Online marketplaces run on one fragile ingredient: trust between strangers. A buyer wants to know they won’t be scammed. A seller wants to know they’ll be paid. The marketplace wants fewer disputes, fewer refunds, and fewer angry support tickets. Traditional platforms solve this with an escrow-like experience: the buyer pays, the platform holds the funds, and the seller receives the money once delivery is confirmed.

Stablecoins make this even more interesting because they offer “internet dollars.” If a marketplace can escrow USD₮ (USDT), it can serve cross-border buyers and sellers without forcing everyone into slow bank rails or expensive currency conversions. But many stablecoin escrow attempts feel clunky for beginners, not because escrow is complicated, but because the underlying blockchain experience is complicated. Users get stuck on gas tokens, confusing fees, and uncertainty about when a payment is final.

That is the kind of problem Plasma is designed to reduce. Plasma positions itself as a stablecoin-focused Layer 1 that keeps full EVM compatibility while building stablecoin-first features into the protocol. For an escrow product, this matters because the best escrow is invisible: the buyer should feel like they paid in dollars, the seller should feel like the dollars are reserved, and the marketplace should feel like disputes are manageable.

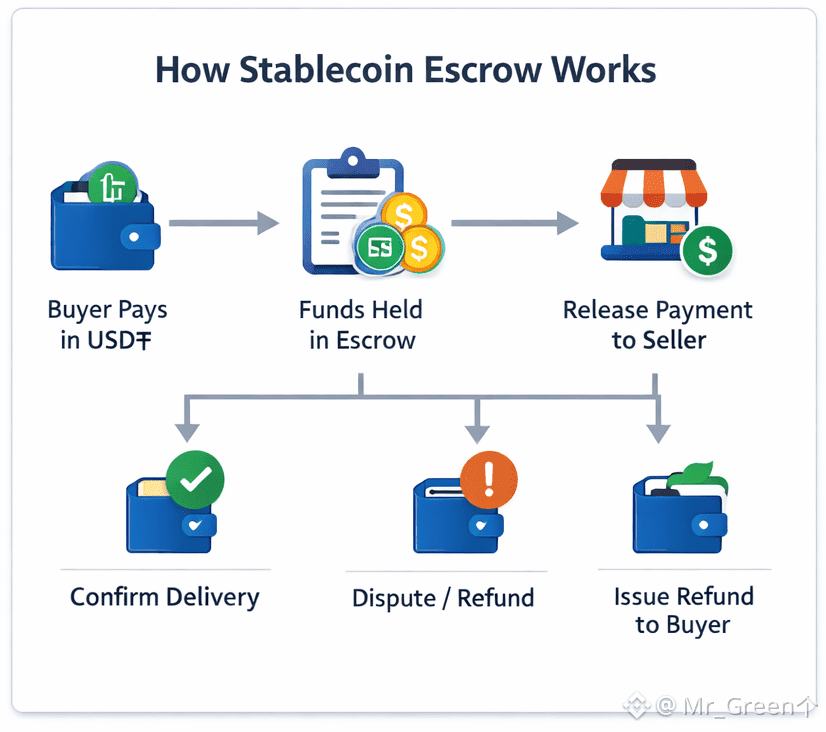

To understand escrow on-chain, picture three states of money: “not paid,” “held,” and “released.” In a marketplace escrow contract, the buyer sends USD₮ into a smart contract instead of directly to the seller. The contract records the order details and locks the funds. When the buyer confirms delivery—or when a shipping proof condition is met—the contract releases the USD₮ to the seller. If something goes wrong, the contract can route the funds back to the buyer according to the marketplace’s rules.

That logic is simple, but the user experience around it is where marketplaces win or lose. Escrow only works when people trust the flow, and trust comes from clarity. Buyers need to see that the funds are genuinely held and not already in the seller’s wallet. Sellers need to see that the buyer has actually funded the escrow, not just “sent a promise.” Marketplace operators need a reliable record of who paid, when it was locked, and when it was released. This is where blockchain is naturally strong: the escrow state is publicly verifiable and can be audited in real time.

