In 2026, @Dusk stands ready to claim its spot as the essential privacy layer for the exploding world of tokenized real-world assets (RWAs). I firmly believe Dusk isn't just another blockchain—it's the compliant backbone that bridges traditional finance (TradFi) and decentralized finance (DeFi), solving the privacy puzzle that regulators and institutions demand. As trillions in assets go on-chain, Dusk's unique blend of zero-knowledge proofs, selective disclosure, and regulatory alignment will make it indispensable. This isn't hype; it's the logical next step in a market shifting toward secure, private, yet auditable transactions.

Understanding Dusk: The Privacy-First Layer-1 Built for Finance

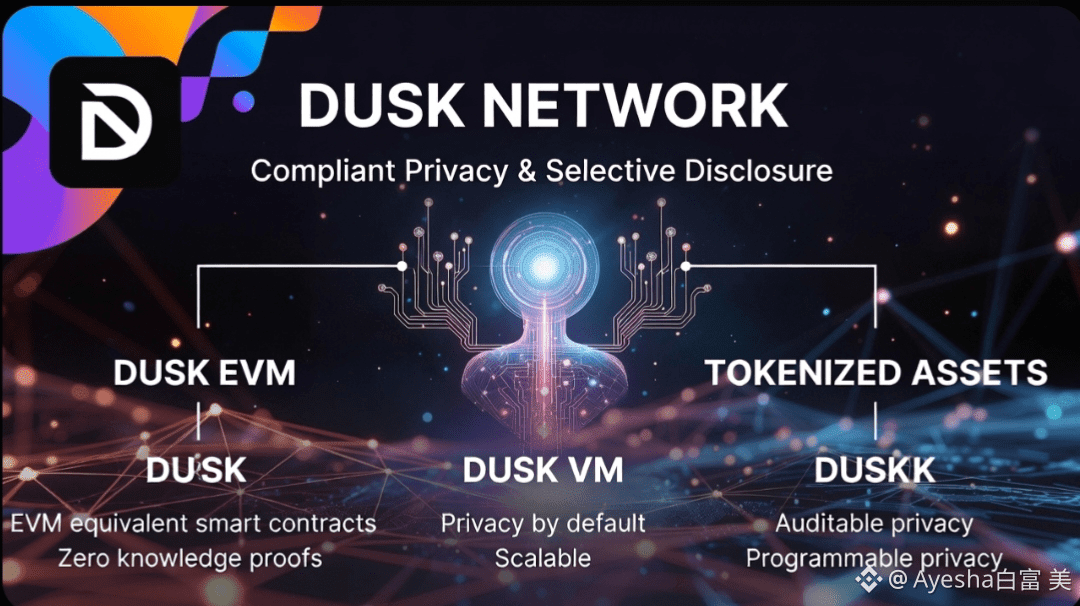

Dusk Network is a Layer-1 blockchain designed specifically for bringing global financial markets on-chain while ensuring compliant privacy. Its mainnet launched on January 7, 2026, after six years of rigorous development. Dusk enables institutions to tokenize assets like stocks, bonds, and securities without sacrificing user privacy or regulatory requirements.

At its core, Dusk uses zero-knowledge (ZK) proofs to keep transactions confidential by default—amounts, senders, and receivers stay hidden from the public blockchain. The game-changer is **selective disclosure**: users or regulators can reveal specific details when needed, such as for audits or compliance checks.

This "auditable privacy" sets Dusk apart from pure anonymity coins like Monero or Zcash, which often clash with regulations. Dusk aligns with frameworks like the EU's MiCA (Markets in Crypto-Assets) and Travel Rules, making it a safe choice for institutions wary of privacy tech's bad reputation.

The network's modular architecture includes DuskEVM (Ethereum Virtual Machine-compatible for Solidity developers) and DuskVM (for Rust-based apps). This flexibility lets builders create everything from private payments to tokenized securities, all with instant settlement and low fees.

Think of Dusk as the secure vault in a digital bank: it protects sensitive data while keeping the doors open for oversight. In a world where data breaches and surveillance are constant threats, this positions Dusk as the core layer for privacy-conscious finance.

The 2026 Privacy Boom: Why Now?

