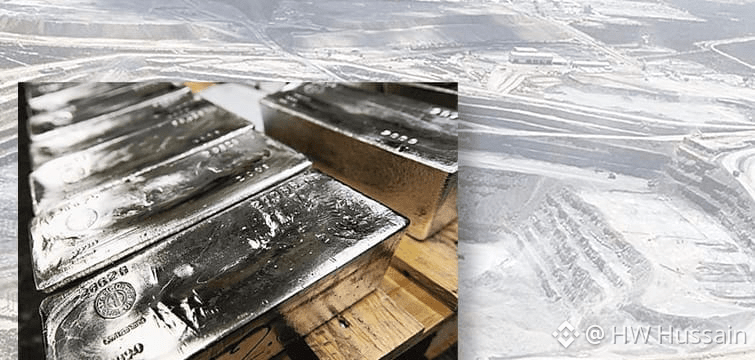

Silver has surged to $108 per ounce, up sharply from around $30 just one year ago, marking one of the strongest rallies in the metal’s history. The move is drawing significant attention from investors, particularly toward silver mining companies, which stand to benefit the most from sustained high prices.

🚨 SILVER STOCKS ARE ABOUT TO EXPLODE 💥

$RIVER | $ACU | $BTR

Why Silver Miners Are Gaining Focus

The economics of silver mining change dramatically at current price levels:

Average production cost: ~$20 per ounce

Current silver price: ~$108 per ounce

Estimated free cash flow after taxes: ~$60 per ounce

By comparison, miners were earning only $5–$7 per ounce in free cash flow last year. This represents a substantial expansion in margins and profitability.

Impact on Mining Companies

Higher silver prices typically allow miners to:

Accelerate debt repayment

Increase dividends

Fund share buybacks

Reinvest in production growth and new projects

Companies that are already producing silver — rather than explorers — are positioned to benefit immediately.

Examples of Producers With Growth Potential

Some market participants are highlighting producers with both current output and expansion plans:

Aya Gold & Silver (AYASF / AYA):

Producing approximately 6 million ounces annually, with plans for the Boumadine project, expected to be significantly larger than its existing operation.Silver X (AGXPF / AGX):

Currently producing around 1 million ounces per year in Peru, with a longer-term goal of scaling production toward 6 million ounces annually.

If silver prices remain elevated, such companies could generate hundreds of millions of dollars in free cash flow over the coming years.

Bigger Picture

Silver demand continues to grow across electronics, solar energy, electric vehicles, and industrial manufacturing, while supply remains constrained. Combined with investor interest in hard assets, this has fueled speculation that silver may be entering a long-term bull cycle.

While prices remain volatile, sustained levels above historical averages could reshape the silver mining sector and significantly strengthen the balance sheets of established producers.