DUSK was never meant to be a general-purpose blockchain. It doesn’t chase every narrative, and it doesn’t try to host everything under the sun. Its focus is narrower, and intentionally so. DUSK is built for EU-regulated securities tokenization, a corner of the RWA landscape where privacy, legal clarity, and technical reliability all have to exist at the same time. That constraint shapes what it can become—and what it refuses to be.

Because of that, DUSK ends up competing on several fronts at once. On one side are public blockchains like Ethereum, transparent by default and dominant in liquidity and mindshare. On another are RWA-focused protocols such as Centrifuge and Ondo, which already have scale and strong institutional relationships. Then there are privacy networks like Monero or Secret, built around confidentiality but largely outside regulatory frameworks. And finally, there’s traditional finance itself: SWIFT, custodians, clearinghouses—slow, expensive, but legally embedded. DUSK sits somewhere in between, not comfortably, but deliberately.

When compared to traditional finance, the advantage is mostly mechanical. Settlement on DUSK happens in seconds. Fees are minimal. There’s no chain of intermediaries reconciling the same data over days. Traditional systems can take one to five days to settle cross-border transactions, with costs stacking up at every step. The problem, of course, is trust. TradFi is inefficient, but it’s predictable and legally sound. DUSK’s bet is that cryptography can replicate that certainty on-chain without carrying the same overhead.

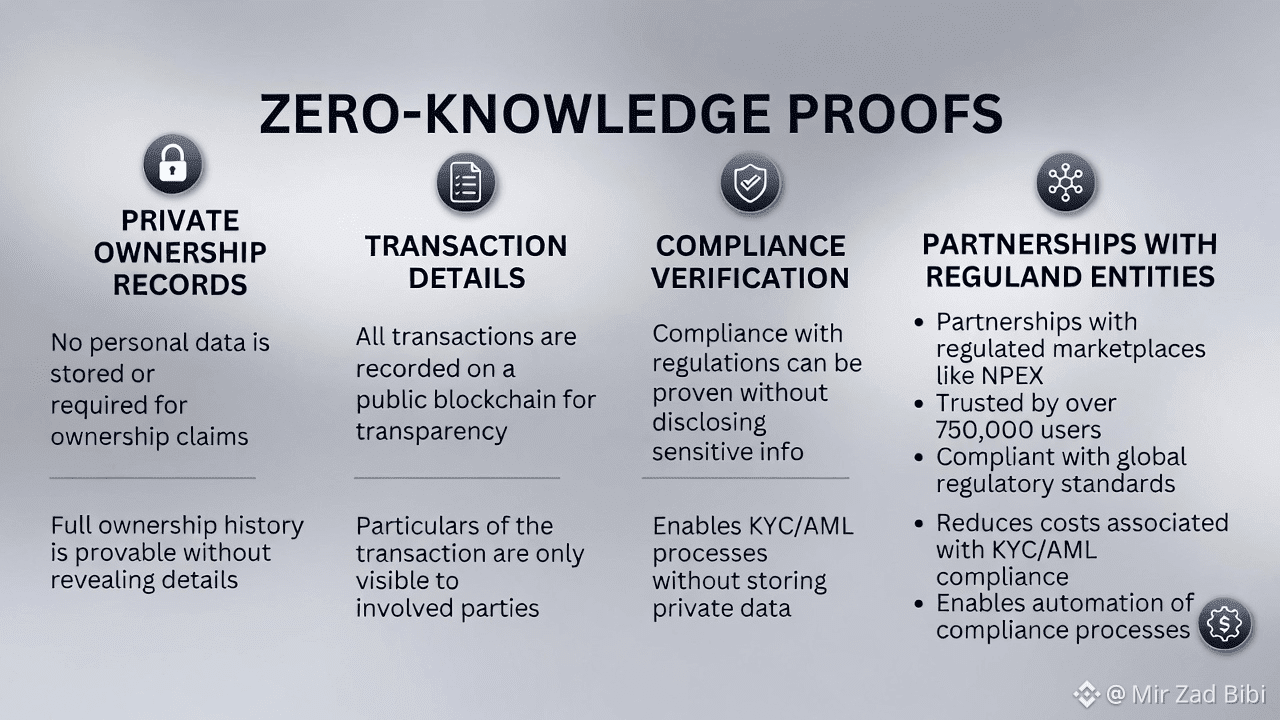

This is where zero-knowledge proofs come into play. They allow rules to be enforced without broadcasting sensitive information to the world. Ownership records and transaction details stay private, while compliance can still be verified when required. Partnerships with regulated entities like NPEX matter here for a simple reason: they show this model can operate inside existing legal structures. The goal isn’t disruption for its own sake. It’s cost reduction and automation, without breaking the rules.

Inside crypto, the tradeoffs look different. Ethereum’s openness is a strength, but it’s also a limitation for regulated finance. Everything is visible. Privacy requires extra layers, extra assumptions, and extra complexity. DUSK starts from the opposite end. Privacy is native, enforced at the protocol level through its zkVM and confidential smart contracts. Transparency exists, but only selectively and intentionally.

