The problem doesn’t start on-chain.

It starts in accounting.

A USDT payment arrives late enough that nobody is comfortable closing the entry. The sender swears it’s sent. The receiver sees nothing yet. A second attempt goes out “just to be safe.” Eventually, something lands.

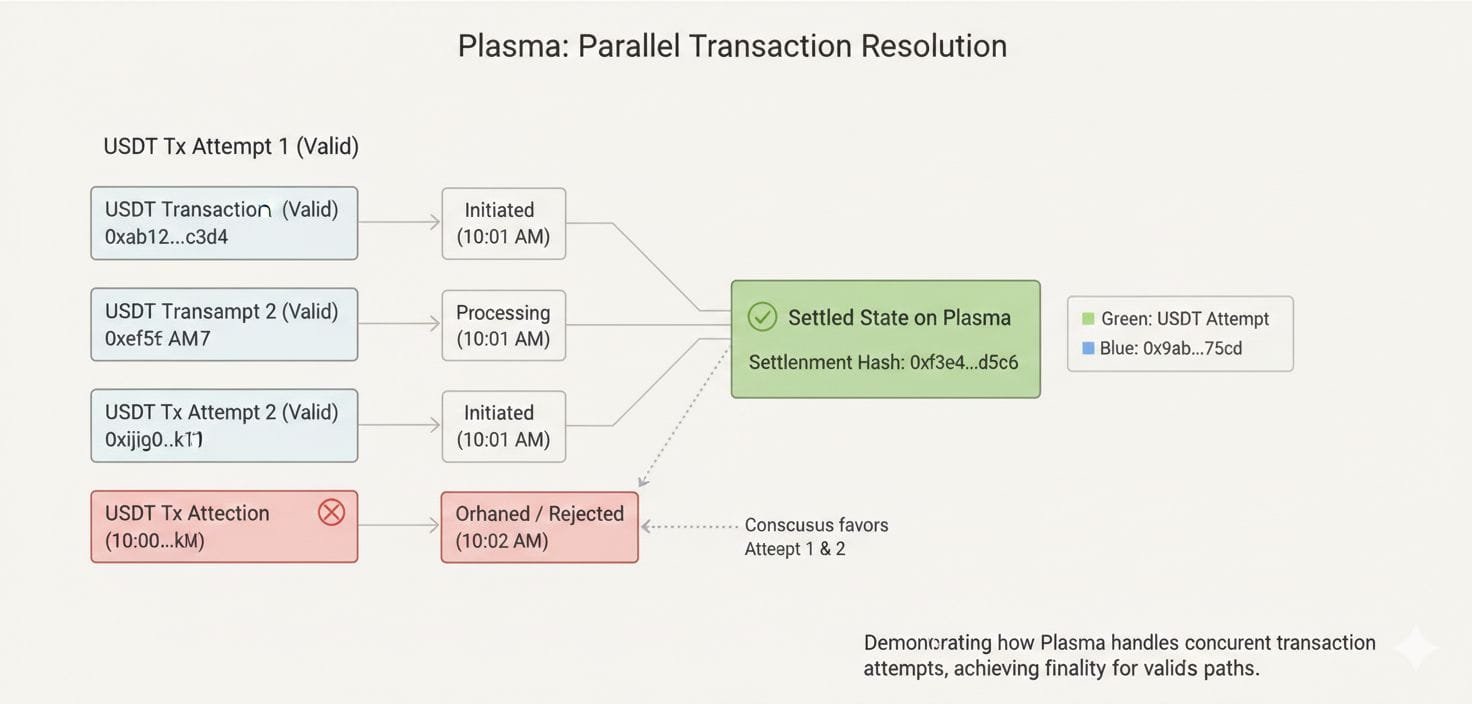

Now there are two hashes.

One invoice.

And a finance team that needs exactly one truth.

This is where stablecoin settlement quietly gets expensive. Not in fees. In time.

Plasma’s blocks can finalize cleanly while this confusion still exists, because the confusion isn’t about ordering. It’s about certainty. Humans don’t act on probabilistic states when money is involved. They wait. They duplicate. They hedge.

Gasless USDT flows amplify this behavior. When retries feel consequence-free, they become reflexive. No warning. No friction. No signal that says “don’t do that yet.”

From the user’s perspective, they’re being cautious.

From the system’s perspective, they’re creating parallel realities.

Now Plasma’s sponsored lane has to resolve it. Someone is paying for inclusion. Someone is deciding which intent clears and which doesn’t. That decision might be correct, but correctness doesn’t erase the downstream mess.

Support tickets don’t ask about PlasmaBFT.

They ask why the app shows “sent” twice.

