I watch charts every day.

I have watched them for years.

I remember when a “fast” blockchain still made you wait long enough to doubt your own trade.

That memory matters when we talk about Vanar’s three-second block time, because speed in trading is not a buzzword. It’s a feeling. It’s the gap between clicking buy and wondering, hmmm… did that actually go through?

For scalpers and short-term traders, that gap is everything.

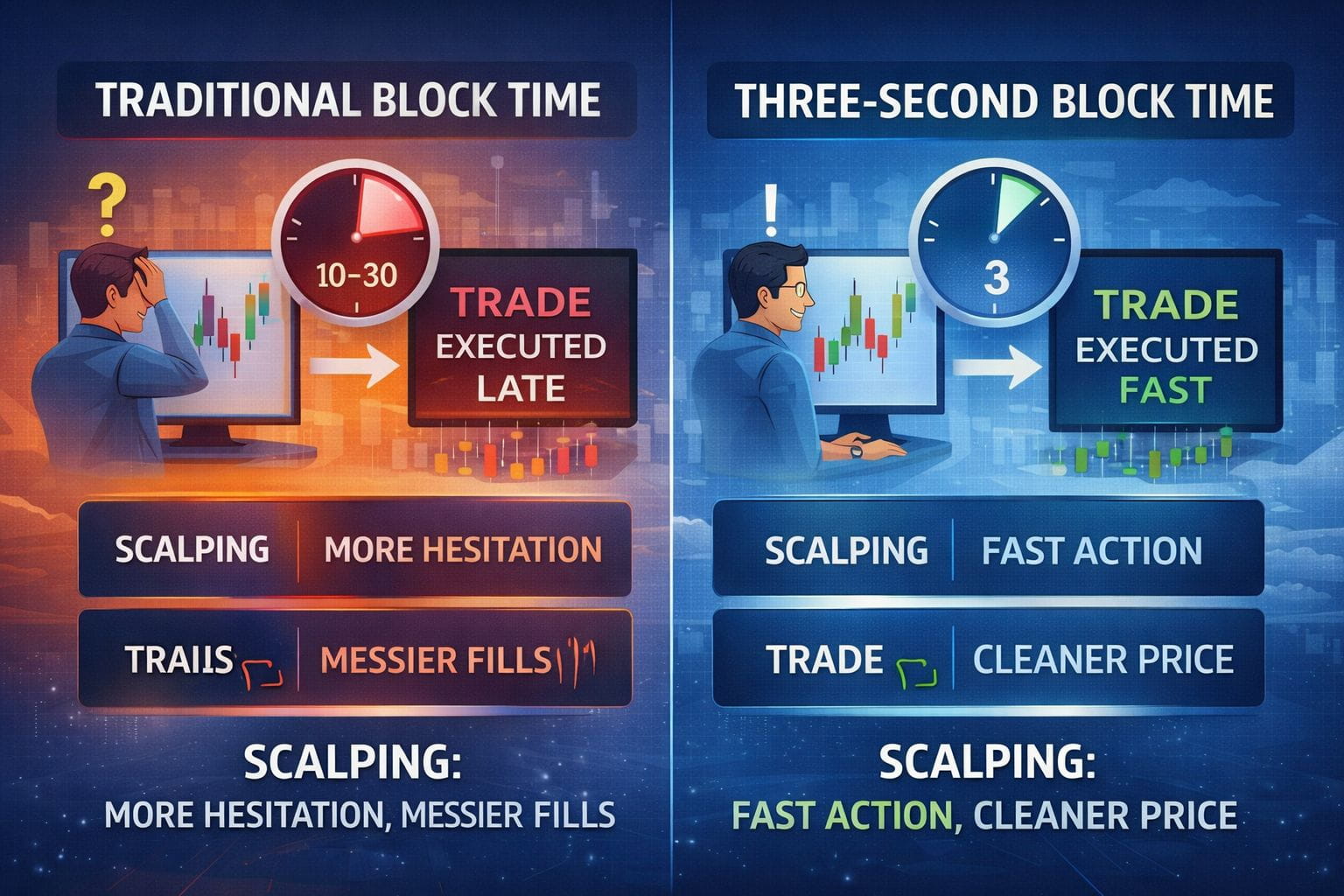

Scalping, at its core, is simple. You aim to take small, repeatable price moves with tight risk. There’s no room for hesitation, no tolerance for delayed confirmation. On slower networks, even the best setup can fail because execution lags behind intention. I’ve lost count of how many times a clean scalp turned messy just because the network took too long to respond.

