In crypto, people often talk as if blockchains compete the way cities compete. One chain must “win,” and the others must “lose.” But finance does not really work like that. Real markets are not built around one venue. They are built around many venues that share one thing in common: a single source of truth for ownership and settlement.

That is the idea sitting underneath the post you shared.

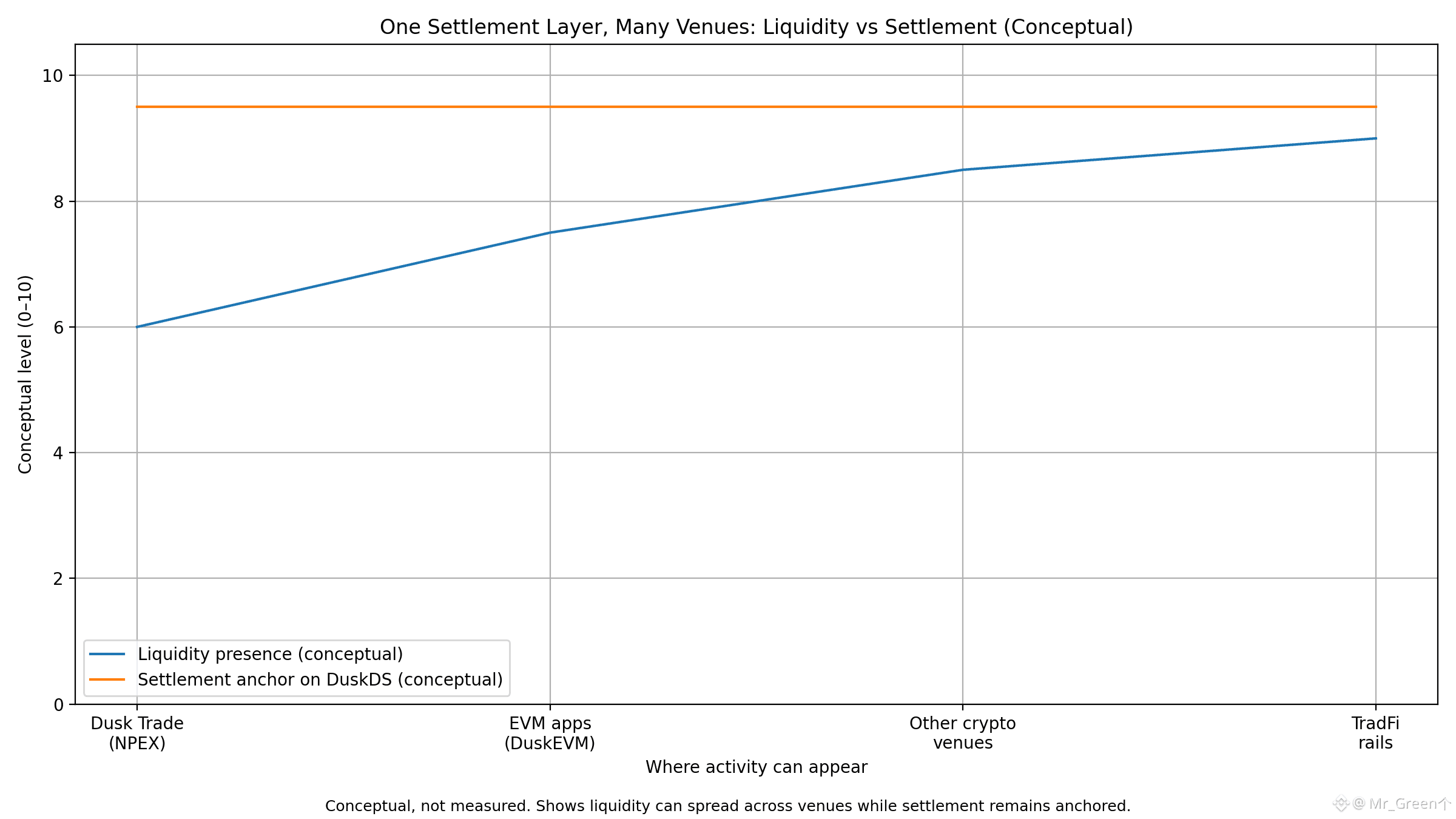

Liquidity moves. It always has. It moves to where traders are, where tools feel familiar, where fees make sense, where regulations allow access, where the best execution is. You can see that pattern in crypto today. You can also see it in traditional finance, where the same asset can trade in multiple places, but ownership and settlement still need a clean record somewhere.

Dusk is trying to position itself as that “somewhere,” but for regulated on-chain assets. Not as the chain that must capture all liquidity, but as the chain that anchors issuance and settlement, where compliance rules and ownership records live on-chain.

That’s why the right mental model for Dusk is not “another Layer 1 trying to steal users.” It’s closer to a settlement layer that wants to be boring in the ways real finance requires. In regulated markets, the chain that matters most is the one that can say, clearly and finally, who owns what, and under what rules that ownership can change.

