Since its mainnet beta launch in September 2025, Plasma has quickly evolved from a niche idea into one of the most talked‑about blockchain projects in the stablecoin space. What sets Plasma apart isn’t just its technical design — though its Layer‑1 structure tailored for stablecoin payments is innovative — but how ecosystem partnerships, liquidity adoption, and real‑world integrations are already driving significant activity on the network.

A Massive Liquidity Influx from Day One

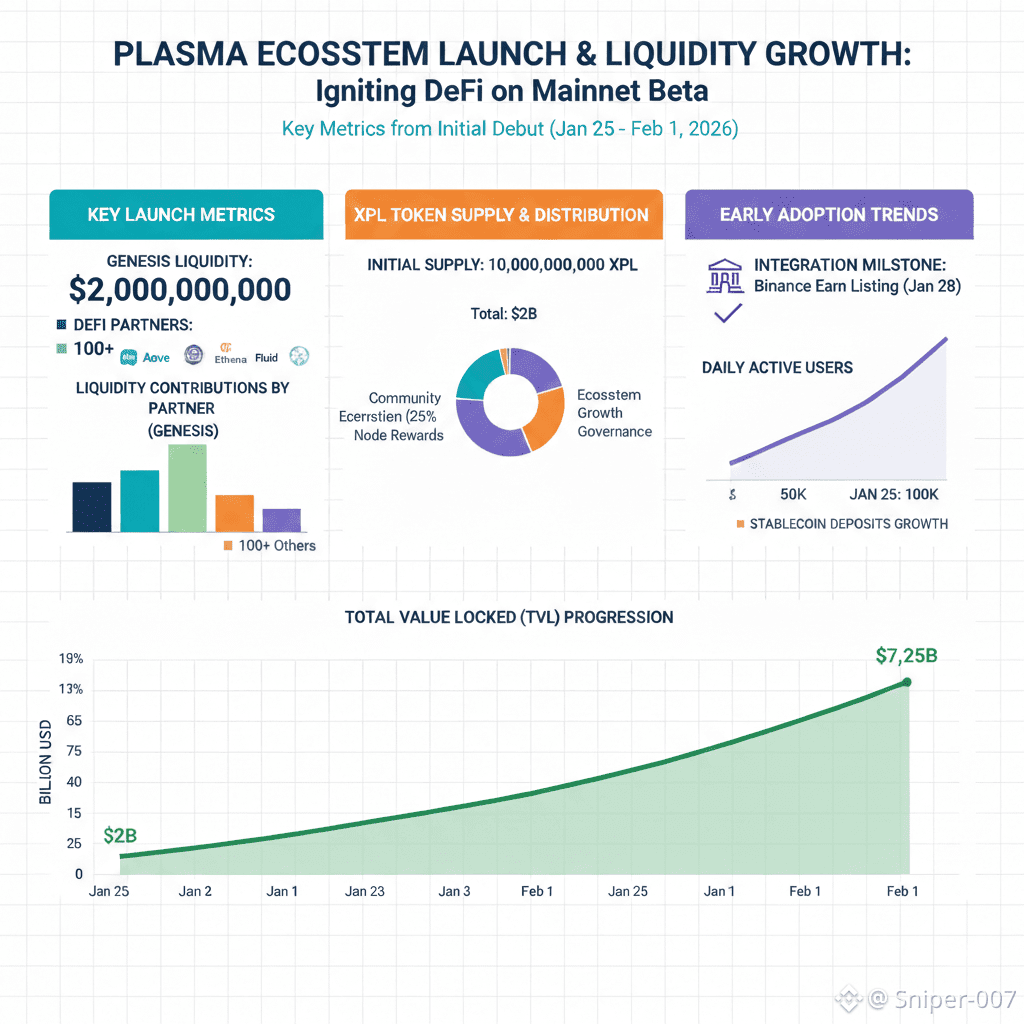

Plasma’s rollout was notable right from the start. At the mainnet beta launch on September 25, 2025, more than $2 billion in stablecoin liquidity was active on the network, distributed across over 100 DeFi partner protocols such as Aave, Ethena, Fluid, and Euler. This placed Plasma among the largest blockchains by stablecoin liquidity immediately at launch, an almost unheard‑of achievement for a new Layer‑1 chain.

Such a high level of liquidity on day one signals genuine demand for a specialized stablecoin settlement network, rather than speculative interest alone. It also demonstrates strong confidence from major DeFi players who integrated their protocols early, showing that developers see value in Plasma’s payment‑focused architecture.

