The strongest financial systems are the ones people forget are even there. When everything works no one stops to think about the machinery underneath. Trades go through. Records line up. Trust holds without effort. The moment something breaks that invisibility disappears and suddenly everyone realizes how much depended on it. This idea explains Dusk better than any technical description ever could.

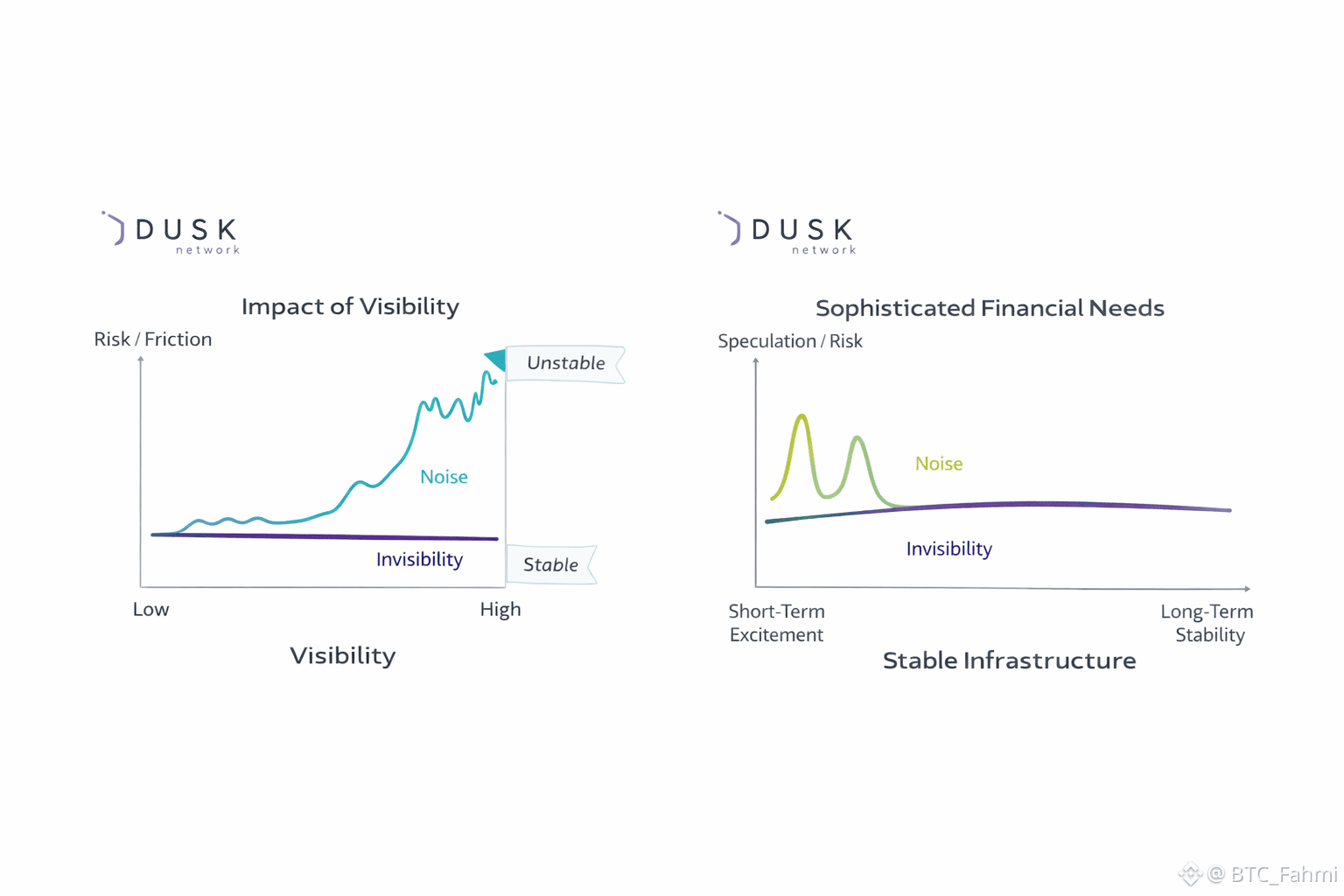

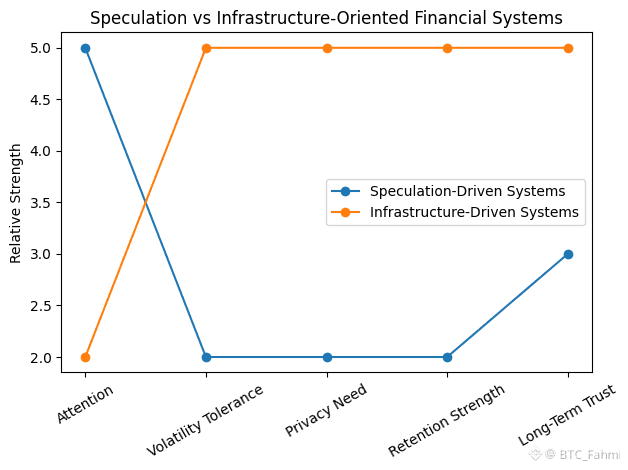

Dusk Network is not built to chase attention. It is built to earn quiet confidence. In markets, that distinction matters. Short-term speculation feeds on excitement, but capital that intends to stay looks for calm. Traders who manage real risk and investors who think in years rather than weeks do not want surprises from the systems that handle settlement and verification. They want consistency, even on days when volatility is high and liquidity is thin.

Traditional finance evolved around this principle. The most important layers clearing, settlement, compliance are not designed to be impressive. They are designed to be dependable. Nobody praises them during normal operation, yet entire markets depend on them behaving exactly as expected. Crypto, by contrast, has spent much of its life optimizing for visibility. Everything is public. Everything is fast. Everything is expressive. That openness enabled innovation, but it also exposed weaknesses when real capital began to participate.

Dusk starts from a more grounded assumption. If digital assets are going to sit alongside traditional finance, the underlying systems must respect how financial actors actually behave. Privacy is central to this. In real markets, privacy is not about hiding activity. It is about protecting participants from unnecessary exposure. Traders do not want their positions revealed in real time. Funds do not want strategies inferred from transaction data. Institutions cannot operate if client information is permanently visible to the world. Selective disclosure is not optional at scale. It is required.

Anyone who has tried to execute a large trade on a fully transparent network understands this instinctively. The moment a transaction becomes visible, the market reacts. Fees rise. Slippage increases. Even if the trade settles, the experience feels unstable. Now imagine that same dynamic applied to regulated assets or institutional settlement. The tolerance for that kind of friction drops to zero. Dusk is designed to remove that stress at the foundation rather than patching it after the fact.