This is where Vanar quietly changes the game.

As of late 2025 and moving into early 2026, Vanar operates with a block time capped around three seconds. For non-technical readers, block time is simply how often the network groups transactions into a new block and confirms them. Shorter block time means faster confirmation. Faster confirmation means your action becomes reality sooner.

That may sound obvious, but the impact on trading behavior is deeper than most people realize.

On slower Layer-1 chains, scalpers adapt in unhealthy ways. They widen stops. They reduce size. They hesitate at entries. They exit early, not because price says so, but because uncertainty creeps in. Variable gas fees add another layer of stress. You’re not just trading price; you’re trading the network.

Vanar removes much of that friction. With predictable fees and near-instant confirmation, execution starts to feel mechanical again. You see the setup, you act, and the system responds before doubt takes over. That’s not hype. That’s psychology.

Since December 2025, traders have started to notice how VANRY’s short-term price action behaves differently compared to similar-cap assets on slower chains. Candles are cleaner. Wicks feel more intentional. Sudden spikes caused by delayed confirmations are less frequent. This doesn’t mean price only goes up. It means price reflects decisions more honestly.

From my own trading, I’ve noticed something subtle but important. When confirmation is fast, I trade less emotionally. I don’t rush. I don’t second-guess. That leads to fewer trades, but better ones. Ironically, speed encourages patience.

Scalping thrives on structure. You need consistent fills and predictable outcomes. Vanar’s three-second blocks support that by aligning blockchain behavior with human reaction time. Anything slower than that starts to feel like lag. Anything faster risks introducing noise. Three seconds sits in a practical middle ground.

Another factor often overlooked is how block time interacts with transaction ordering. Vanar processes transactions on a first-in, first-out basis. That means you’re not racing other traders by paying higher fees. You’re competing on timing and decision quality. For scalpers, that restores fairness. It doesn’t eliminate competition, but it removes an artificial advantage that favors deeper pockets.

Why is this topic trending now? Because market structure is shifting. After years of narrative-driven volatility, traders are becoming more selective about where they deploy capital. Execution quality is starting to matter again. Networks that support active trading without hidden costs naturally attract attention, even without loud marketing.

Developers feel this too. Fast finality allows them to build trading tools, bots, and interfaces that respond in real time. That ecosystem feedback loop matters. Better tools attract better traders. Better traders create better liquidity. Liquidity tightens spreads. Spreads improve scalping viability. It’s all connected.

Philosophically, this brings up a bigger idea. Markets are not just about price discovery. They are about trust. Trust that when you act, the system will behave as expected. Every delay erodes that trust a little. Every smooth execution restores it.

I’ve learned that the best trading environments are the ones you stop thinking about. When the infrastructure fades into the background, your focus shifts back to analysis, discipline, and risk. That’s where skill actually shows.

Does a three-second block time guarantee profitable scalping? No. Nothing does. Bad trades are still bad trades. Overtrading is still overtrading. But Vanar removes excuses. Losses feel earned, not imposed by the network.

And that’s important.

As traders and investors, we often chase complexity, believing it equals sophistication. Over time, I’ve come to respect simplicity more. Systems that respond quickly and fairly allow humans to trade honestly with themselves.

Hmmm… yes, maybe that’s the real value of Vanar’s speed.Not that it makes you faster, but that it makes your intentions clearer.

In trading, clarity is rare.

When infrastructure helps instead of interferes, that clarity becomes a quiet edge.