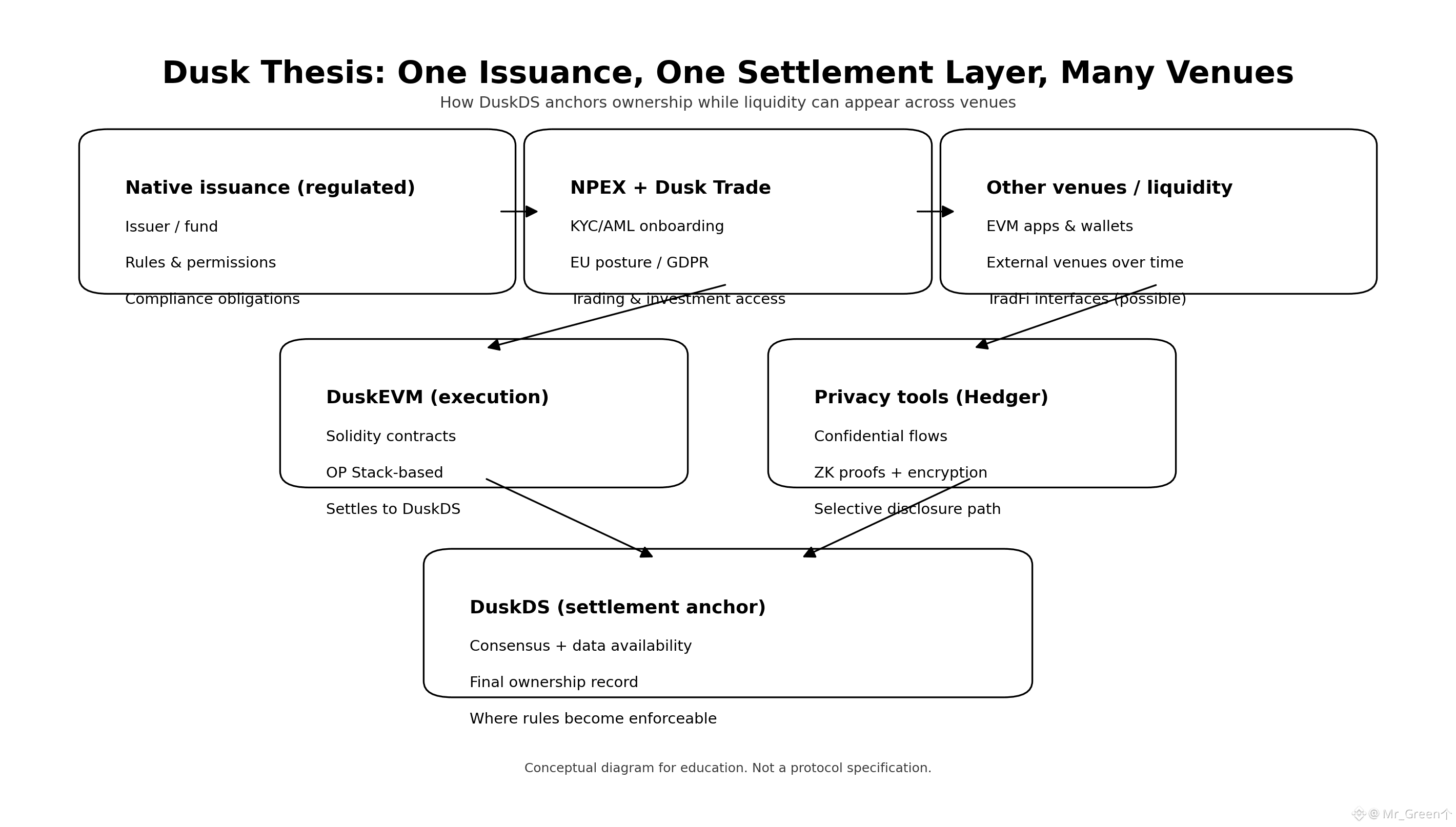

This is where DuskDS enters the story. Dusk’s own documentation describes DuskDS as the foundation layer responsible for settlement, consensus, and data availability. In plain language, it is the layer that finalizes truth, stores the data needed to prove that truth, and secures the entire stack. If you believe “one issuance, one settlement layer” is the goal, then DuskDS is the part doing that job.

Above it sits DuskEVM, and this is where the “many venues” idea becomes practical instead of poetic. An EVM environment is basically the most common “execution language” in crypto today. Developers know Solidity. Wallets speak EVM fluently. Tooling is mature. That tooling gravity is real liquidity gravity, too, because liquidity follows where integrations are easy.

DuskEVM is described as an OP Stack–based EVM execution layer, but with one crucial difference from the usual OP Stack story: it settles directly to DuskDS rather than Ethereum. That means Dusk is not simply trying to become another Ethereum L2. It is trying to use EVM familiarity as an access layer, while keeping settlement anchored to its own base layer. If DuskDS is the “court record,” DuskEVM is the “busy front office” where applications run, then post results back for final settlement.

