@Plasma Native Bitcoin Bridge on Plasma: Move BTC Into the EVM Without Centralized Custodians

There’s a particular kind of fear that only shows up when you’re moving Bitcoin and you can’t quite explain who is holding the keys. People don’t always say it out loud, but you see it in behavior: they send small test amounts, they keep screenshots, they hesitate right before the final click. A bridge can look sleek and still feel like a leap of faith, because the real question isn’t “will it work,” it’s “who can stop it from working, and who can take it if something goes wrong.” Plasma’s decision to build a native path for BTC into its EVM world is really a decision to take that fear seriously, and to treat custody as the core problem—not an implementation detail.

Plasma frames itself first as a stablecoin settlement chain, which sounds narrow until you sit with what stablecoin settlement actually means. It means the chain is trying to become the place where people move value when they’re not trying to speculate, when they’re trying to pay, remit, settle, and survive volatility without turning every transaction into an emotional event. That’s why the network talks so directly about zero-fee stablecoin transfers at launch and why its mainnet beta date mattered: September 25, 2025 wasn’t just a launch milestone, it was a claim that payments infrastructure should be boring on purpose.

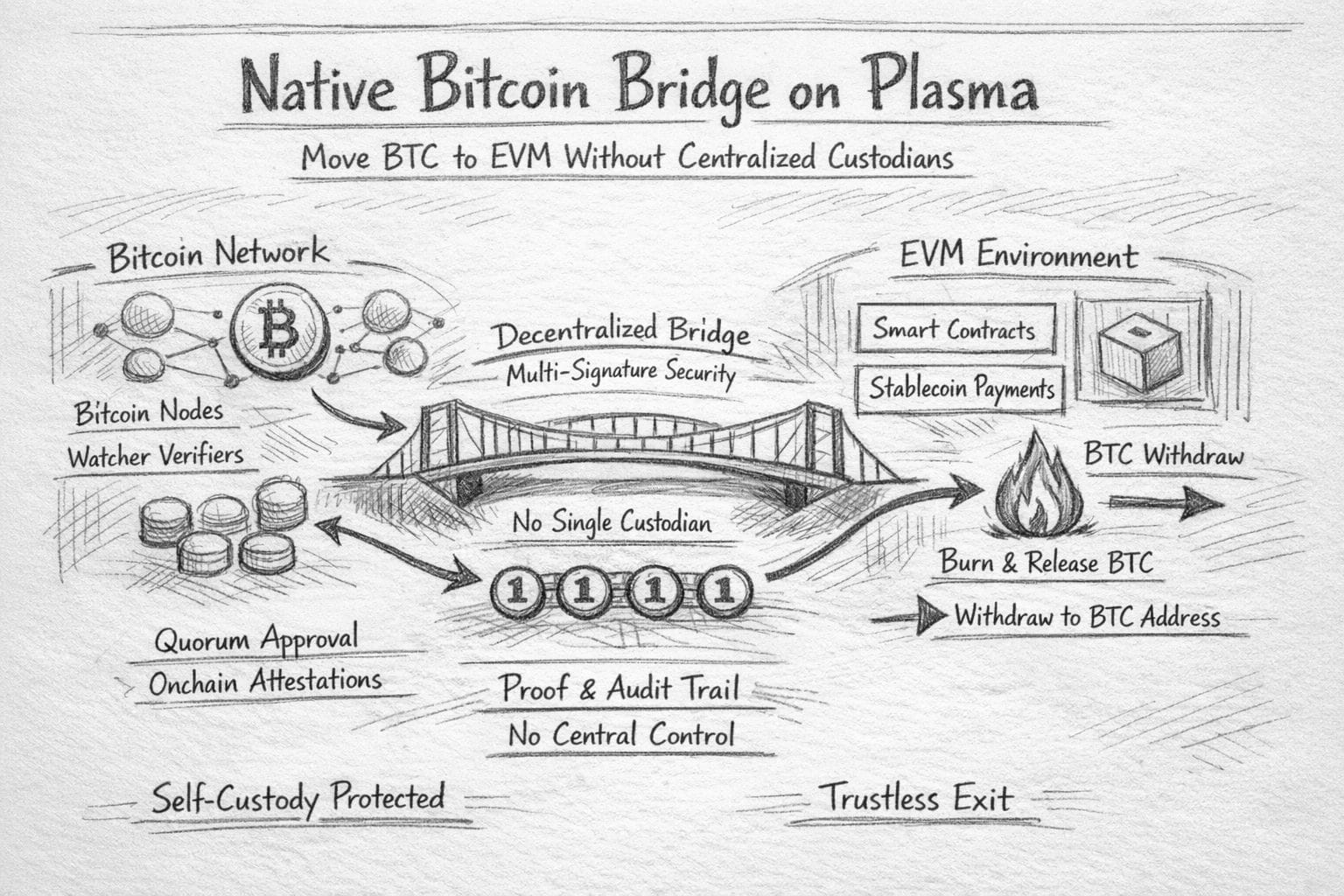

But Bitcoin changes the emotional temperature. Stablecoins are about certainty of value; Bitcoin is about certainty of ownership. When you try to bring BTC into an EVM environment, the temptation is to “make it feel easy” by putting someone in the middle—a custodian, a small signing group, an entity you’re told to trust. Plasma’s docs take a different posture: they describe a design where deposits are observed independently by multiple verifiers who each run their own Bitcoin infrastructure, and where withdrawals require a threshold of signers so no single party holds the full key. The point isn’t that this is perfect today; the point is that it acknowledges the real threat model: the quiet moment when a single actor can freeze, delay, or drain value.

