Ethereum: Network upgrades and rising ETF inflows strengthen long-term institutional confidence.

Chainlink: Deep financial partnerships and cross-chain infrastructure support real-world asset tokenization growth.

Bittensor: Fixed supply and AI adoption attract growing institutional accumulation.

Smart investors tend to focus on promising crypto assets with strong fundamentals and clear growth paths. Several altcoins now stand out due to network upgrades, rising adoption, and growing institutional interest. These projects solve real problems and continue to attract serious capital. Market confidence has started to improve, and patient investors are positioning early.

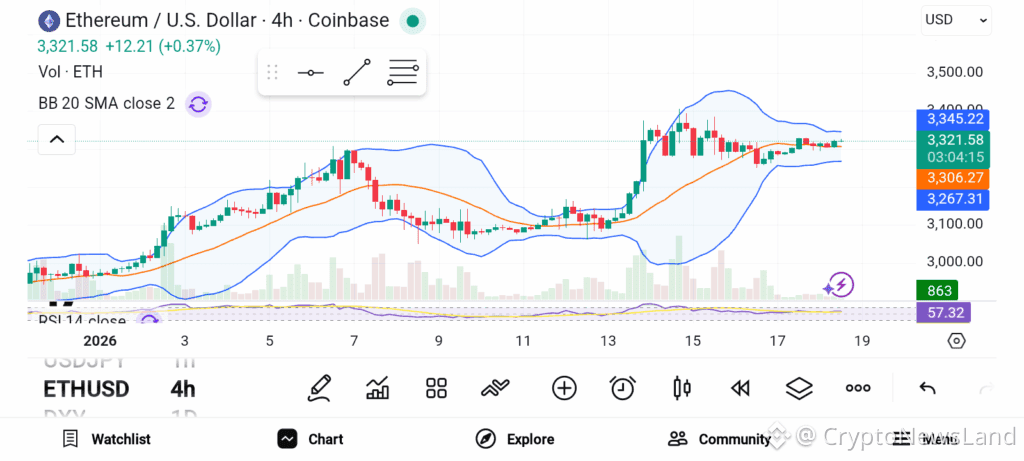

Ethereum (ETH)

Source: Trading View

Source: Trading View

Ethereum Network continues to serve as the backbone of decentralized finance and many on-chain applications. Investor confidence has strengthened ahead of a major network upgrade scheduled for early November. This upgrade focuses on improving scalability while preparing the network for broader Layer-2 usage. Faster processing and lower congestion strengthen overall network performance and improve user experience across decentralized platforms. Institutional demand for Ethereum has also shown notable growth.

During the third quarter, Ethereum exchange-traded fund inflows surpassed those of Bitcoin for the first time. That shift suggests a changing outlook among large investors who now see stronger upside in Ethereum. Corporate treasuries and investment funds continue accumulating ETH, adding steady support to price action. Market analysts remain optimistic about long-term potential. As adoption expands and infrastructure improves, Ethereum remains a core holding for investors seeking long-term exposure.

Chainlink (LINK)

Chainlink continues to strengthen connections between blockchain networks and real-world systems. The project has become deeply integrated with traditional finance through high-profile partnerships. During the SmartCon conference held in early November, industry leaders such as Swift, Mastercard, and JPMorgan participated, highlighting growing institutional trust in Chainlink technology.

The Cross-Chain Interoperability Protocol now connects more than 60 blockchains. This framework supports the growing market for real-world asset tokenization. Analysts project this sector could exceed $16 trillion by 2030. As tokenization expands, Chainlink remains positioned as a critical infrastructure layer. Token supply dynamics also support long-term value.

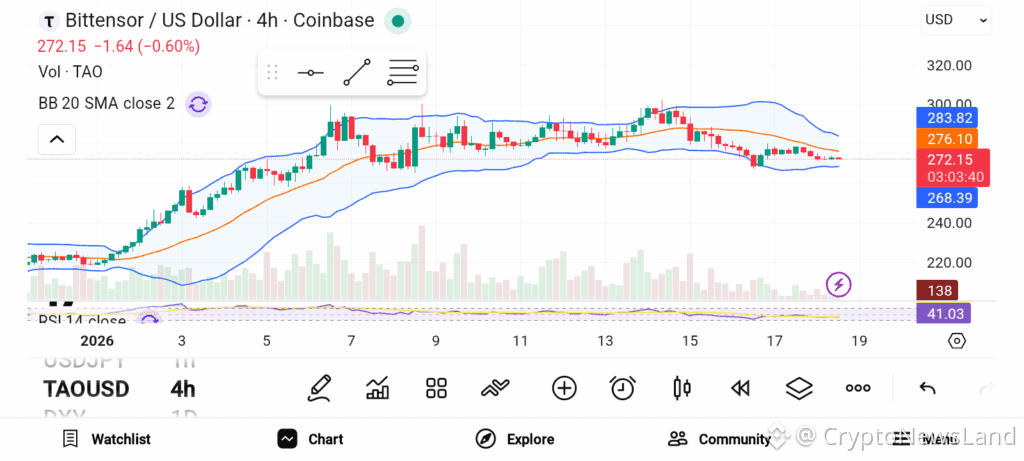

Bittensor (TAO)

Source: Trading View

Source: Trading View

Bittensor merges artificial intelligence with decentralized networks, placing the project at the intersection of two fast-growing sectors. Institutional interest continues to rise, with NASDAQ-listed Tao Synergies and Grayscale-backed funds accumulating sizable TAO holdings. That level of backing reflects growing confidence in decentralized AI infrastructure. TAO follows a strict supply cap of 21 million tokens. This scarcity model mirrors Bitcoin’s hard-cap structure.

The first halving event, expected in early December, will reduce new token issuance. Reduced supply may create favorable conditions for price appreciation if demand continues rising. As interest in decentralized AI grows, demand could increase sharply. Some projections suggest potential upside toward $500 to $700 if adoption and narrative strength continue.

Ethereum benefits from network upgrades and rising institutional demand. Chainlink supports real-world asset tokenization through trusted infrastructure. Bittensor offers scarce exposure to decentralized artificial intelligence. Together, these three altcoins highlight why disciplined investors continue stacking with a long-term mindset.