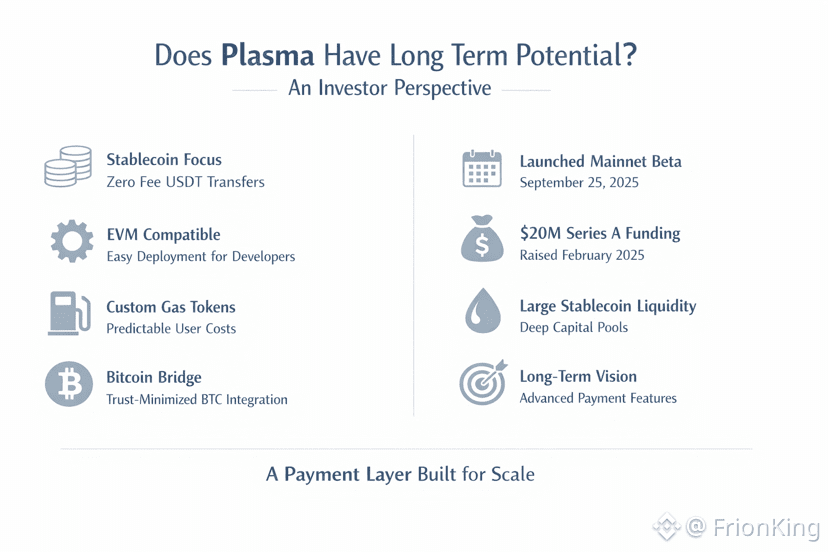

Plasma is a stablecoin native layer one blockchain built for global USDT payments, and the project is commonly described as founded in 2024. Its mainnet beta launched on September 25, 2025, and the headline feature on day one was zero fee USDT transfers, designed to feel like payments infrastructure rather than a speculative toy.

I have been around long enough to notice a pattern, real adoption does not arrive because a chain says it is fast, it arrives when a chain makes one specific job effortless at scale. Plasma picked a job that already moves serious volume, stablecoin payments, and then built the base layer around that reality. Do you want the next loud narrative, or do you want rails that can quietly move value every day.

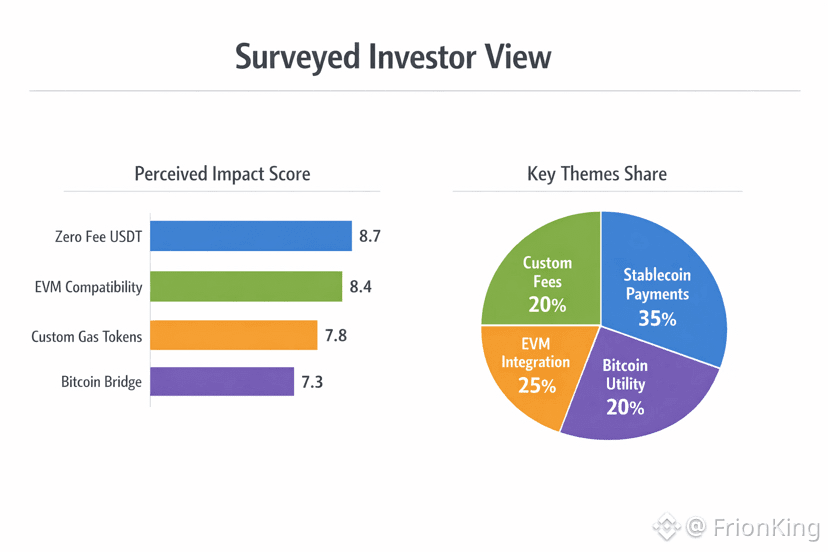

From my view, what makes Plasma stand out is the stablecoin native design philosophy. Instead of treating stablecoins as just another token, it treats them as the core workload, and this shows up in features like zero fee USDT transfers through a paymaster style model. That is the kind of product decision that signals intent, because payments users do not debate gas strategy, they just want the transfer to happen.

Plasma also leans into full EVM compatibility, and that matters more than people admit. In every cycle, the winners reduce friction for builders, they do not demand that developers relearn everything. With EVM compatibility, the path from idea to deployment is shorter, and the path from deployment to real transaction flow is clearer. Ask yourself this, if developers can ship faster, does usage arrive sooner.

Another feature I rate highly is the support for customizable gas tokens, because it gives product teams a lever to shape user experience without constantly fighting fee volatility. Payments is a game of predictability, and predictable user costs is a competitive advantage, even when the market is noisy.

Then there is the Bitcoin bridge narrative, not as a slogan, but as a design choice that aims for trust minimized movement of BTC into smart contract environments, often discussed as minting pBTC for native use in applications. If stablecoins are the daily liquidity, BTC is the long horizon collateral, and combining those flows on usable rails is a strong strategic direction.

Recent traction signals also matter to me, not as hype, but as proof that the market sees a clear use case. Plasma raised a reported 20 million dollars in a Series A in February 2025, and launched with large stablecoin liquidity narratives around mainnet. When capital and liquidity align around a simple utility, that is usually where long runway begins.

So when I look at Plasma, I do not frame it as “one more chain”. I frame it as a focused payments layer that keeps sharpening the exact features that make payments feel invisible, zero fee stablecoin transfers, EVM ready deployment paths, customizable fee abstraction, and an expansion path toward more advanced payment properties like privacy oriented roadmaps that some ecosystem materials have highlighted. Do you prefer infrastructure that compounds quietly, while everyone else chases the next headline.