Tokenizing real-world assets is often presented as a distribution problem: put equities, bonds, or funds on-chain and unlock liquidity. That framing skips the harder question. The real challenge is not issuance, but operability under regulation. Real assets do not become permissionless simply because they are tokenized. They are still subject to the rule of law, various disclosure requirements, transfer restrictions, and auditing obligations. Dusk Network has been designed to live with this fact, rather than attempting to abstract it away.

Tokenizing real-world assets is often presented as a distribution problem: put equities, bonds, or funds on-chain and unlock liquidity. That framing skips the harder question. The real challenge is not issuance, but operability under regulation. Real assets do not become permissionless simply because they are tokenized. They are still subject to the rule of law, various disclosure requirements, transfer restrictions, and auditing obligations. Dusk Network has been designed to live with this fact, rather than attempting to abstract it away.

Most public blockchains approach RWAs like digital twins. Assets are mirrored on-chain, but compliance, identity, and oversight live somewhere else. This sets up a bifurcated system: the token goes wherever it wants, while legality is enforced elsewhere, with the help of contracts and intermediaries. Over time, this becomes brittle. Enforcement lags execution. Disputes become ambiguous. Trust quietly recentralizes.

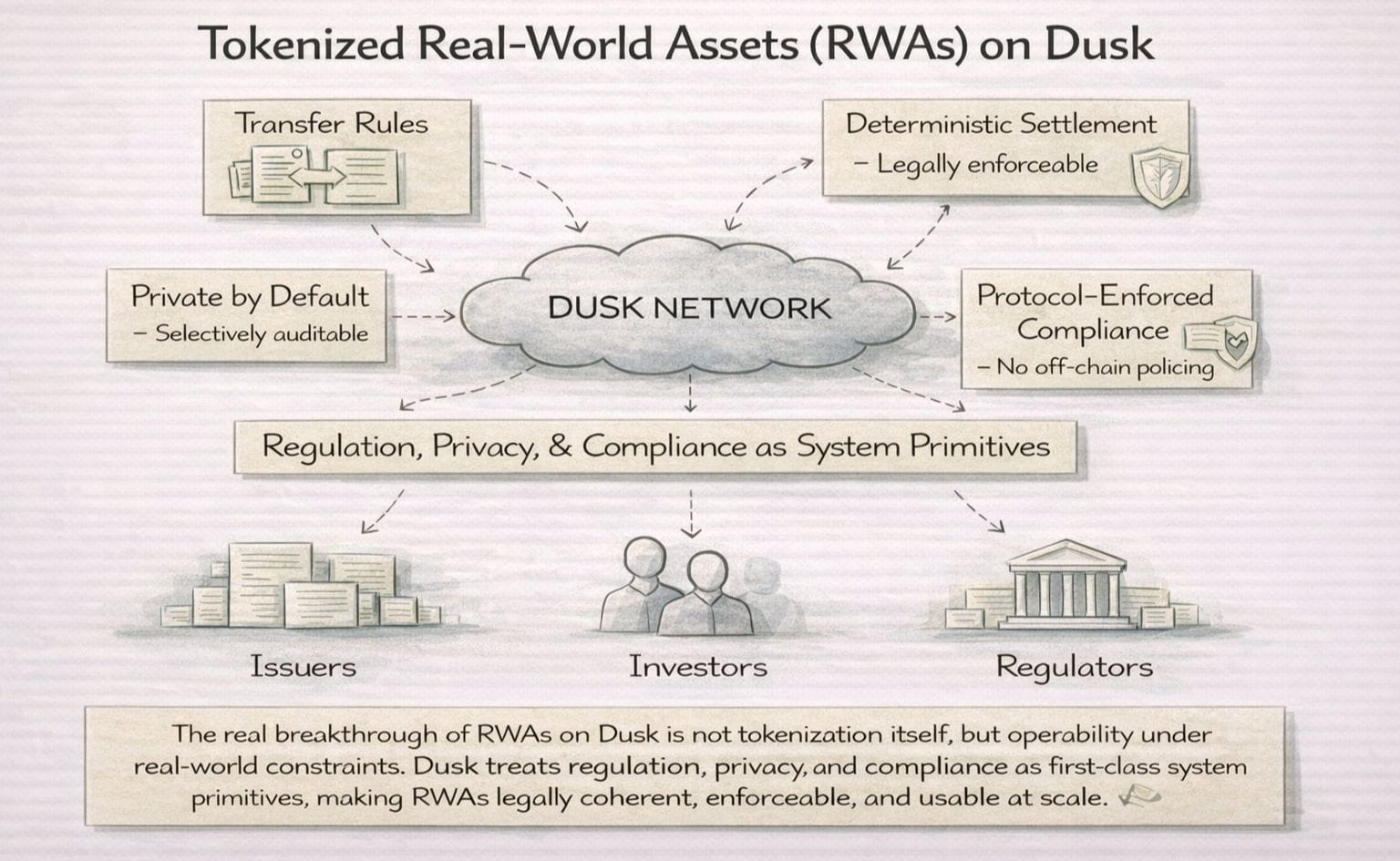

Dusk takes a different position. RWAs are not just tokens with metadata; they are regulated instruments with constraints. Those constraints must be expressible and enforceable at the base layer. Transfer rules, eligibility checks, holding limits, and disclosure requirements are embedded into the asset’s lifecycle rather than delegated to external systems. The chain is not neutral to regulation it is fluent in it.