RWA-focused platforms like Centrifuge and Ondo approach the problem from another angle. They’ve moved faster, captured more volume, and built strong relationships, particularly in US-centric markets. DUSK doesn’t try to compete on scale today. Instead, it leans into strict EU regulatory alignment, designing around MiCA and MiFID II from the start. The collaboration with NPEX reflects that choice. It’s slower, and it’s harder, but it fits the regulatory environment DUSK is targeting.

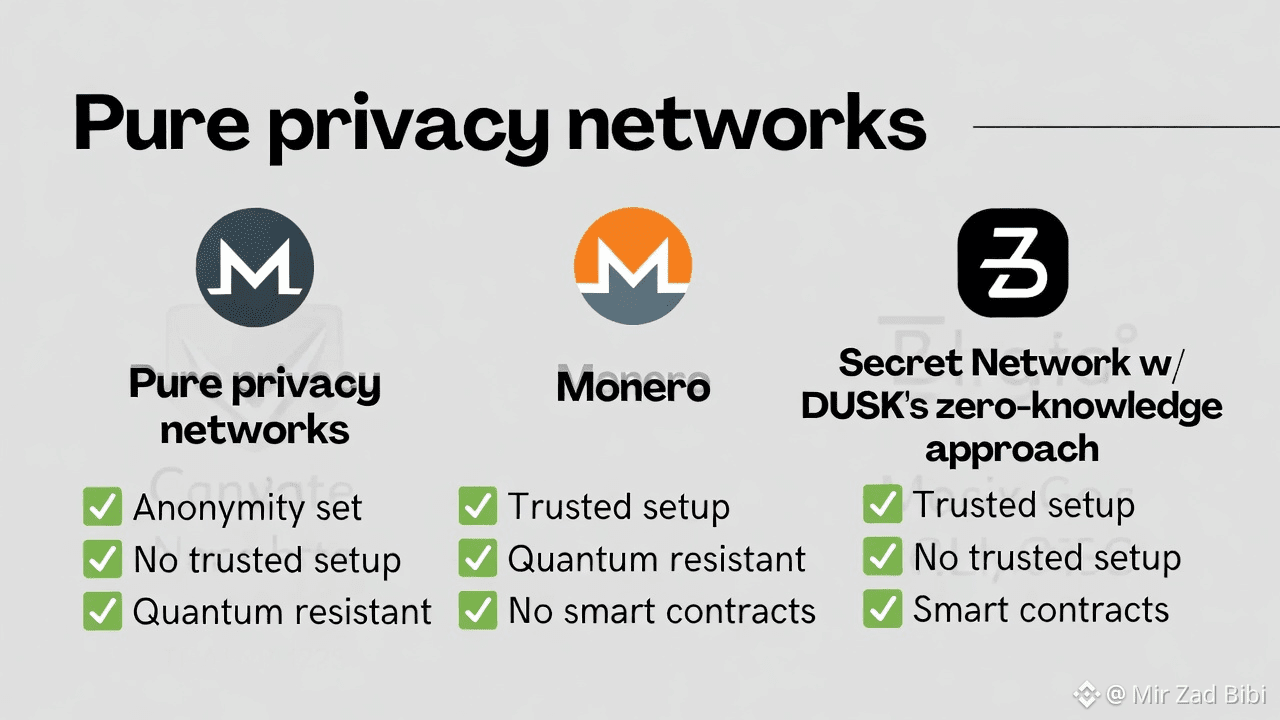

Pure privacy networks highlight yet another contrast. Monero prioritizes anonymity above all else. Secret Network relies on trusted hardware environments, which come with their own assumptions and risks. DUSK’s zero-knowledge approach avoids those hardware dependencies, but it isn’t free. The system is heavier, more complex, and more demanding to build on. These networks aren’t interchangeable; they solve different problems for different users.

That complexity is one of DUSK’s biggest drawbacks. Zero-knowledge systems raise the bar for developers and slow iteration. Tooling is improving, but it’s still early. On top of that, DUSK remains smaller than many of its competitors. Ecosystem depth, brand recognition, and live usage all lag behind the leaders in the space.

Regulation itself is another variable DUSK can’t control. Its entire thesis depends on regulatory acceptance and participation. While Europe offers clearer direction than many regions, rules change, timelines slip, and adoption can stall. Compliance creates a moat, but it also introduces a gate that has to open for progress to happen.

Taken as a whole, DUSK looks less like a safe, diversified play and more like a focused bet. If its 2026 roadmap is executed well and institutional partners succeed in onboarding real assets, its position becomes difficult to replicate. If that execution falters, the narrow focus leaves little room to pivot elsewhere.

For investors, the implication is fairly simple. DUSK isn’t a bet on crypto as a whole. It’s a bet on compliant privacy becoming a real category inside traditional finance—and on DUSK being one of the few networks built specifically for that role. The upside is meaningful. The risk is obvious. What matters now isn’t narrative, but delivery.