For investors, this creates an uncomfortable reality. Infrastructure rarely delivers instant gratification. Progress shows up as steady development careful integration and long stretches without drama. That makes it easy to ignore in favor of louder narratives. But infrastructure value compounds quietly. Once embedded into real workflows, it becomes difficult to replace. That is how long-term relevance is built.

Current market direction supports this view. Tokenization of real-world assets is no longer theoretical. It is being explored by banks, funds, and issuers right now. Regulation is becoming clearer, not looser. Compliance expectations are rising, not fading. Each of these forces pushes the market toward systems that can balance transparency with discretion. Dusk sits directly in that space.

This is where the retention problem becomes impossible to ignore. Many networks attract users through incentives or speculation, then struggle to keep them once conditions change. Retention driven by infrastructure works differently. Users stay because leaving creates risk. They stay because systems are integrated, processes are familiar, and reliability has been proven over time. That kind of retention does not trend on social media, but it endures.

There is also a human layer beneath all of this. Traders who have experienced frozen withdrawals, broken bridges, or failed settlements develop a different set of priorities. They stop looking for excitement in core systems. They want fewer unknowns, not more. Dusk reflects that mindset. It is designed to reduce anxiety, not amplify it.

Nothing here guarantees outcomes. Building systems that disappear into routine is difficult, and recognition often comes late. But direction matters. As crypto matures, the most valuable layers will be the ones that support everything else without demanding attention.

For traders and investors looking at Dusk, the real question is not whether it will dominate headlines or drive short-term narratives. The question is whether it can become something you rely on without thinking about it. In finance, that is often the highest form of success. And it is usually where long-term conviction bework.

Artigo

Dusk: The Best Systems Are the Ones You Don’t See

Aviso Legal: inclui opiniões de terceiros. Não se trata de aconselhamento financeiro. Poderá incluir conteúdos patrocinados. Consulta os Termos e Condições.

DUSK

0.1799

+30.93%

199

4

Fica a saber as últimas notícias sobre criptomoedas

⚡️ Participa nas mais recentes discussões sobre criptomoedas

💬 Interage com os teus criadores preferidos

👍 Desfruta de conteúdos que sejam do teu interesse

E-mail/Número de telefone