Since its launch in September 2025, XPL has become the cornerstone of Plasma’s blockchain ecosystem. Plasma was designed for one clear purpose: enabling fast, secure, high-volume stablecoin transfers across a frictionless network. At the heart of this system, XPL is not just a token—it is the engine driving network security, transaction execution, ecosystem growth, and real-world adoption. Its design reflects a careful balance between usability, incentives, and long-term sustainability, making it central to Plasma’s success.

Network Security and Validator Incentives

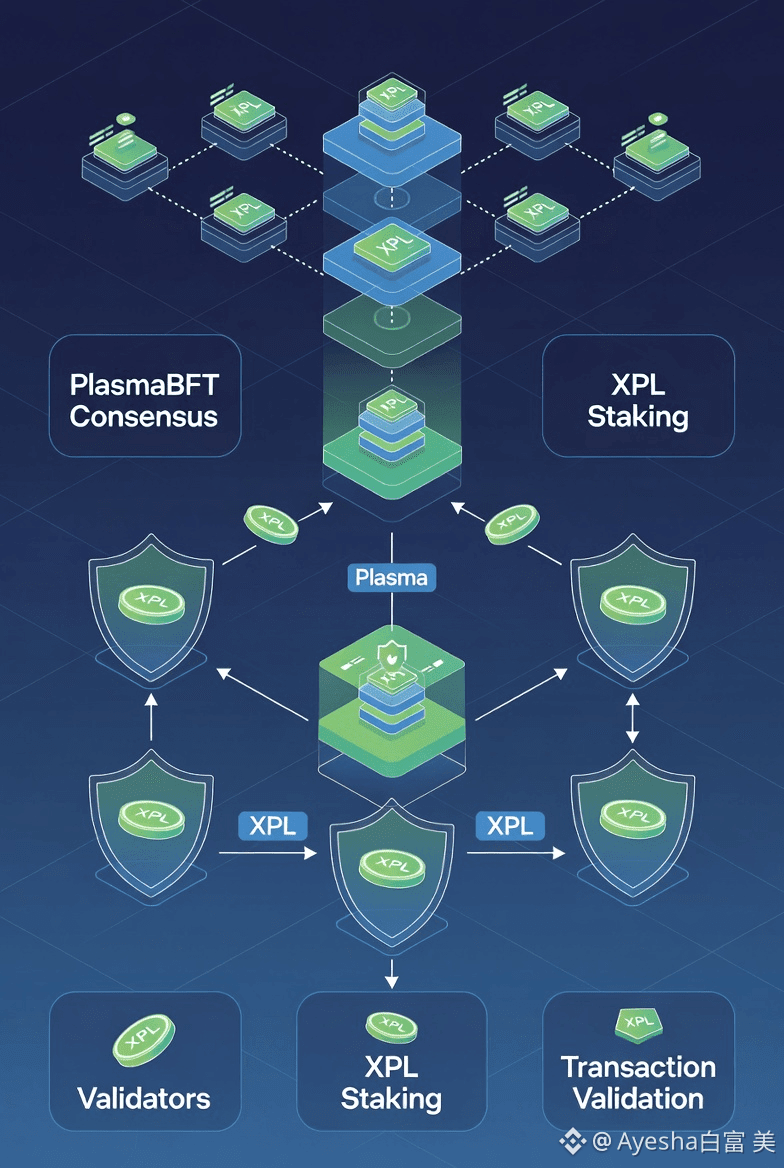

XPL is fundamental to Plasma’s security model. Plasma employs the PlasmaBFT consensus protocol, which requires validators to stake XPL to validate blocks, process transactions, and maintain the integrity of the network. Validators earn staking rewards proportional to their contributions, creating strong alignment between token ownership and network security. This mechanism ensures that XPL holders who actively participate have a direct influence on the health and stability of the blockchain.

Beyond staking, XPL enables advanced operations within the ecosystem. Token holders can participate in governance-like decisions, vote on incentive programs, and interact with new features that drive adoption. In this sense, XPL performs a role similar to Bitcoin on Bitcoin and Ether on Ethereum, but with a key distinction: it is fully integrated with a stablecoin-first approach. By tying token utility to stablecoin flows, Plasma ensures that XPL is relevant not just for validators, but for users, developers, and partners building real-world applications.