That design explains why someone would say Dusk is not competing with other L1s in the usual sense. If you can offer EVM-style execution and still settle to a finance-oriented base layer, you are not forced to win by capturing every user and every app inside one monolith. You can try to become the settlement rail for a specific class of assets, while meeting developers where they already live.

Now bring NPEX and Dusk Trade into this picture, because they are the clearest real-world test of the thesis.

Dusk’s partnership announcement with NPEX describes a commercial agreement aimed at building a blockchain-powered security exchange to issue, trade, and tokenize regulated financial instruments. Dusk has also published that, through the partnership, it gains access to a suite of financial licenses tied to NPEX, including MTF, Broker, and ECSP, with DLT-TSS described as forthcoming. Whether a reader loves or dislikes licensing language, the point is simple: Dusk is not treating regulation as an afterthought. It is trying to connect on-chain workflows to regulated market structure.

Dusk Trade is the product-shaped expression of that connection. The Dusk Trade site and recent posts state the waitlist is open, and present it as a regulated RWA trading platform built with NPEX. It’s framed as a way to access tokenized assets and funds on-chain, with “secure onboarding” that is KYC/AML-ready from day one, and with EU regulation and GDPR called out directly. Those aren’t random marketing words. They are the kinds of constraints that decide whether real issuers and regulated participants can touch the system.

What makes this interesting is not only that Dusk Trade exists. It’s what it implies about Dusk’s strategy.

If a regulated venue can issue or list compliant instruments, and those instruments settle on DuskDS, then Dusk can aim for a world where issuance and settlement are consistent even as liquidity appears in different execution contexts. Dusk Trade becomes one venue where those assets can be accessed. DuskEVM becomes another venue type, because it can host Solidity applications that interact with those assets while still settling to DuskDS. And beyond that, the broader market reality still holds: liquidity can express itself across many places—crypto venues, wallet interfaces, and traditional market rails—while the “official” issuance and settlement record remains anchored.

This is also where the post’s line “where compliance and ownership live on-chain” stops being a slogan and starts being a design claim. Ownership is not just “a balance in a wallet.” For regulated assets, ownership comes with conditions. Some holders may be eligible and others not. Some transfers may be restricted. Some actions may require reporting. Some disclosures may be required, but not to the whole world.

That’s why Dusk keeps pushing the idea of privacy that does not break auditability. Dusk’s Hedger module is described as bringing confidential transactions to DuskEVM using a combination of homomorphic encryption and zero-knowledge proofs. In simple terms, this is about proving that rules were followed without exposing everything publicly by default. That matters if you want regulated assets to live on-chain without turning every trade and position into a public signal.

Put these pieces together and the strategy becomes clearer.

DuskDS is the “final record” layer. It’s the settlement foundation. DuskEVM is the compatibility bridge that lets builders and integrations arrive without learning a new world. Hedger is part of the privacy story for EVM activity when confidentiality is required but verification still matters. NPEX is the regulated market counterpart that brings real-world licensing and venue structure into the design. Dusk Trade is the product that packages these ideas into a user path: onboarding, compliant access, and on-chain exposure to tokenized assets and funds.

This is also why “many venues” is not just a hopeful phrase. It is an honest admission about how markets behave. Even in traditional finance, liquidity does not stay in one place. People route orders. They seek best execution. They use different interfaces for different jobs. A settlement layer does not need to be the only venue. It needs to be the layer everyone can trust when disputes arise and when finality matters.

There are real advantages to this approach if it works.

A single issuance and settlement layer can reduce the “copy problem,” where each venue maintains its own version of who owns what, then reconciles later. It can make compliance rules part of the asset’s life instead of a patch at the front end. It can make audits more straightforward because the settlement record is consistent. And if privacy tools like selective disclosure mature, it can reduce the cost of information leakage that public chains impose on serious market participants.

But it also has real limits, and they are worth saying out loud.

First, “one settlement layer” only matters if participants trust it as the canonical record. In regulated assets, that trust is not purely technical. It’s legal, operational, and institutional. The link between the on-chain record and the legal instrument has to be clean. Second, “many venues” creates coordination work. Different interfaces, different execution environments, and different access models can fragment liquidity unless standards and integrations are strong. Third, regulated adoption is slow by nature. Even with a licensed partner, market structure does not change overnight.

Still, as a strategy, it’s coherent. It does not rely on Dusk becoming the only chain anyone uses. It relies on something more realistic: that the future of tokenized assets will look like real markets, where liquidity moves freely, but settlement remains anchored.

If Dusk can make DuskDS the place where regulated ownership and compliance rules are finalized, and if DuskEVM and Dusk Trade can act as credible access layers to that settlement system, then “one issuance, one settlement layer, many venues” stops being a tweet and starts being a workable blueprint.