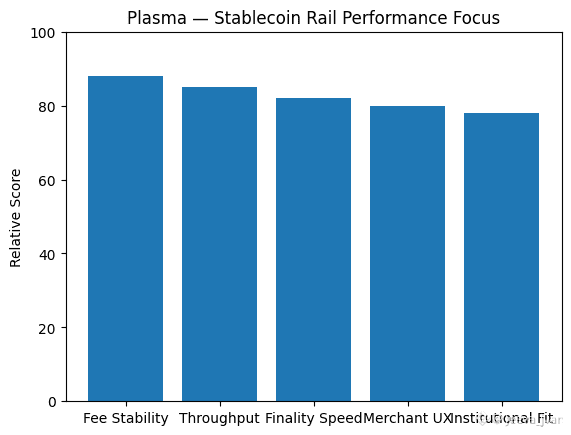

Crypto’s next phase is unlikely to be defined by meme cycles or speculative leverage, but by whether blockchains can quietly support the everyday movement of money at global scale. Stablecoins have already proven product–market fit, moving trillions of dollars annually across borders and through DeFi protocols, yet the infrastructure beneath them remains fragmented and often ill-suited for payments. General-purpose chains must juggle NFTs, gaming traffic, memecoins, and complex DeFi contracts alongside financial transfers, creating congestion, volatile fees, and unpredictable confirmation times. Plasma positions itself as a network designed from the ground up for one task above all others: moving stable-value money cheaply, quickly, and reliably.

At the core of Plasma’s thesis is the belief that payments infrastructure should disappear into the background. Users should not need to understand gas tokens, fluctuating fees, or settlement mechanics in order to send dollars, euros, or tokenized deposits. By centering transaction costs around stablecoins themselves and engineering for high-throughput execution, Plasma attempts to make blockchain payments resemble traditional card networks or wire systems in usability while retaining the programmability and global reach that crypto enables. In this vision, wallets, merchants, payroll providers, and remittance platforms integrate Plasma as invisible plumbing rather than as a speculative venue.

Beyond consumer payments, Plasma’s ambitions extend into institutional treasury management and cross-border commerce. Multinational companies increasingly hold stablecoins to manage liquidity across jurisdictions, while DAOs operate payroll systems for globally distributed contributors. These organizations require predictable settlement times, transparent accounting, and the ability to automate complex cash flows without exposing themselves to the volatility of native gas assets. Plasma’s focus on stablecoin-denominated fees and optimized settlement rails speaks directly to these operational realities, positioning the chain not merely as another execution environment but as a specialized financial network.

As regulators around the world clarify frameworks for digital cash, tokenized deposits, and on-chain settlement, networks purpose-built for compliant value transfer may find themselves advantaged. Plasma’s narrative suggests that rather than competing head-to-head with general smart-contract platforms, it aims to complement them by becoming the layer where regulated money ultimately moves. In such a scenario, DeFi protocols, fintech apps, and even centralized exchanges could route stablecoin flows through Plasma while continuing to operate their business logic elsewhere.

The economic design of a payments-focused blockchain differs from that of speculative ecosystems. High transaction volume at thin margins rewards efficiency, reliability, and uptime rather than exotic yield mechanisms. If Plasma succeeds in attracting sustained payment flows from merchants, enterprises, and service providers, network value would derive from throughput and integration depth rather than headline-grabbing volatility. This mirrors how traditional payment rails accrue power through ubiquity rather than through visible consumer brands.

Another long-term implication of Plasma’s approach lies in composability. Stablecoin rails that support programmable payments can enable streaming salaries, usage-based subscriptions, escrowed commerce, supply-chain settlements, and automated tax remittance, all executed in real time across borders. When these primitives become reliable, entirely new categories of fintech products can emerge on top of them, blurring the boundary between decentralized protocols and traditional financial services.

Competition in this space is inevitable, as other networks also recognize the centrality of stablecoins to crypto’s growth. Plasma’s differentiation rests on whether it can maintain lower friction than multipurpose chains while offering sufficient security and regulatory comfort to onboard serious capital. Partnerships with issuers, custodians, wallet providers, and payment processors will ultimately matter more than raw performance metrics, because payments networks live or die by distribution rather than technical elegance alone.

If stablecoins continue their trajectory toward mainstream financial adoption, the blockchains that specialize in moving them could become as structurally important as clearing houses and correspondent banks are today. Plasma is betting that specialization, not maximal generality, will define the next generation of crypto infrastructure. Should that bet pay off, Plasma would fade into the background of everyday finance, quietly routing trillions in value while enabling programmable money to operate at planetary scale.