Zero-knowledge proofs are often introduced as a privacy technology. A way to hide balances, obscure identities, or shield transactions from public view. That framing understates their importance. In Dusk’s financial stack, zero-knowledge proofs are not a feature layered on top of the system they are the mechanism that allows the system to function at all.

Zero-knowledge proofs are often introduced as a privacy technology. A way to hide balances, obscure identities, or shield transactions from public view. That framing understates their importance. In Dusk’s financial stack, zero-knowledge proofs are not a feature layered on top of the system they are the mechanism that allows the system to function at all.

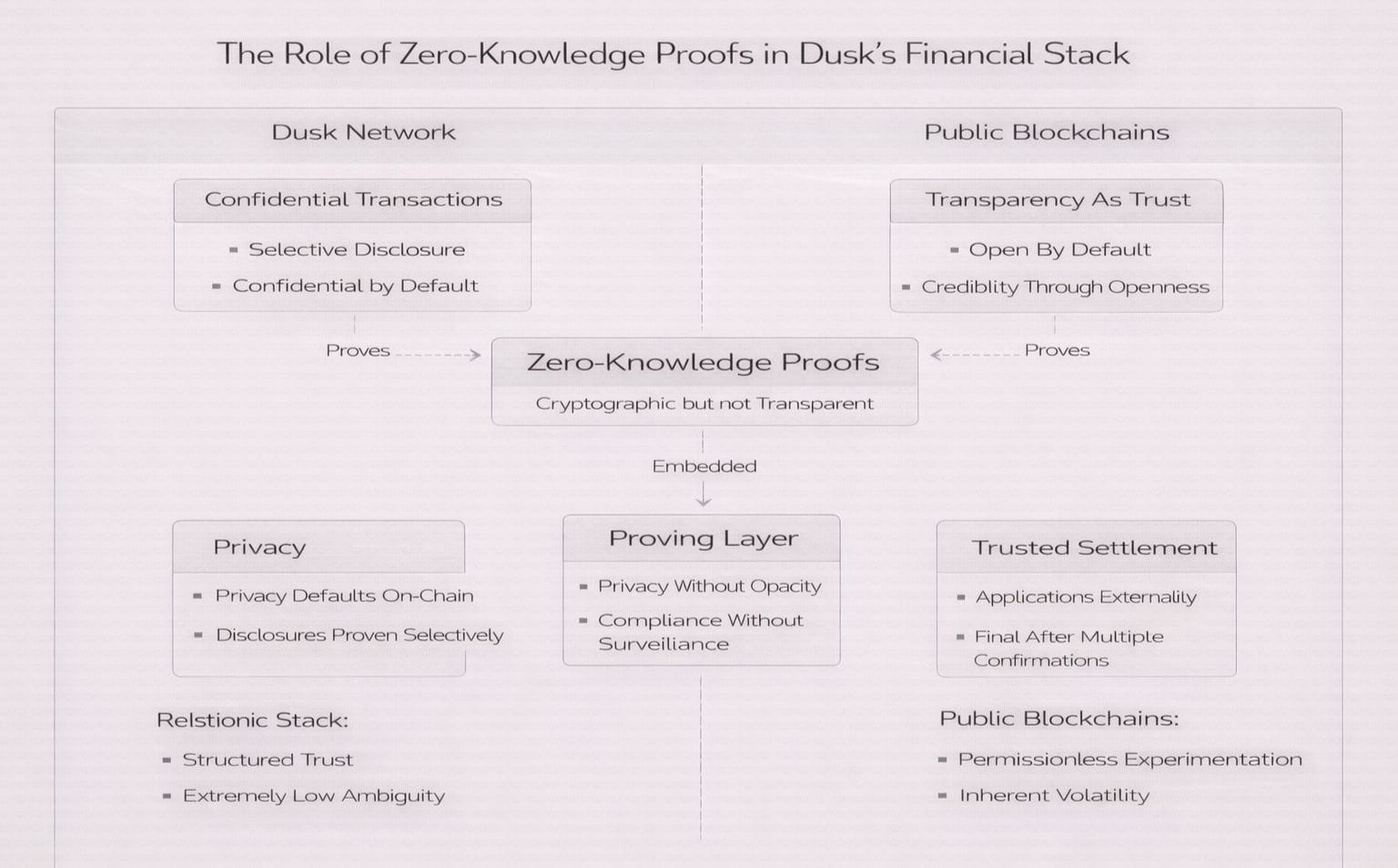

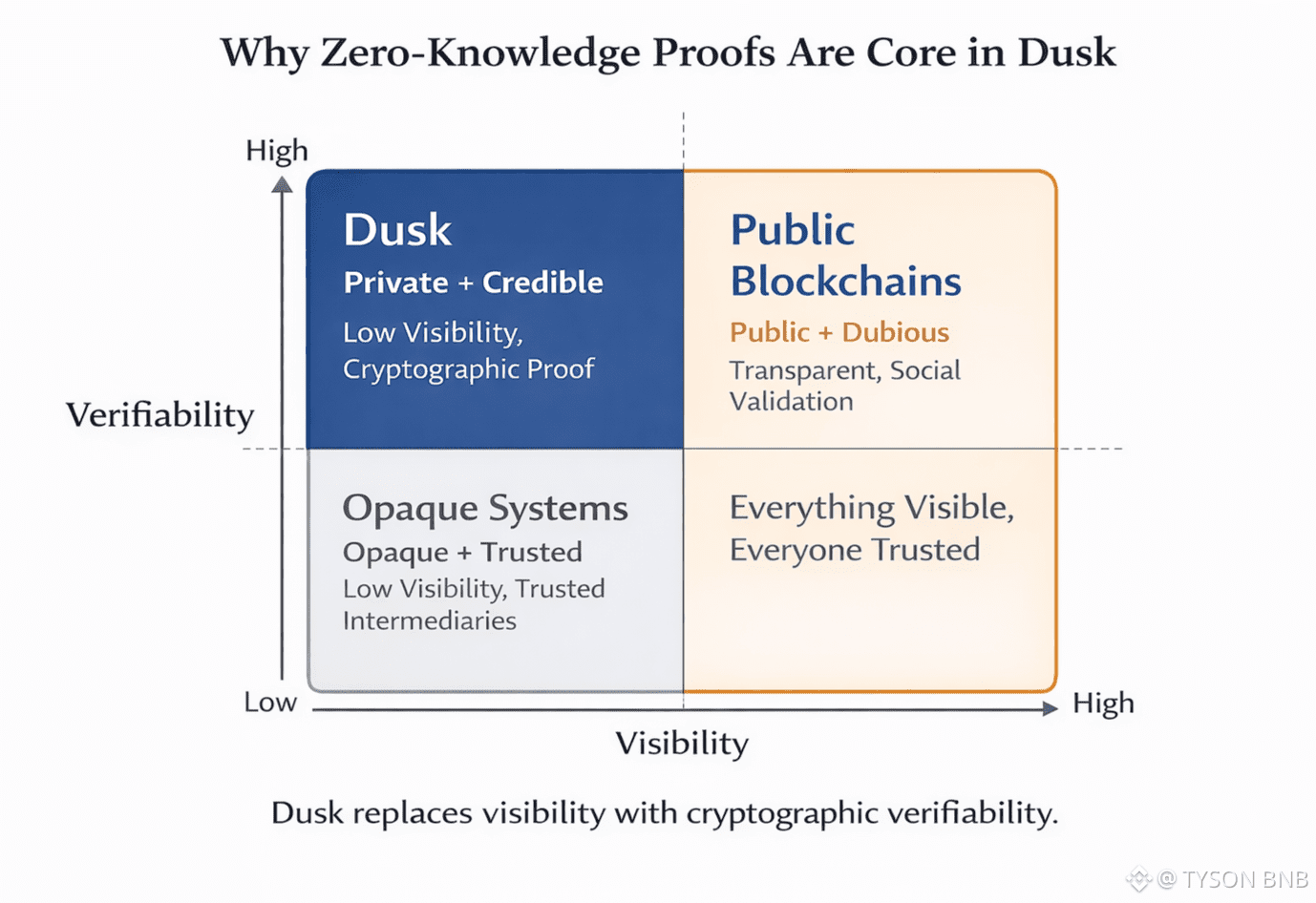

Dusk Network starts from a constraint most blockchains avoid: regulated finance requires both confidentiality and verifiability. Markets cannot expose sensitive information, yet they must be auditable, enforce rules, and produce legally meaningful outcomes. Traditional blockchains solve verifiability by making everything public. Traditional finance solves confidentiality by trusting intermediaries. Dusk uses zero-knowledge proofs to remove that trade-off entirely.

At a fundamental level, zero-knowledge proofs allow the system to prove that something is true without revealing why it is true. In financial terms, this means a transaction can demonstrate compliance with rules eligibility, limits, permissions, balances without disclosing the underlying data. The proof replaces visibility. Trust moves from observation to mathematics.

This shift is critical because regulation does not demand exposure. It demands assurance. Regulators do not need to see every transaction detail; they need confidence that rules are being followed. Zero-knowledge proofs provide that confidence natively. Compliance becomes something the protocol can demonstrate continuously, rather than something applications promise after the fact.

