I first looked at Dusk Foundation the way I look at most “finance-ready” chains: I skimmed the stack, nodded at the privacy claims, and then asked myself what actually breaks when real money shows up. The more I read, the more the interesting part wasn’t only the cryptography it was how many outcomes depend on a small set of adjustable protocol parameters. That’s where my trader brain shows up: knobs are incentives in disguise.

The friction is straightforward: regulated markets want confidentiality without sacrificing fast settlement or accountability. Public chains make positions and counterparties legible by default, which is fine for hobbyist transparency but awkward for anyone who can be front-run, audited, or litigated. The 2024 whitepaper frames the goal as privacy-focused and compliance-ready, aiming for finality within seconds, and it builds this on a committee-based proof-of-stake consensus plus two transaction models: a transparent account model and a UTXO-style model that can hide balances and transfers.Governance tuning here feels like adjusting the suspension on a race car: tighter control can improve handling, but it also makes every adjustment a potential point of sabotage.

At the plumbing level, message propagation comes first. The design leans on Kadcast—structured broadcast built on Kademlia-style routing so blocks, transactions, and votes move efficiently without the churn of pure gossip. Then consensus: Succinct Attestation runs in rounds with a proposal step and two committee steps (validation and ratification), and it produces attestations as proof that a quorum was reached.

Here’s the part that ties directly to the topic. Committee membership is selected via deterministic sortition that is weighted by stake “credits,” with scores derived from a per-block seed so future committees are hard to precompute. Attestations become the accounting object for rewards and penalties, and the VM applies those changes during state transition. The protocol also exposes safety valves: it limits iterations per round, uses a fallback procedure for forks, and has an emergency mode where an empty recovery block can be produced if a majority of stake requests it.

These mechanisms make the chain tunable, and tunable systems invite governance capture. Tightening quorum thresholds, committee sizing, or penalty severity can improve security and liveness under stress. But the same levers can be steered to favor large stake blocs via credit dynamics, committee influence, or reward geometry and small parameter shifts can compound because selection itself is stake-weighted. The improvement process is at least formalized through Dusk Improvement Proposals (DIPs), which exist to propose and document substantive protocol adjustments before they become shared rules.

On the transaction side, the split between Moonlight and Phoenix adds another governance surface because costs shape behavior. Phoenix pushes correctness checks into a zero-knowledge proof: the chain verifies the proof plus public inputs (like note-tree roots, nullifiers, and maximum gas cost), then updates state if it passes. If gas rules or proof-verification limits are tuned poorly, users can be nudged into the public lane for convenience, or priced out of private usage for cost reasons.

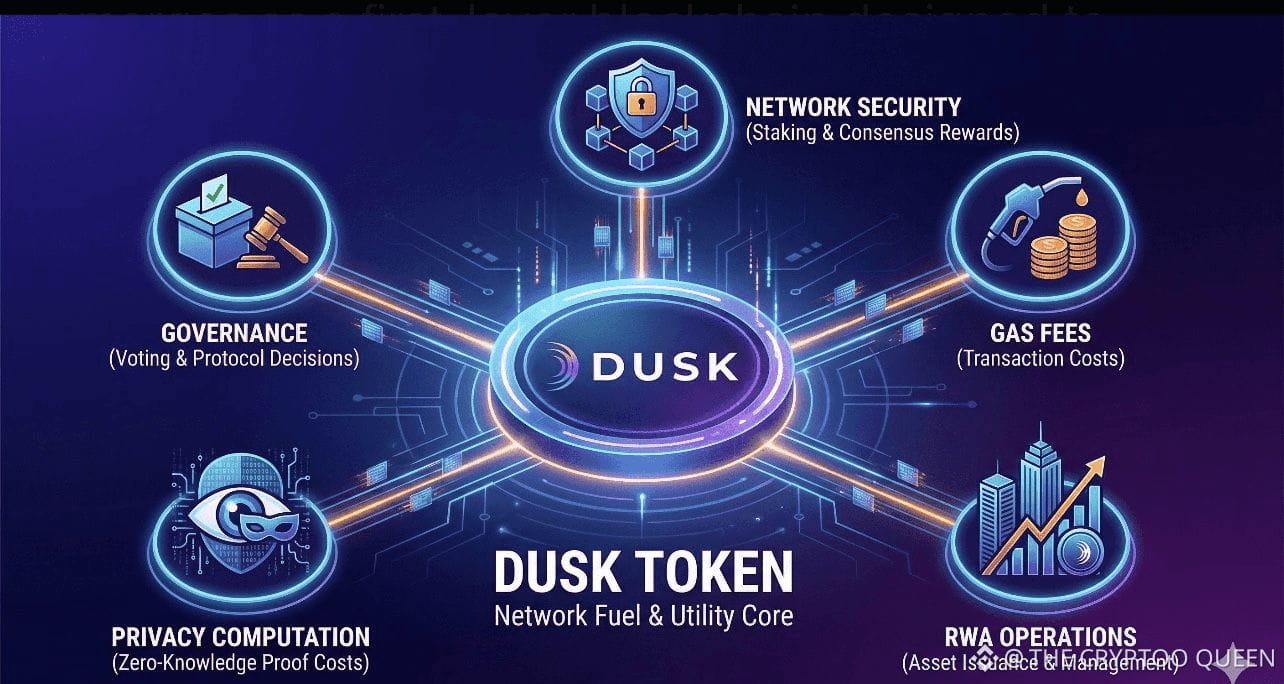

The DUSK token pays fees and gas, it is staked to participate in consensus and earn rewards (with slashing as the stick), and it supports the governance workflow around protocol changes its market price is separate from whether those utilities stay secure and fair.

even with clean specs, unforeseen client bugs, governance fatigue, or coordinated stake blocs can make “reasonable” parameter tweaks behave very differently in production than they do on paper.