They ask which transaction to reference.

They ask whether the first one might still arrive.

Nothing is broken. Everything is uncomfortable.

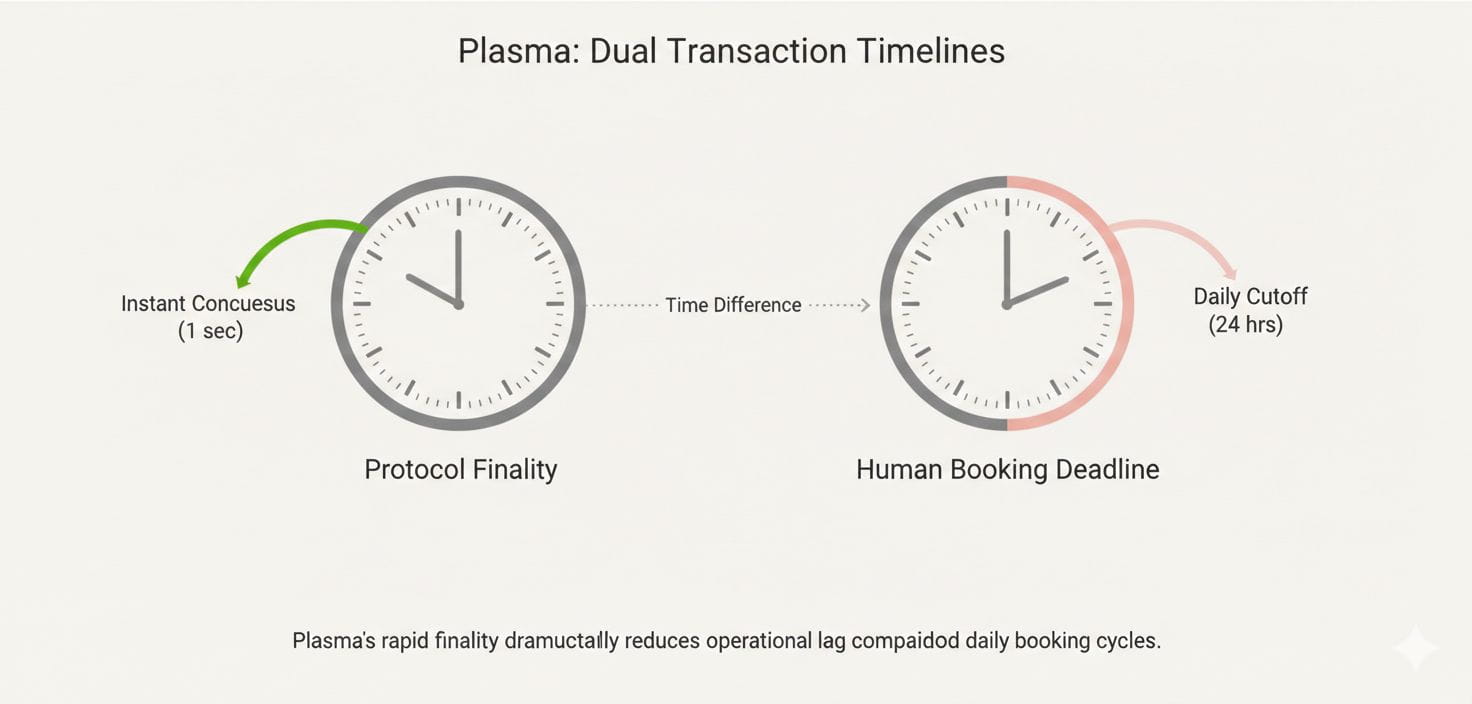

This is why finality is not just a speed metric. It’s a behavioral constraint. The faster the system delivers a status that humans trust, the fewer backup actions they take. The fewer backups, the cleaner the ledger looks downstream.

Plasma seems designed around compressing that gray zone.

Sub-second finality matters here not because it wins benchmarks, but because it reduces the time window where duplicate intent feels reasonable. The chain isn’t racing competitors. It’s racing human anxiety.

Bitcoin anchoring sits outside this moment. It reassures institutions deciding whether value should live here long-term. But no accountant books against Bitcoin anchoring. They book against timestamps and confirmed states.

Those are different clocks.

What actually clears a payment isn’t cryptographic certainty alone. It’s a signal boring enough, fast enough, and singular enough that nobody feels the need to create a backup.

The first time finance asks “which one do we book,” the network hasn’t failed.

But it has crossed a threshold where abstraction leaks into operations.

Plasma’s real test is whether those questions stop appearing.

Not because retries are blocked.

But because nobody feels the urge to make them.

That’s what stablecoin settlement looks like when it’s working.