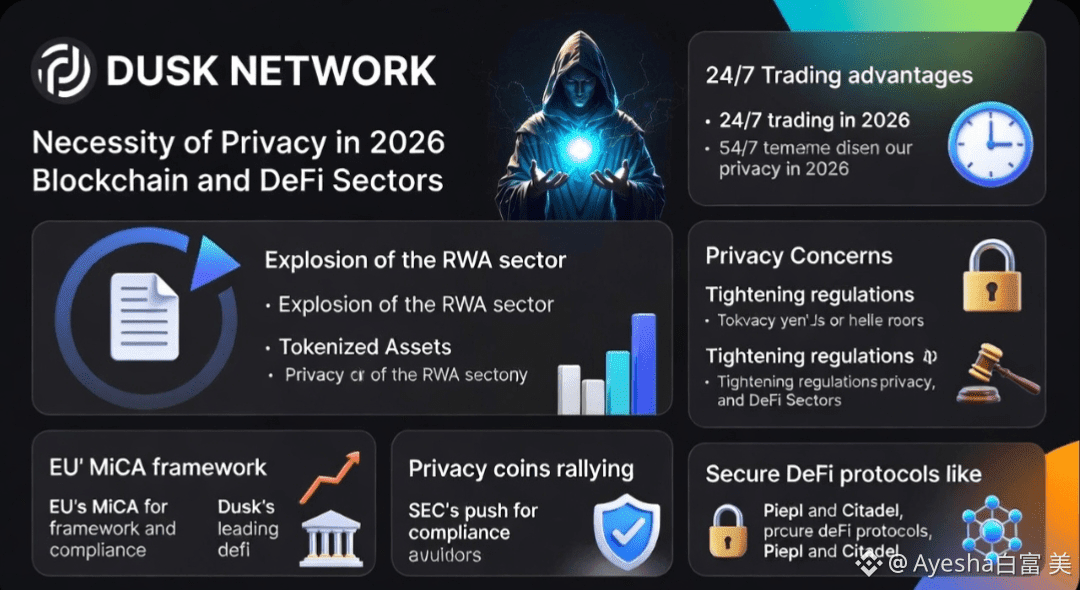

Privacy isn't a luxury in 2026—it's a necessity. The RWA sector is exploding, with projections of trillions in tokenized assets by the end of the decade. Traditional players like the New York Stock Exchange are diving in, announcing platforms for 24/7 tokenized trading with instant settlement.

But here's the catch: without privacy, on-chain finance exposes everything—from trade sizes to investor identities—to prying eyes, scaring off institutions.

Regulations are tightening. The EU's MiCA, fully in effect by 2026, mandates compliance for crypto assets, including KYC/AML checks and transparent reporting. Globally, bodies like the SEC are pushing for "tokenization of everything," but only if it's secure and auditable.

Dusk solves this by offering privacy that's compliant, not combative. As CTO Hein Dauven explained, transfers are private by default, but selective disclosure ensures regulators can verify without compromising the system.

This timing is perfect. Privacy coins are rallying in 2026 amid renewed demand for decentralized anonymity in a post-regulatory era. Dusk leads the pack, surging dramatically in recent weeks and outperforming peers.

Why? Because it's not just about hiding—it's about enabling secure, institutional-grade DeFi. Protocols like Piepl for private payments and Citadel for digital identity are already building on Dusk, turning it into the "utility fuel" for global private finance.

