Most beginners believe losing money in crypto means they chose the wrong coin or the wrong strategy.

That’s rarely true.

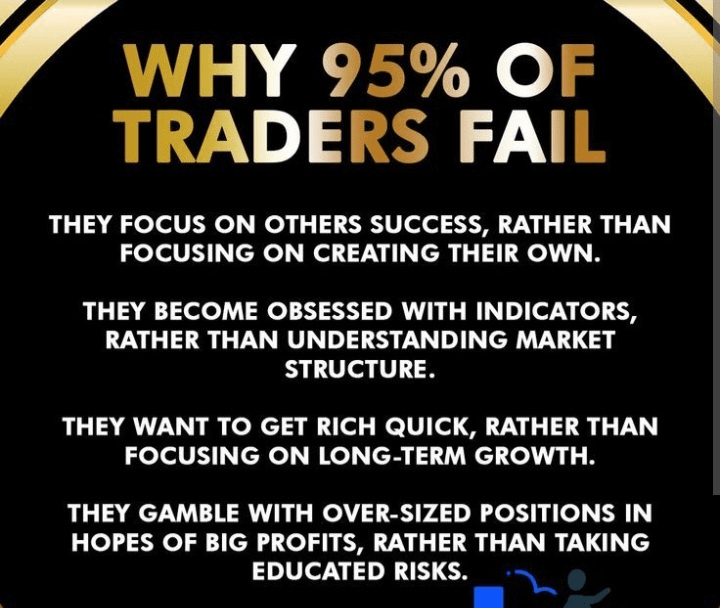

In reality, most traders fail before strategy even matters.

Crypto trading is not about predicting the market perfectly. It’s about managing behavior, risk, and consistency. Beginners ignore this—and pay the price.

The Strategy Myth

Many beginners jump from one strategy to another:

One day scalping

Next day futures

Then copy trading

Then signals

They think the problem is the strategy.

But the real issue is no system and no patience.

A simple strategy followed consistently beats a “perfect” strategy used emotionally.

Overtrading: The Silent Killer

New traders feel they must trade every day. More trades = more chances to lose.

Professional traders wait. Beginners rush.

Overtrading increases:

Fees

Emotional decisions

Revenge trades

This slowly drains accounts—even in good markets.

No Risk Management

Most beginners risk too much on one trade.

One bad trade should not wipe out your account.

But beginners risk 30–50% per trade, hoping for fast profits.

That’s not trading.

That’s gambling.

Why Knowledge Alone Isn’t Enough

Watching videos and reading threads feels productive.

But without discipline, knowledge is useless.

Discipline means:

Fixed risk per trade

Clear entry and exit

Accepting losses calmly

This is where most beginners fail.

Final Thought

Crypto doesn’t punish beginners.

It reveals habits.

Fix behavior first.

Strategy comes second.

#BinanceSquar #CryptoBeginners #CryptoEducation #cryptomindset