The most honest line in Plasma’s bridge documentation is also the one that should slow you down in a healthy way: the bridge architecture is “under active development” and “will not be live at mainnet beta.” That’s not a marketing footnote. That’s a refusal to pretend that custody risk disappears just because you’ve shipped something. It’s also a subtle promise that Plasma would rather be explicit about what is still changing than let users build emotional certainty on top of an assumption. In systems that touch Bitcoin, that kind of honesty is a form of safety.

If you follow the intended data flow as Plasma describes it, you can feel where the chain is trying to place accountability. Bitcoin deposits happen on Bitcoin, in the open, with finality that isn’t negotiated by Plasma’s validators. The verifiers are supposed to watch that reality independently, attest onchain, and only then allow a 1:1-backed representation of BTC to appear inside the EVM environment. Withdrawals reverse the emotional direction: you burn the representation on Plasma, and the system must prove—publicly, repeatedly, and without shortcuts—that the corresponding BTC is released back to the address you chose. The design goal is that the “truth” of your BTC never becomes a private database entry inside one organization.

The hard part isn’t cryptography; it’s disagreement. Bitcoin nodes can disagree briefly, indexers can lag, infrastructure providers can fail at the worst time, and attackers don’t need to break math if they can break coordination. Plasma’s bridge model tries to treat these as normal conditions instead of rare edge cases, using quorum-based approval and onchain attestations that are meant to be observable by anyone who wants to audit behavior in real time. When something looks off, you don’t want to beg a support desk for an explanation. You want the system’s own records to tell you who saw what, when, and why the system acted.

This is where Plasma’s identity as a stablecoin settlement chain quietly intersects with Bitcoin. A payments-focused chain lives or dies by user experience under stress: network congestion, panic withdrawals, fast-moving price swings, and sudden compliance pressure from the real world. Plasma’s approach to gasless stablecoin transfers is one expression of that philosophy—reducing the number of reasons a normal person can get stuck mid-transaction. The Bitcoin bridge idea fits the same emotional frame: if BTC is going to be used inside an EVM environment, it should not require users to trade away the one property they care about most—self-custody—just to get composability.

When you zoom out to the token, you can see Plasma trying to align incentives with this kind of responsibility.

