DeFi moves fast, maybe faster than most people can keep up with. And in that rush, problems pile up quickly—projects struggle with sustainability, liquidity can be thin, and governance often feels… messy. Users end up paying higher fees, tokens can inflate out of control, and there’s little incentive to stick around or participate. For anyone thinking of investing or building on a protocol, these are real concerns. It’s hard to know if the project can actually last.

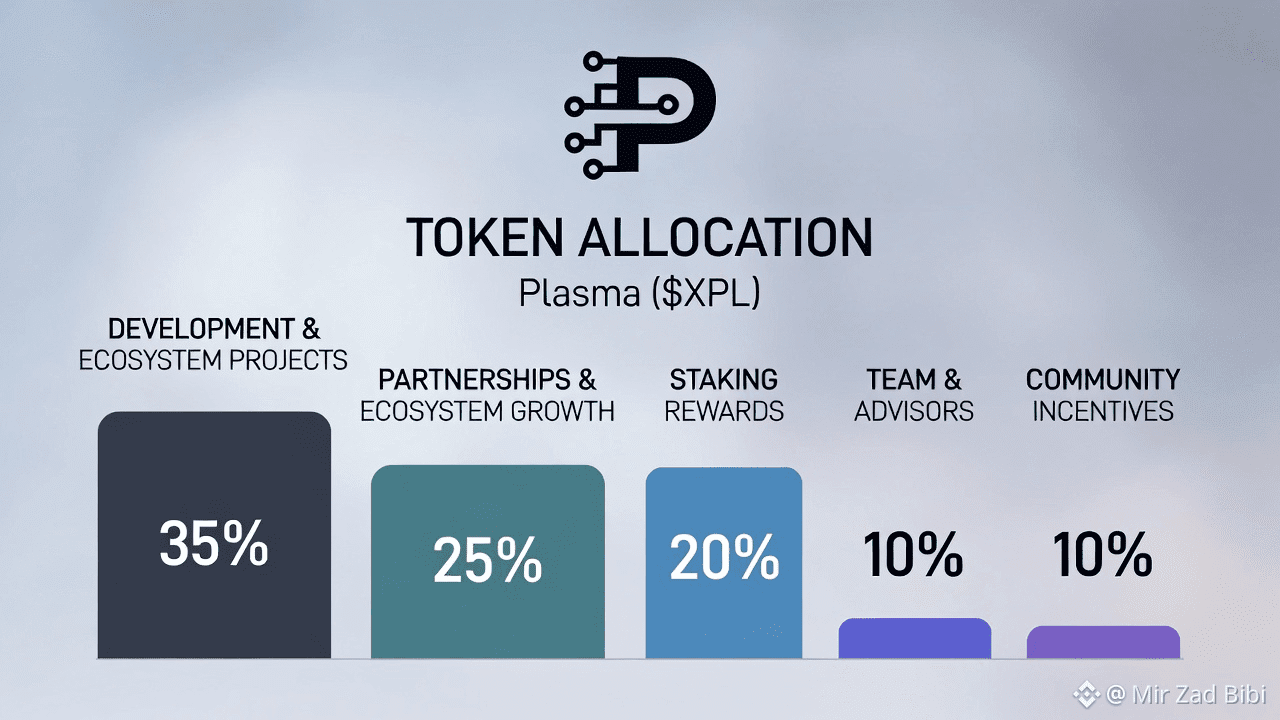

Plasma ($XPL) steps into that space with a design meant to address these exact issues. The total supply is capped at 1 billion tokens, which is a simple way of keeping inflation in check. But it’s more than just a number. The allocation of $XPL is deliberate: development and ecosystem projects get 35% to fund upgrades, security checks, and ongoing improvements; 25% goes toward partnerships and ecosystem growth, helping attract integrations and liquidity; 20% is set aside for staking rewards, giving people a reason to hold and secure the network; 10% is for the team and advisors, structured to make sure they stay committed; and 10% is for community incentives—early adopters, contributors, and governance participants. All of it is designed to keep the network alive and balanced.

There are real risks in DeFi. Token over-supply, sudden dumps, or low adoption can wreck confidence overnight. Plasma takes steps to reduce those risks. Team and advisor allocations follow vesting schedules, so tokens don’t hit the market all at once. On top of that, there are deflationary measures—burns and staking rewards that slowly reduce supply and encourage users to participate rather than just sit on their tokens. It’s not a perfect solution, but it’s a thoughtful way to keep the system from collapsing under its own weight.

$XPL is not just a token to hold—it’s meant to be used. Transaction fees, governance votes, staking, and integration with other protocols all rely on it. That keeps the token moving in the ecosystem, which in turn creates natural demand. Stakers earn rewards, sure, but they also play a role in securing the network. It’s a cycle that ties participation to tangible benefits, without forcing anyone to act unnaturally.

Liquidity has always been a tricky issue in DeFi. Plasma tackles it by reserving a portion of tokens for partnerships, liquidity programs, and development grants. That encourages other projects to join the network, which brings in users and keeps the ecosystem active. Early adopters and contributors get rewarded, but the system doesn’t feel rigid. It nudges people toward participation rather than forcing them, which helps the community grow organically.

Trust matters. Plasma is transparent about allocations, rewards, and governance. Users can see how tokens are distributed, how staking works, and how decisions are made. It’s not flashy, it’s just clear. That clarity matters because it reduces risk for anyone who wants to join the network, and it makes the ecosystem feel more human and approachable.

In short, the problems are clear: inefficient token economics, unsustainable networks, low participation. The risks are obvious: inflation, market instability, weak adoption. Plasma’s solution is straightforward: a tokenomics framework that balances supply, utility, governance, and incentives. It’s a network designed to grow, not just to be speculated on.

The vision behind $XPL is quiet but steady: make DeFi sustainable, usable, and community-driven. By combining a capped supply, deflationary measures, staking rewards, governance participation, and ecosystem incentives, it encourages people to engage, secure the network, and contribute to adoption. Investors, developers, and users all see the effects—value tied to use, not hype.

Plasma ($XPL) shows what happens when tokenomics are thought through with care. It addresses the risks, solves the problems, and provides an incentive system that feels natural. That doesn’t guarantee success, of course, but it creates a foundation that can actually last. For anyone looking to be part of DeFi beyond the headlines and speculation, understanding $XPL isn’t optional—it’s necessary.