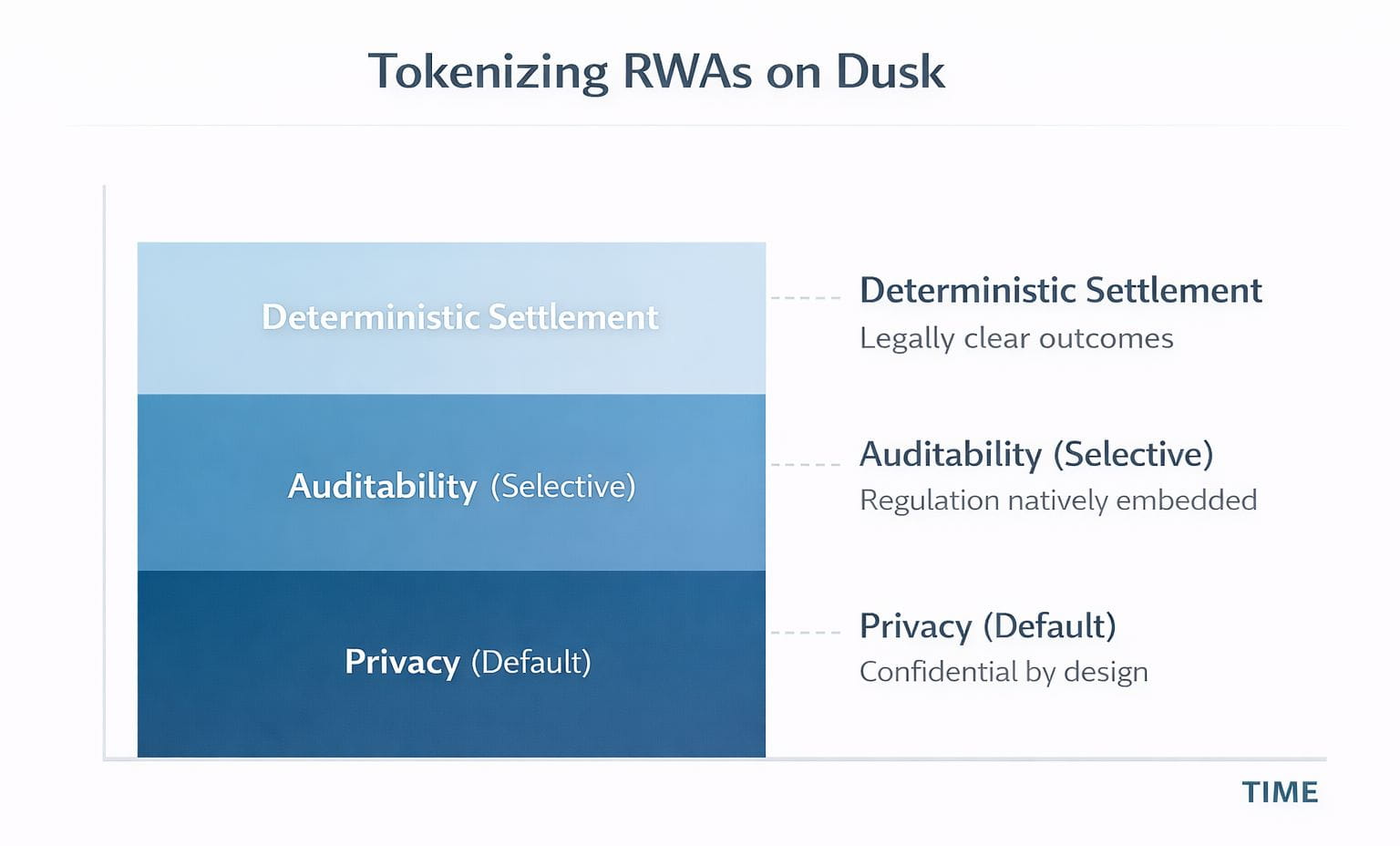

Privacy plays a central role in making this viable. Regulated markets cannot function if every position, trade, and counterparty is public. Yet at the same time, regulators need to be able to verify adherence without having to rely on a leap of blind faith. Dusk resolves the tension by making privacy the default and auditability selective. Transactions keep confidential while producing cryptographic proofs of the rules being followed. Exposure is substituted for assurance.

This design changes how RWAs can be used. Issuers can create assets that respect jurisdictional boundaries without fragmenting liquidity. Investors can hold and transfer compliant assets without broadcasting strategies or balances. Regulators can audit activity without turning markets into public ledgers. Each participant interacts with the same system, but not with the same visibility.

Settlement is another critical piece. Real-world assets require deterministic outcomes. Probabilistic finality may be acceptable for speculative tokens, but it is inadequate for legally binding transfers. Dusk is built around clear settlement semantics so that ownership changes are unambiguous and enforceable. A transfer either happened or it did not and that distinction holds under scrutiny.

The use cases follow naturally from this structure. Equity-like instruments can trade privately while remaining auditable. Funds can validate on-chain eligibility of investors without disclosing their lists. Debt instruments can settle with confidentiality while preserving reporting guarantees. Even complex instruments benefit from a system where rules are enforced by protocol logic rather than operational trust.

What matters most is not any single use case, but the removal of a systemic compromise. RWAs on Dusk do not require choosing between decentralization and compliance. The infrastructure assumes both are necessary. By aligning cryptography with legal reality, Dusk allows tokenization to move beyond experimentation and into durable financial coordination.

Tokenized RWAs on Dusk are not about making assets more liquid at any cost. They are about making assets correct in an on-chain environment. When infrastructure respects how real markets function, tokenization stops being a promise and starts becoming usable.