Plasma XPL: From Idea to Everyday Use

Plasma didn’t set out to build just another DeFi chain. The team had one big, simple goal: fix the chaos of digital payments and cross-border money transfers, especially with stablecoins like Tether (USDT). They focused on what actually matters—speed, low fees, and making sure stablecoin transfers just work. The whole idea was to build something both developers and regular people would want to use, not just another science experiment.

1. How Plasma Got Started and What Makes It Tick

It began when a bunch of developers looked around and realized most blockchains just aren’t built for fast, cheap payments. Fees get crazy, transactions slow down, and the user experience falls apart. So instead of piling on more features, Plasma’s team cut out the clutter and built their network on PlasmaBFT—a fast Proof-of-Stake system inspired by the latest Byzantine tech. It’s quick, it scales, and it’s made for payments first—not just speculation and hype.

For developers, Plasma tries to keep things simple. It’s EVM compatible through its Reth implementation, so anything you already built for Ethereum works here too. That means you can use tools like Hardhat, MetaMask, or Foundry right away. No need to learn a whole new language or rewrite everything from scratch.

And here’s something that changes the game: Plasma has its own native Bitcoin bridge. You can move BTC right into the Plasma ecosystem, no trust issues or complicated steps required. This lets developers build apps that tap into Bitcoin’s liquidity, all inside a regular EVM environment. That’s huge.