Token Distribution and Supply Design

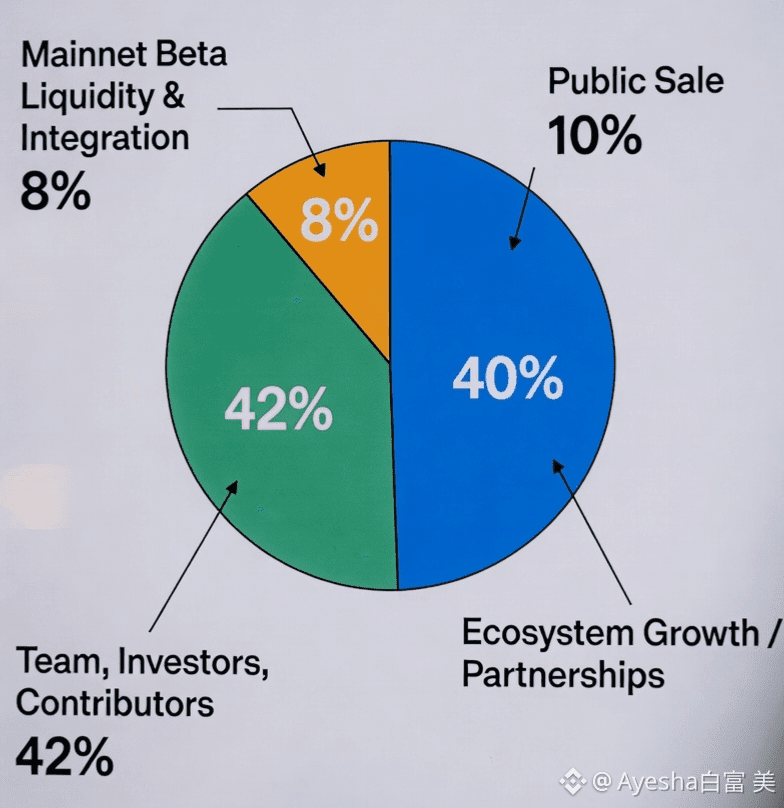

Plasma launched with a fixed total supply of 10 billion XPL. Ten percent of the supply was allocated to the public sale, while 40% was reserved for ecosystem growth, partnerships, and development initiatives. At mainnet beta, 8% of the total supply was unlocked to provide initial liquidity, support partner incentives, and facilitate early integrations. The remaining allocations—particularly for team members, investors, and long-term contributors—follow strict vesting schedules. This structure mitigates the risk of sudden sell pressure while allowing for gradual, sustainable distribution over time.

Public sale participants outside the U.S. received fully unlocked tokens at launch. U.S. participants face a 12-month lockup period. This dual-track unlocking model balances accessibility with disciplined capital management, ensuring that early investors cannot disrupt market stability while still supporting global inclusion.

Sustainable Tokenomics

XPL’s tokenomics are designed to maintain value and encourage network participation over the long term. Validator rewards start at approximately 5% annually, gradually decreasing to a baseline of 3% over time. This declining reward schedule reduces inflationary pressure while maintaining strong incentives for active network security.

Plasma also incorporates a fee burn mechanism inspired by Ethereum’s EIP-1559. A portion of transaction fees is permanently removed from circulation, offsetting inflation and preserving the value of staked XPL. Additionally, Plasma’s “paymaster” system allows standard USDT transfers to carry zero fees. By subsidizing fees through the protocol, users are not required to hold XPL for routine transfers. This lowers friction, increases adoption potential, and positions XPL as a token for both high-level operations and everyday activity.

Market Performance and Reception

XPL’s market debut generated immediate attention. Within hours, more than $2 billion in stablecoins had entered the network, spread across over 100 DeFi protocols. Early trading showed rapid demand, with XPL prices surging over 50% due to limited circulating supply and strong speculative interest. Peak prices reportedly reached above $1.50 before stabilizing between $0.90 and $1.10. Fully diluted market value estimates reached $8–10 billion, reflecting high expectations for Plasma’s growth and utility.

While early performance was strong, the market also highlighted structural challenges. Locked tokens create potential supply pressure as vesting schedules release additional XPL over time. Managing these unlocks is critical to maintaining price stability and supporting sustained adoption. The paymaster system, while effective at lowering user friction, also transfers operational costs to the protocol’s reserves. Scaling usage without careful revenue management could strain resources if fee income does not offset the subsidies.

Validator Decentralization and Network Trust

A central factor for XPL’s long-term value is validator decentralization. PlasmaBFT’s security model relies on broad participation and active oversight. Concentration of validators or uneven application of slashing rules could reduce trust in network integrity. XPL stakers expect a secure, trust-minimized system where their tokens directly support network resilience. The protocol’s reward and slashing mechanisms are designed to mitigate risk and enforce validator discipline, but ongoing monitoring and adoption of best practices are critical to sustaining confidence.

Ecosystem Integration and Real-World Use Cases

XPL’s utility extends beyond staking and governance. Early ecosystem deployments demonstrate real-world applications that strengthen token relevance. Plasma provided XPL grants to Clearpool, supporting the development of PayFi, a stablecoin-based credit infrastructure. This establishes secondary use cases for XPL, including merchant flows, yield protocols, and credit rails. These integrations position XPL as an operational token for decentralized finance, not just a speculative asset.

Binance’s 75 million XPL HODLer airdrop further expands the token’s reach among retail investors. This strategic distribution increases user engagement, promotes adoption, and creates a broader base of active token holders. However, it also carries a risk of short-term speculative activity. Balancing retail engagement with ecosystem health is essential to long-term value creation.

Regulatory Considerations

As a stablecoin-focused blockchain, Plasma and XPL operate in a sensitive regulatory environment. Stablecoins intersect both monetary and securities frameworks, and networks built around them are subject to scrutiny. Plasma has implemented KYC procedures, jurisdictional filters, and cautious U.S. participation to manage compliance risks. Scaling globally will require ongoing attention to evolving regulations to ensure XPL’s utility is not hindered by legal constraints.

Conclusion

XPL is the engine of Plasma’s stablecoin-first blockchain. It secures the network, powers transactions, incentivizes growth, and enables governance participation. Its tokenomics are structured for long-term sustainability, combining staking rewards, fee burns, and a paymaster system to support adoption. Market response shows strong demand, while ecosystem integrations demonstrate real-world utility beyond speculation.

Success for XPL depends on disciplined vesting, decentralized validator participation, careful scaling of fee subsidies, and navigation of regulatory frameworks. Early moves—such as Clearpool’s PayFi integration and Binance’s airdrop—signal growing adoption and utility. XPL is more than a token; it is the foundation of a frictionless, stablecoin-native blockchain designed to connect traditional finance and decentralized applications in a secure, scalable, and usable way.

With its clear design, strong incentives, and growing ecosystem, XPL embodies Plasma’s vision: a high-performance, stablecoin-first blockchain capable of powering the next generation of digital payments and decentralized finance.