2026 feels like a turning point for blockchain privacy. The days when “anonymity-only” coins like Monero defined the space are fading. Now, privacy is measured differently—by whether it works for real institutions without running afoul of regulators. Dusk has quietly become the go-to infrastructure for European institutions needing a MiCA-compliant blockchain. It offers a level of confidentiality that actually matters for finance, without falling into secrecy for secrecy’s sake. The network’s 117% price jump in January 2026 isn’t just a number—it’s a signal that institutional players are taking notice, and that privacy in finance has a practical, measurable value.

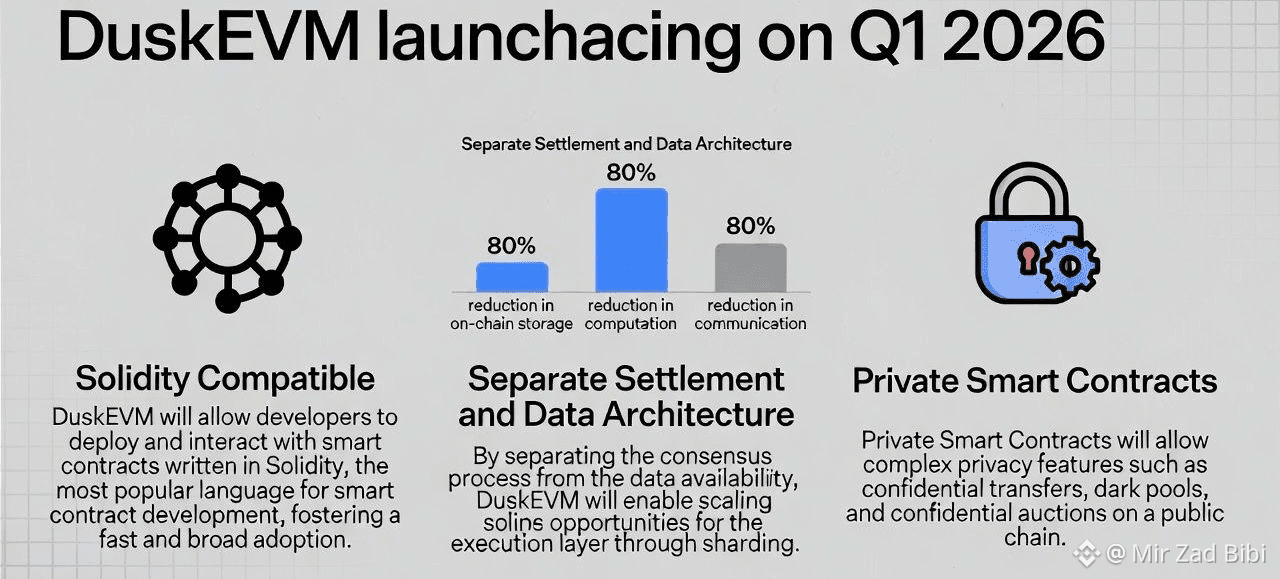

The launch of DuskEVM in Q1 2026 changes the game in a practical way. Developers can now use Solidity, something they already know, while gaining native Zero-Knowledge (ZK) privacy. The architecture itself is smart—settlement and data are handled separately, cutting fees by up to 80%, which isn’t just efficient, it’s meaningful for anyone running bigger operations. And those “Private Smart Contracts”? They let complicated financial moves—dark pools, confidential auctions—happen on a public chain without revealing all the details. It’s one thing to promise privacy, another to make it actually usable for the kind of institutions that handle real money.

2026 also saw a real milestone on the adoption front. The Dutch exchange NPEX tokenized over €200M in regulated securities on Dusk. That’s serious institutional volume. With Chainlink CCIP integration, these assets can move across chains like Ethereum and Solana, and they stay compliant. Thanks to MiFID II licenses, these tokenized securities can trade legally in the EU. It’s a quiet but significant example of how Dusk is linking traditional finance with DeFi—not in theory, but in real, regulated trades that matter.

The economics of $DUSK are changing, too. It’s moving away from inflationary rewards and leaning into actual transaction revenue—fees from real-world asset (RWA) issuances, dividends, and so on. Node operators are central here, hyperstaking and securing the network while also earning fees from these regulated flows. Analysts in 2026 are eyeing $DUSK targets between $0.33 and $0.55, tracking how fast tokenized assets gain traction. The network is starting to feel less like a speculative playground and more like a functioning, self-sustaining ecosystem for regulated finance.

That’s not to say it’s all smooth sailing. Dusk has technical risks—bridges and ZK smart contracts aren’t trivial, and audits are critical. There’s competition, too, from other ZK Layer-1s and private institutional chains like JPMorgan’s Onyx. Liquidity could be a bottleneck if onboarding large, traditional assets takes longer than expected. These aren’t dealbreakers, but they are real factors to keep in mind when weighing Dusk against its peers.

By now, it’s fair to ask whether Dusk is the “Polygon of RWA” for 2026. Its combination of regulatory compliance, ZK privacy, and developer-friendly tools makes it a serious contender. Institutions that want both privacy and legality can actually operate on-chain, not just talk about it. In this next phase of DeFi, Dusk feels like a quiet but steady foundation—one that proves privacy and regulation don’t have to be at odds.