However, marketplaces don’t live in a perfect world. Real escrow needs real-life features: partial refunds, cancellations, dispute windows, and timeouts. If a buyer disappears, you need an automatic release after a certain period. If a seller fails to ship, you need a refund path. If the package arrives damaged, you need a dispute resolution workflow. Smart contracts can encode these rules, but encoding them safely is the key. The goal isn’t to build the most complex contract; it’s to build the simplest contract that supports the most common outcomes without locking funds unfairly.

This is where Plasma’s stablecoin-first design can become meaningful. Plasma documents gasless-style USD₮ transfers for simple sends through a paymaster/relayer system, scoped to direct USD₮ transfers with controls intended to reduce abuse. Even if escrow funding isn’t always eligible for “gasless” treatment, the design philosophy matters: reduce the “extra token” trap that causes users to fail before they ever fund the contract.

For escrow interactions beyond basic transfers—funding a contract, triggering release, issuing a refund—fee handling becomes a huge UX issue. Plasma’s documentation describes custom gas tokens via a protocol-managed paymaster approach, aiming to let users pay fees in whitelisted tokens like USD₮ rather than requiring the native token for every action. For beginners, this is the difference between “I’m using dollars” and “I’m doing crypto.” In an escrow flow, users may need to interact multiple times: fund, confirm, dispute, resolve. If each step requires managing a separate gas token balance, people drop off and disputes rise.

EVM compatibility is the other big reason escrow fits Plasma’s narrative. The escrow patterns marketplaces need—timelocks, role-based permissions, dispute states, and upgrade-safe design—are already well understood in the EVM world. Developers can build escrow contracts using familiar tools, get them audited with familiar methodologies, and integrate them into wallets and frontends that users already recognize. The marketplace doesn’t need to teach users a new execution environment; it can focus on teaching them the escrow rules, which is what actually matters.

If you imagine a “fintech-feeling” marketplace escrow, the steps should read like a normal purchase. The buyer pays in USD₮. The app clearly shows the funds are held. The seller ships. The buyer confirms. The seller receives payment. If something goes wrong, there is a clearly defined dispute window and a refund path. The blockchain should be the infrastructure behind the curtain, not the main character.

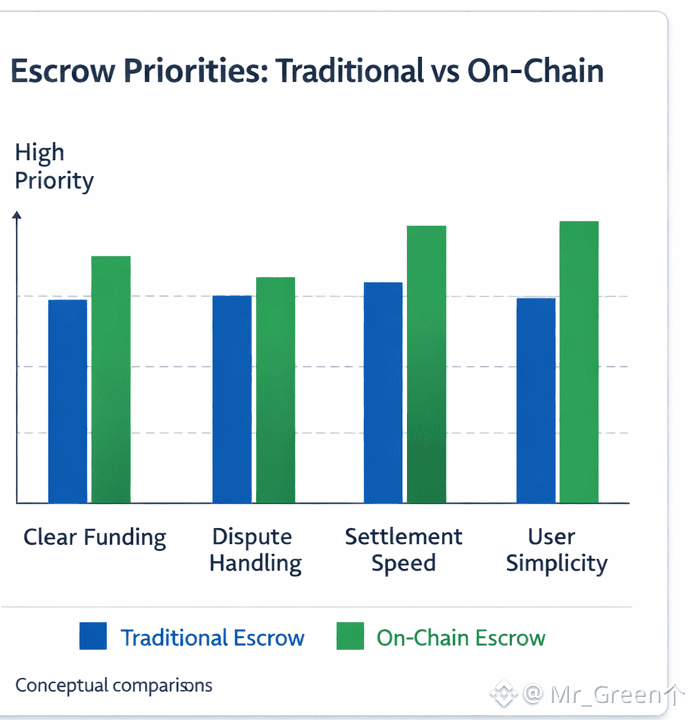

That’s the real promise of stablecoin escrow: not that it is flashy, but that it is clean. It can reduce cross-border friction, improve settlement speed, and make marketplace trust more transparent—if the chain doesn’t add new friction in the form of gas complexity and confusing fees.

The most important takeaway is that escrow isn’t just a smart contract. It’s a product system. The chain can help by making stablecoin interactions simple, predictable, and consistent. Plasma’s stablecoin-first focus is essentially a bet that when you remove the “crypto tax” of gas-token management, you can build marketplace experiences that feel much closer to the apps people already trust.