Key Technical Innovations Driving Dusk's Edge

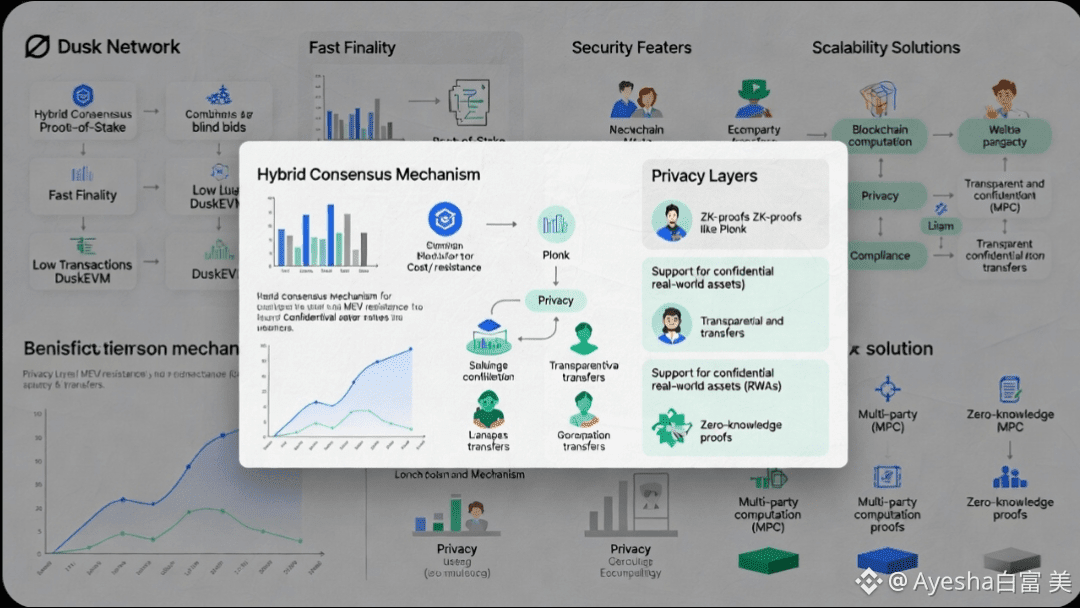

Let's dive deeper into what makes Dusk technically superior for 2026's demands. The mainnet introduced a hybrid consensus mechanism blending Proof-of-Stake with blind bids for block production, ensuring fairness and resistance to MEV (Miner Extractable Value). This keeps transactions fast—under 10 seconds—and cheap, ideal for high-volume financial apps.

DuskEVM is the star: It allows seamless porting of Ethereum smart contracts while adding privacy layers. Developers can build confidential RWAs, where asset ownership and transfers remain private, but compliance proofs are verifiable. For example, a tokenized bond could hide investor details from competitors but reveal them to tax authorities via selective disclosure.

On the privacy front, Dusk's ZK-proofs use Plonk, an efficient system for proving statements without revealing underlying data. Users can opt for transparent transfers (like standard ERC-20) or confidential ones (shielding amounts and parties). This choice is crucial for RWAs, where some data must be public (e.g., total supply) while others stay hidden (e.g., individual holdings).

Security is baked in: Dusk's architecture prevents common vulnerabilities like front-running, and its compliance focus has attracted audits from top firms. As more assets tokenize—think hundreds of millions from partners like NPEX—Dusk's tech ensures scalability without privacy trade-offs.

2026 Milestones: Partnerships and Adoption Fueling Growth

Dusk's momentum in early 2026 is undeniable. The mainnet launch triggered massive price surges and volume spikes tied to real progress.

Key partnerships underscore Dusk's positioning:

NPEX: A regulated Dutch stock exchange building tokenized securities on Dusk, with significant assets set for deployment via the NPEX dApp for instant, private settlements.

Chainlink: Integrated for cross-chain RWAs, oracles, and CCIP, bringing regulated market data on-chain.

Quantoz and EURQ: Stablecoin integration for compliant euro-denominated transactions.

Exchange Listings: Binance US, and others DEX (with high-leverage perps)m

Dusk is also pursuing an MTF (Multilateral Trading Facility) license in the EU, a huge step for hosting regulated trades. Community events and AMAs continue to build buzz around privacy infrastructure.

Market-wise, $DUSK shows strong bullish sentiment despite volatility. Analysts eye significant upside if RWA pilots succeed.

Risks and Realistic Outlook

No project is bulletproof. Success hinges on execution—delivering upgrades and rollouts without delays. Volatility remains high, with dips from profit-taking common.

Yet, the fundamentals are strong. Dusk's long track record, institutional ties, and focus on regulated RWAs mitigate risks. In a year where privacy tokens rebound amid regulatory clarity, Dusk's balanced approach—privacy without anarchy—gives it a clear edge.

The Core Privacy Layer: Dusk's Inevitable Rise in 2026

I stand by this: 2026 will cement Dusk as the core privacy layer for on-chain finance. As RWAs tokenize trillions and institutions demand compliant tools, Dusk delivers exactly that—secure, scalable, and auditable privacy. It's not about being the biggest; it's about being the most essential. If you're in crypto for the long game, Dusk is the play that unlocks economic inclusion through privacy-first innovation. Watch as it evolves from a niche project to the standard for global markets.