Rapid Ecosystem Momentum After Launch

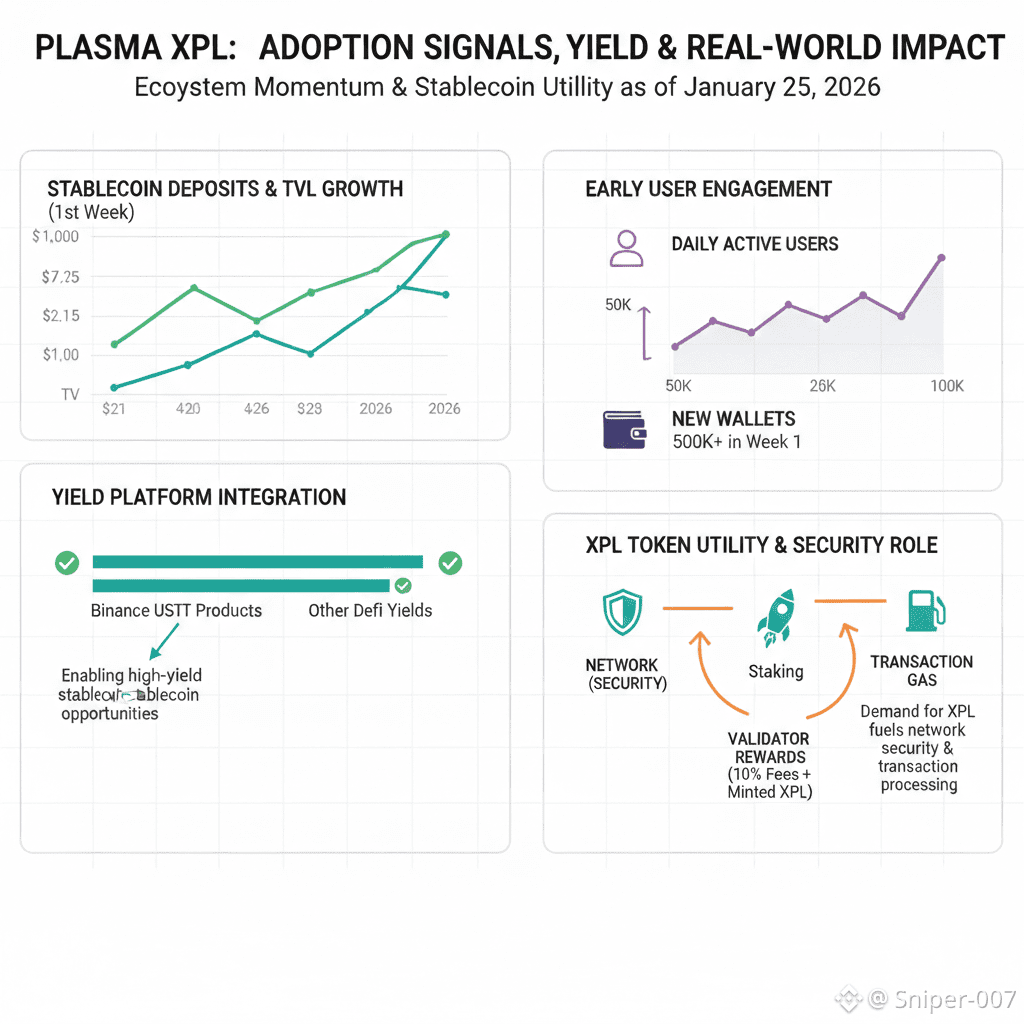

In the days following launch, on‑chain activity continued to grow. Within the first week, total stablecoin deposits on Plasma reportedly exceeded $7.25 billion, with more than $5.25 billion in Total Value Locked (TVL) across the network’s DeFi ecosystem. These figures helped Plasma rank as one of the top chains globally in terms of stablecoin liquidity — demonstrating not just initial interest, but meaningful early engagement from users and liquidity providers.

Daily active users also doubled shortly after launch, with thousands of new users joining each day. Integrations with major platforms like Binance Earn, which brought yield opportunities on Plasma‑based USDT to over 280 million users, played a role in driving both awareness and real participation in the ecosystem.