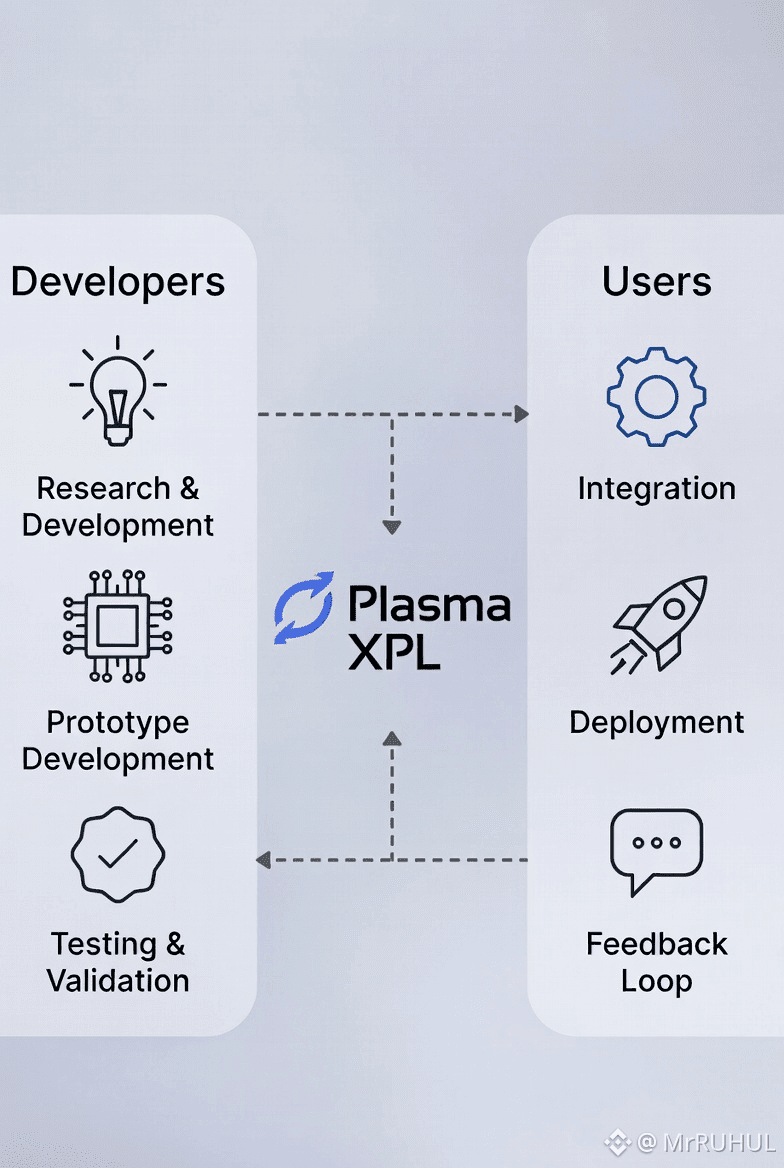

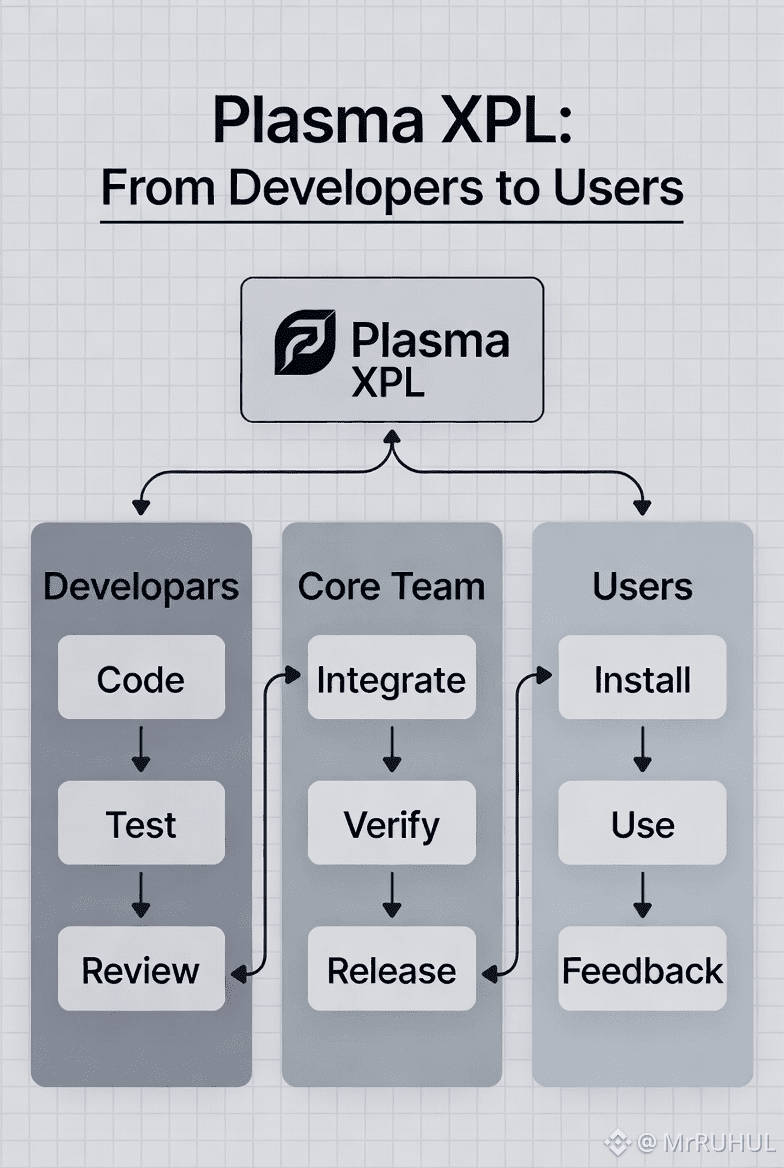

2. Developers Came First

Even before everyday users showed up, developers were already deep in the weeds. Plasma rolled out testnets early, giving devs and the community a real playground to break things, try wild ideas, and figure out how it all worked—without risking any real money.

Then came mainnet beta on September 25, 2025, and everything got real. Over $2 billion in stablecoin liquidity, more than 100 DeFi protocols hooked in, and the XPL token went live. Developers jumped in fast, launching payment apps, DeFi projects, and all kinds of financial tools—everything built around Plasma’s focus on stablecoins. Zero-fee USDT transfers? Paying gas with whatever token you have? All of that worked from day one.

Plasma didn’t just build the chain and walk away. They set up everything developers need: card issuing, fiat on-ramps and off-ramps, compliance, third-party integrations—the whole toolkit. Suddenly, building real-world finance on-chain actually felt possible.

3. From Devs to Real People

For regular folks, getting started with Plasma wasn’t a headache. The XPL token is at the center—used for fees, staking, governance, and rewards. Out of 10 billion tokens, 10% went to public sale, 40% to ecosystem and partnerships, 25% to the team, and 25% to investors. Once mainnet beta launched, most non-U.S. users got access to their tokens, while U.S. holders have to wait until mid-2026 because of regulations.

As soon as XPL launched, it landed on big exchanges like Binance and OKX. Anyone could buy, sell, or trade it—even if they were totally new to crypto. Wallet support rolled out quickly too, with apps like Backpack and CEX-linked wallets making it easy to move XPL and stablecoins around. Not every wallet was ready on day one—Tangem needed some extra time—but things moved fast.

But here’s the thing: people actually started using Plasma. They moved stablecoins for almost nothing, jumped into DeFi, earned yield, and even used their XPL as collateral for loans on platforms like Nexo. This wasn’t just hype or empty promises—real financial activity was happening, every day.@Plasma #Plasma $XPL