Confidentiality and oversight are usually treated as mutually exclusive. Either transactions are private and regulators are locked out, or transactions are transparent and participants give up discretion. That framing has shaped most blockchain design choices and it has quietly limited where blockchains can be used. Dusk Network exists because this trade-off is artificial.

Confidentiality and oversight are usually treated as mutually exclusive. Either transactions are private and regulators are locked out, or transactions are transparent and participants give up discretion. That framing has shaped most blockchain design choices and it has quietly limited where blockchains can be used. Dusk Network exists because this trade-off is artificial.

In real financial systems, confidentiality is normal. Trades, balances, and counterparties are not broadcast to the public. Yet oversight still exists. Regulators audit. Courts adjudicate. Rules are enforced. The system works because visibility is scoped, not universal. Dusk brings this model on-chain instead of forcing finance into a transparency-first ideology it was never built for.

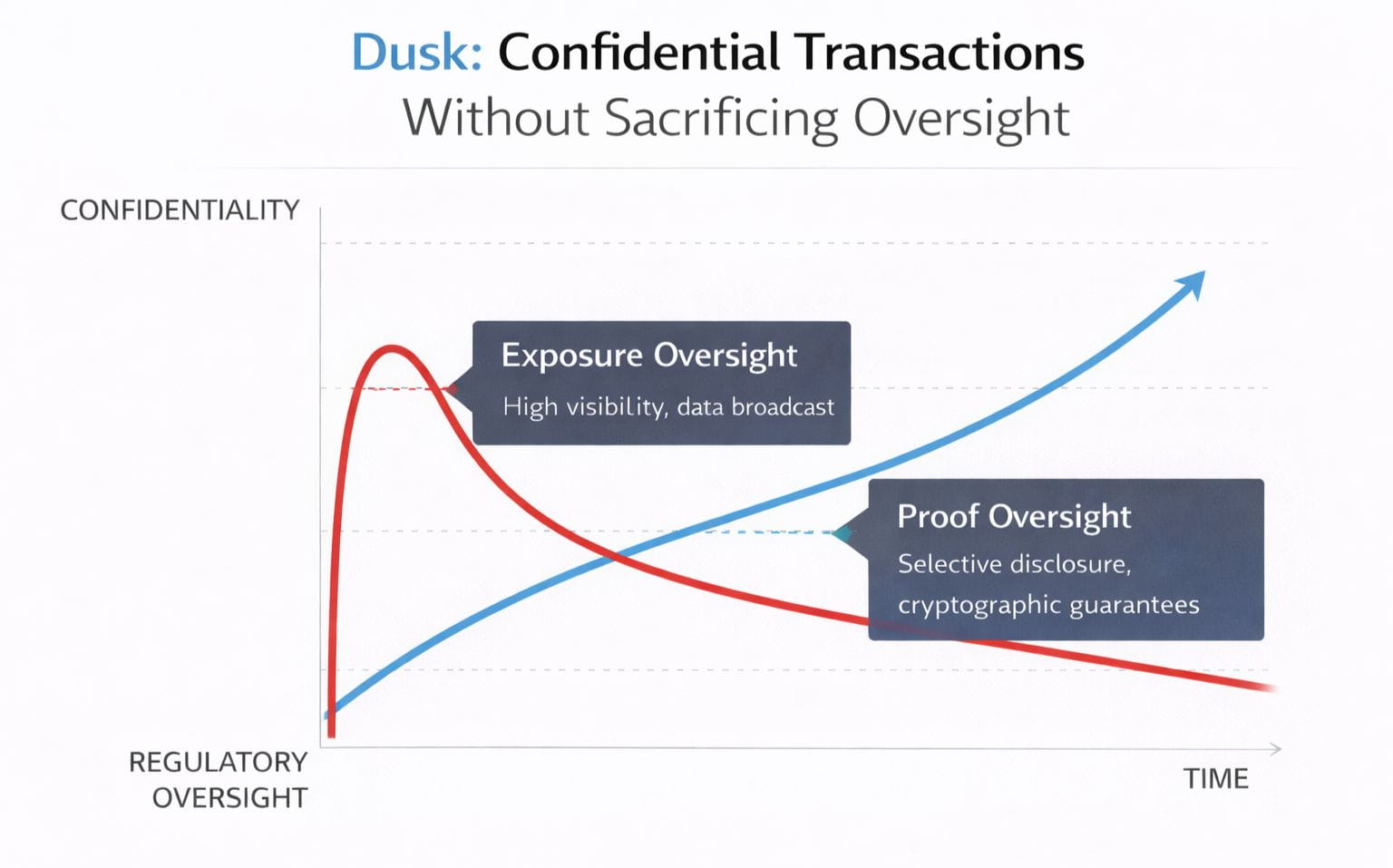

Most public blockchains equate oversight with exposure. If everyone can see everything, the system is considered auditable. In practice, this creates new risks. Strategies leak. Participants are profiled. Market behavior becomes predictable in ways that advantage observers rather than participants. Oversight turns into surveillance, and surveillance distorts markets. Dusk treats this as a structural flaw, not an acceptable side effect.