Strategic Integrations with Oracle and Cross‑Chain Networks

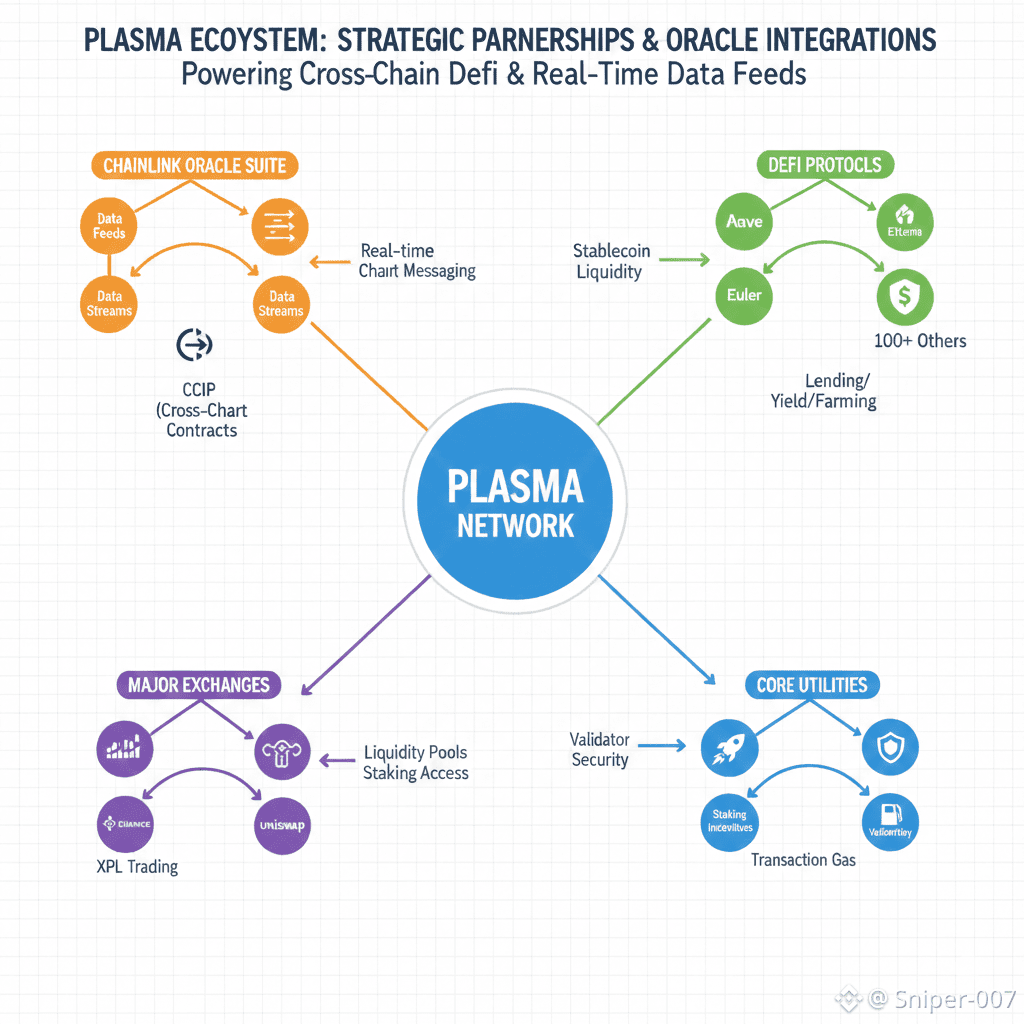

Plasma’s growth isn’t limited to liquidity and user numbers — it’s also expanding its technical connective tissue. The network joined the Chainlink Scale program, integrating Chainlink Data Feeds, the Cross‑Chain Interoperability Protocol (CCIP), and Data Streams. This equips Plasma with secure, high‑quality oracle data and cross‑chain messaging, which are essential for advanced stablecoin applications, real‑time pricing, and interoperability with other blockchains.

Chainlink’s CEO team has emphasized that this partnership provides enterprise‑grade infrastructure from day one, helping builders create robust, secure financial applications that move beyond simple transfers to more complex stablecoin use cases.

Exchange and Yield Platform Support as Adoption Signals

Plasma also tapped into mainstream user bases by partnering with well‑known platforms. For example, Binance launched a USDT locked product tied to Plasma, selling out its allocated cap of stablecoin deposits in under an hour. This shows not just speculative interest but real user desire to engage with stablecoin yield opportunities that also expose them to the XPL ecosystem.

Such partnerships amplify Plasma’s visibility and liquidity, creating a flywheel effect where more users bring more stablecoin usage, which in turn strengthens Plasma’s role as a settlement layer and increases demand for XPL as the token that secures its validator network and aligns ecosystem incentives.

Why These Trends Matter for Plasma’s Long‑Term Vision

Stablecoins today represent one of the largest flows of on‑chain value globally — and Plasma’s model is to capture not just that movement but to serve as the settlement fabric. The combination of major liquidity across top DeFi protocols, rapid growth in TVL and daily users, strategic oracle integrations, and ecosystem support from exchanges and yield platforms forms a compelling ecosystem trajectory that goes beyond early hype.

Rather than being a general layer for any application, Plasma is fine‑tuned for a specific and enormous use case: efficient, low‑cost, scalable movement of stablecoins across borders, apps, and markets. Its early ecosystem signals suggest that builders, liquidity providers, and users are not just experimenting — they are using Plasma as a foundation for real stablecoin activity right now.

Conclusion: From Launch to Real Adoption Signals

While many new blockchains launch with theoretical promises, Plasma has shown practical adoption signals in a very short time frame:

Billion‑plus liquidity deployed at launch across major DeFi partners.

Rapid TVL growth and multi‑billion stablecoin deposits in the first week.

Strategic integrations with Chainlink’s oracle and cross‑chain tooling.

Exchange and yield product collaborations that expand user reach.

These developments point to more than hype — they show @Plasma advancing toward becoming a true ecosystem and infrastructure layer for stablecoins and digital money movement, with $XPL at the center of its security and incentive structure.