. When data is uploaded, it is split into cryptographic pieces and distributed across many independent nodes. No single node holds the full file, and no single failure can break the system.

What makes this powerful is how Walrus Protocol treats failure as normal, not exceptional. Nodes can go offline. Hardware can fail. Networks can churn. Walrus is designed for this reality. As long as enough fragments remain, the original data can be reconstructed. If fragments are lost, the network automatically repairs itself using what is still available. There is no central coordinator and no manual recovery process.

This self-healing behavior is one of the main reasons Walrus Protocol feels safer than most DeFi projects. In DeFi, when something breaks, users often find out after funds are at risk. In Walrus, failure is anticipated and absorbed by the protocol itself.

Another important difference is verification. Many systems ask users to trust that data is being stored correctly. Walrus Protocol removes that assumption. Storage providers must continuously prove, through cryptographic challenges, that they still hold the data they committed to store. If they fail to prove it, they are penalized. This creates a direct link between honest behavior and economic consequences.

That kind of enforcement is rare in DeFi. Financial protocols often rely on incentives that work only as long as conditions are favorable. Walrus enforces correctness regardless of market sentiment. Data either exists and can be proven, or it doesn’t.

Walrus Protocol also avoids overloading itself with unnecessary complexity. It doesn’t try to bundle trading, lending, governance experiments, and social layers into one system. It focuses on doing one job well: keeping data available, verifiable, and durable over time. That focus reduces attack surfaces and design risk.

Built around the Sui ecosystem, Walrus Protocol benefits from fast execution and predictable performance, but its relevance goes beyond a single chain. As blockchains move toward modular designs, reliable data availability becomes a requirement, not an optional feature. Rollups, on-chain games, AI workloads, NFTs, and long-lived applications all need data that doesn’t disappear when nodes rotate or incentives shift.

From a risk perspective, this matters a lot. DeFi protocols often expose users to financial risk first, then technical risk. Walrus Protocol reverses that order. It minimizes technical uncertainty so that builders and users can reason clearly about everything built on top of it.

This is also why Walrus doesn’t need aggressive marketing to justify its existence. If decentralized applications keep growing, the need for durable data grows with them. That demand is structural, not speculative.

Feeling safe in crypto doesn’t come from promises or dashboards. It comes from systems that behave predictably under stress. Walrus Protocol is designed for stress. It assumes things will break and prepares for that outcome in advance.

That’s why, when I compare it to most DeFi projects, Walrus Protocol stands out. Not because it avoids risk, but because it understands where real risk comes from. In the long run, infrastructure that quietly keeps working is more valuable than financial products that only work when conditions are perfect.

Walrus Protocol doesn’t ask for attention.

It focuses on keeping data alive.