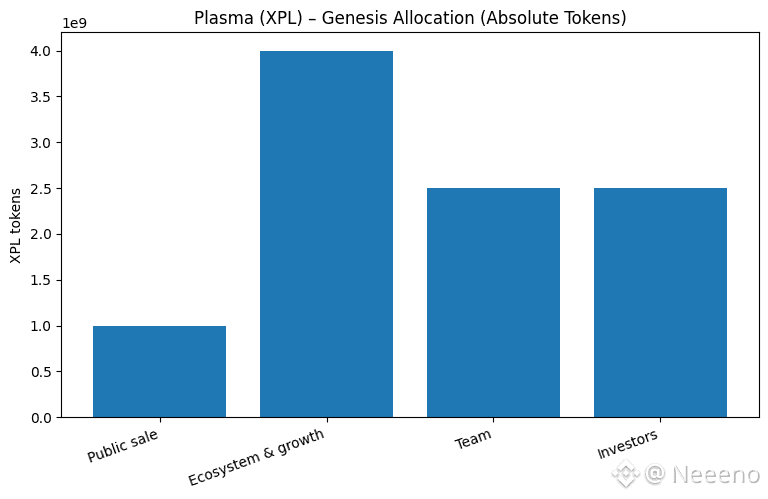

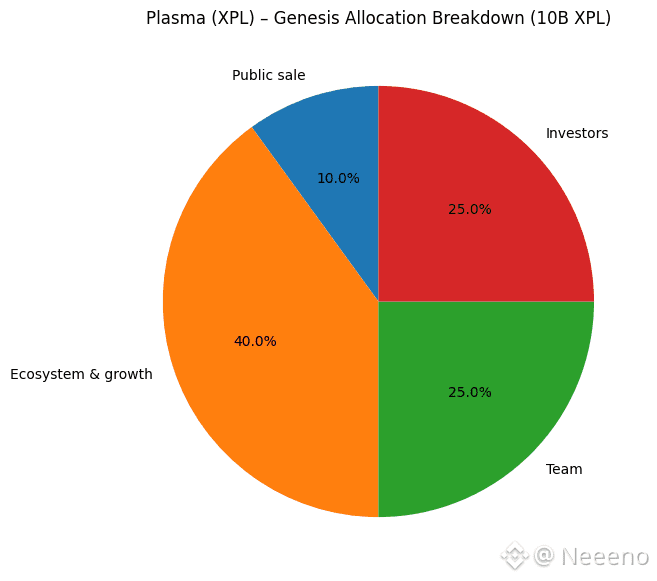

The docs set the initial mainnet beta supply at 10B XPL, and the allocation is simple to verify: 1B to the public sale, 4B to ecosystem/growth, 2.5B to the team, and 2.5B to investors. They also name a concrete regulatory-driven detail that matters for market psychology: XPL purchased by US participants is locked for 12 months and unlocks on July 28, 2026, while non-US public sale tokens unlock at launch. Dates like that don’t just affect price; they affect trust, because users can plan around a schedule that’s stated plainly instead of discovering it through rumors

Even the way Plasma describes emissions tells you something about what kind of chain it thinks it is. The docs talk about validator rewards starting at 5% annual inflation and stepping down over time toward a 3% baseline, with the important caveat that this inflation only activates when a broader validator system and delegation go live. That sequencing matters because it implies Plasma doesn’t want to charge users hidden costs before the network’s security model is mature enough to justify them. In the same document, the project also states it intends to burn base fees in an EIP-1559-style way, which is another small signal: the token is meant to be part of a long-run security and incentive budget, not a toll booth that makes payments emotionally expensive.

The public narrative around Plasma’s launch also anchors some useful real-world data points, even if you treat them cautiously. Multiple outlets described mainnet beta on September 25, 2025, and reported the chain aiming to launch with billions in stablecoin liquidity and a large set of DeFi integrations from day one. Whether you interpret those numbers as traction or as a bootstrapping strategy, the underlying point for this bridge topic is that Plasma is building into a world where capital moves fast and expectations harden quickly. A Bitcoin bridge in that environment can’t be “mostly safe.” It has to be resilient to the boring disasters: partial outages, delayed attestations, messy coordination, and the inevitable moment when users try to exit all at once.

If you care about the phrase “without centralized custodians,” the practical question becomes: what replaces the custodian when things break? Plasma’s answer, as described today, is a verifier set that starts permissioned and is intended to decentralize over time, with an explicit roadmap toward stronger minimization as tooling on Bitcoin evolves. That is a delicate promise, because users have seen “decentralize later” turn into “never decentralize” across this industry. The difference here is that Plasma is putting the trust assumptions in writing, including the fact that the bridge is not live yet, and describing concrete mechanisms—independent observation, quorum approval, and key material never existing in one place—that are designed to keep any single institution from becoming the silent owner of everyone’s BTC.

And that brings you back to why this matters on a chain that’s built for stablecoin settlement. Plasma is trying to make money movement feel like infrastructure again—quiet, predictable, emotionally neutral. The native Bitcoin bridge idea fits that same moral shape: if BTC is going to enter the EVM world on Plasma, it should arrive in a way that doesn’t ask people to trade certainty of ownership for convenience, and it should leave in a way that doesn’t require pleading with an intermediary during the worst five minutes of the market cycle. The token schedule, the explicit unlock date of July 28, 2026 for US public-sale participants, the 10 billion initial supply, and the staged approach to validator emissions are all parts of the same story: a network trying to state its obligations up front, because unspoken obligations are where betrayal usually hides.

In the end, the most meaningful infrastructure is the kind you don’t think about when you use it, and the kind you don’t panic about when you need it. Plasma’s stablecoin focus is a bet that payment rails should be emotionally safe, and its native Bitcoin bridge ambition is a bet that self-custody shouldn’t be the price of participating in programmable finance. The work is slow because responsibility is slow: schedules are stated, assumptions are written down, and the hardest problems are treated as everyday realities rather than edge cases. That’s not the kind of progress that wins attention. It’s the kind that earns trust—quietly, over time—by making reliability feel normal.