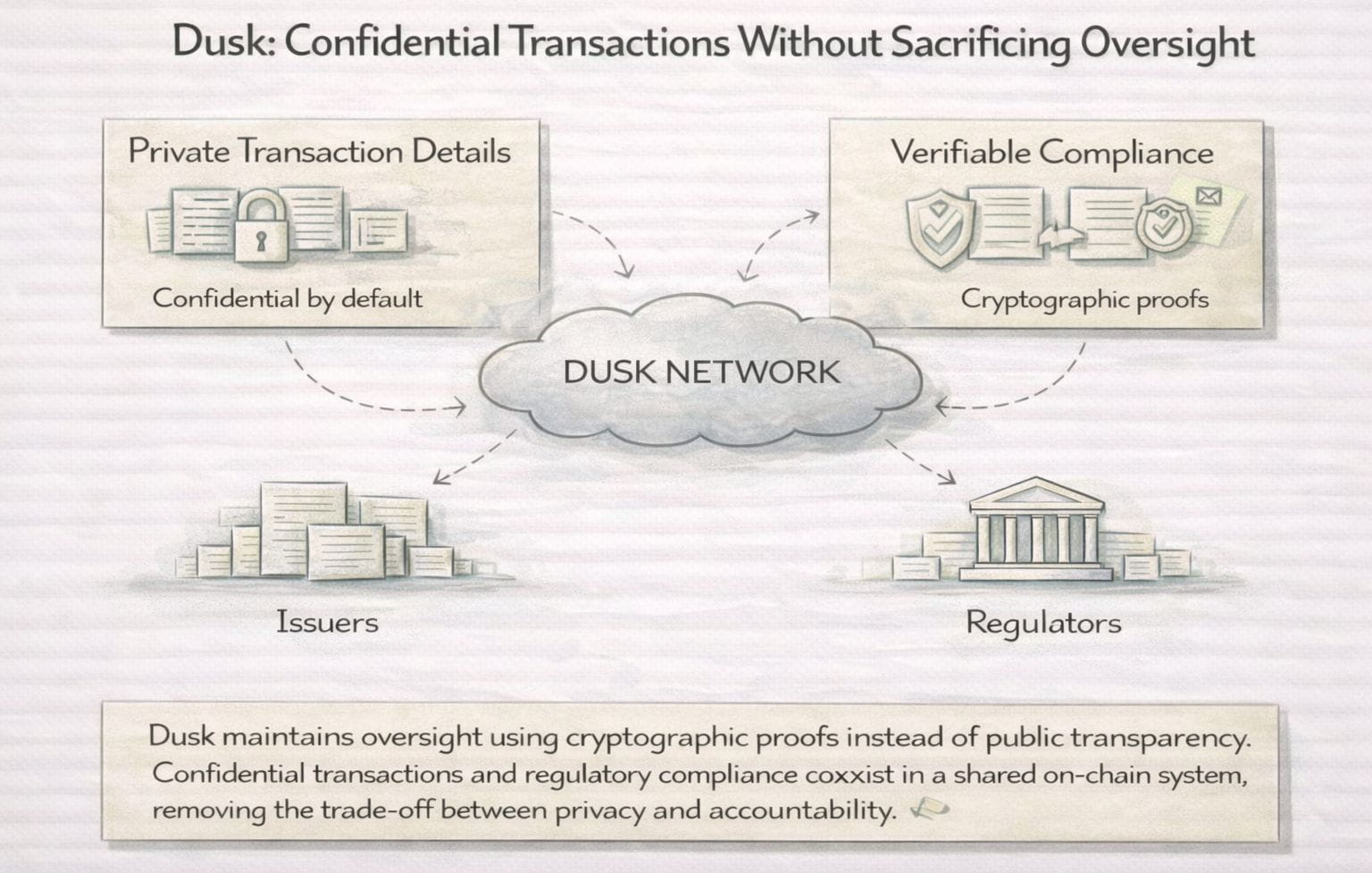

Confidential transactions on Dusk are not about hiding activity. They are about containing information. Transaction details remain private by default, but the system still produces cryptographic guarantees that rules were followed. Compliance is proven without disclosure. Oversight is maintained without turning markets into glass boxes.

This distinction matters because oversight is about assurance, not voyeurism. Regulators need to know that limits were respected, permissions were enforced, and assets were transferred legally. They do not need to see every number in real time. Dusk replaces raw visibility with verifiable correctness. The protocol can explain its behavior without exposing its internals.

Another important consequence is accountability clarity. On transparent chains, all eyes see all, but blame usually lies in a gray area. User-driven, contract-driven, or exploit-driven-which was it? With confidential execution and provable constraints on Dusk, the attribution is cleaner. Oversight focuses on rule compliance rather than forensic guesswork.

Privacy also defends the system per se. When sensitive data is in the open, it is a target for coordination. Actors adapt, front-run or manipulate based on information they were never meant to possess. Dusk limits this attack surface by ensuring that only information necessary for correctness is revealed. Markets behave more like markets when they are not constantly observed.

Crucially, this coexistence is enforced at the base layer. Applications do not have to invent bespoke disclosure mechanisms or rely on off-chain agreements. Oversight is not optional or social. It is cryptographically embedded. This shifts trust away from intermediaries and into protocol guarantees.

Dusk proves that confidential transactions do not undermine oversight; they perfect it. Distinguish between who can act and who can observe; replace exposure with proof. The system retains market integrity along with regulatory confidence. In doing so, it offers a path forward for blockchains that want to support real financial activity without forcing it into public spectacle.

Confidentiality without oversight creates opacity. Oversight without confidentiality creates fragility. Dusk was built to accept neither.