Within Dusk’s stack, zero-knowledge proofs sit at the intersection of privacy, execution, and settlement. They allow assets to move confidentially while still respecting constraints embedded at issuance. They allow trades to settle without leaking strategies or counterparties. They allow balances to remain private without undermining solvency guarantees. Each of these properties is fragile without cryptographic enforcement.

Another subtle role of zero-knowledge proofs in Dusk is responsibility containment. On transparent chains, the burden of interpreting data falls on everyone. On opaque systems, it falls on trusted intermediaries. Dusk uses proofs to push responsibility back into the protocol. The system explains itself without revealing itself. This reduces ambiguity and limits the surface area for disputes.

Zero-knowledge proofs also change how finality is understood. A transaction is not final because it was observed and confirmed by many parties. It is final because the proof validating it cannot be falsified. Finality becomes logical rather than probabilistic. This distinction matters in environments where legal and financial certainty cannot depend on social consensus alone.

Importantly, Dusk does not treat zero-knowledge proofs as a black box abstraction. They are integrated into the financial logic of the system. Issuance rules, transfer restrictions, and audit pathways are all designed with provability in mind. This avoids the common mistake of using zero-knowledge to hide problems rather than resolve them.

The role of zero-knowledge proofs in Dusk’s financial stack is therefore structural. They enable privacy without secrecy, auditability without exposure, and compliance without centralization. Without them, Dusk would collapse into the same compromises other systems make. With them, it can operate in a space most blockchains were never designed to enter.

Zero-knowledge proofs are not what make Dusk private. They are what make it credible.