I remember sitting in front of my screen in late 2021, watching a transaction hang while the market moved without me.

I watched gas tick higher, blocks fill up, and my plan slowly fall apart. I’ve traded long enough to know that moments like that change how you judge infrastructure. They push you to ask why systems are built the way they are. That’s why comparing @Plasma with Ethereum mainnet feels relevant now, especially in 2024 and early 2025.

Ethereum mainnet is the backbone of crypto. It’s designed to be neutral, decentralized, and extremely hard to break. Every transaction competes in the same global space. That’s intentional. Ethereum treats block space like a scarce public resource. When demand rises, fees rise. When activity spikes, users wait. This design prioritizes security and fairness over convenience.

Plasma starts from a different lived reality. It looks at how crypto is actually used today. On-chain data from 2023 and 2024 shows that stablecoins dominate transaction volume. Most users aren’t deploying experimental contracts. They’re settling value, moving liquidity, managing risk. Plasma builds around that behavior instead of assuming users should adapt to base-layer constraints.

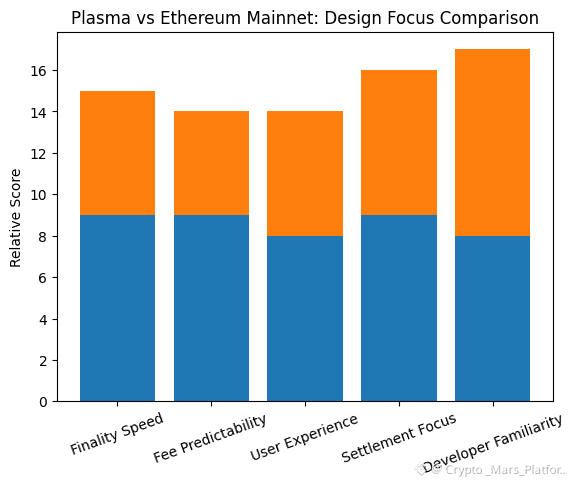

The biggest difference traders notice is finality. Ethereum offers probabilistic finality. Your transaction is likely final after a few blocks, safer after more. In calm markets, that’s fine. In fast markets, that uncertainty matters. Plasma uses deterministic finality. Once a block is confirmed, it’s done. No waiting, no second guessing. For traders moving collateral or reacting to price shifts, that clarity changes decision-making.

Fees highlight another philosophical split. Ethereum’s gas market reflects demand. It’s transparent but volatile. Plasma removes that volatility by anchoring fees to stablecoins and abstracting gas away from the user. In simple terms, you don’t need to manage an extra asset just to transact. The cost feels fixed, predictable. That predictability reduces friction, especially for frequent users.

Why is this comparison trending now? Because Ethereum succeeded beyond expectations. Success brought congestion, complexity, and higher costs. Layer-2 solutions helped, but many still inherit Ethereum’s fee mechanics or user friction. Plasma doesn’t try to be a universal solution. It narrows its scope and optimizes hard for settlement speed and simplicity.

Progress on Plasma’s side reflects that focus. In 2024, development updates emphasized EVM compatibility for tooling, fast finality for execution, and user experience through abstraction. That combination lowers the barrier for both traders and developers. You don’t need to relearn everything. You don’t need to plan around gas spikes. Things just behave.

From my perspective, this isn’t about replacing Ethereum. It’s about specialization. Ethereum is a base layer. It moves carefully because mistakes there are irreversible. Plasma can move faster because it accepts trade-offs. It gives up some decentralization in exchange for speed and usability. That’s not a flaw if the goal is clear.

I’ve learned that markets punish confusion. Chains that try to be everything often end up being nothing in practice. Plasma’s clarity stands out. It doesn’t pretend to be the most decentralized or the most expressive environment. It tries to be the most practical for a specific job.

There’s also a trust component. Ethereum earns trust through time, security, and conservative upgrades. Plasma aims to earn trust through consistency and transparency. Predictable fees. Fast finality. Familiar tools. Trust doesn’t only come from ideology. It comes from repeated, boring reliability.

Philosophically, this comparison reflects crypto’s evolution. Early systems were built to prove ideas. Mature systems are built to serve needs. Ethereum proved decentralization at scale. Plasma focuses on usability at scale. Both matter. One doesn’t invalidate the other.

As a trader, I don’t ask which chain is superior. I ask which one fits the task. Long-term settlement and deep security? Ethereum. Fast movement, stable value, low friction? Plasma makes sense. Mixing those roles leads to frustration.

I’ve watched infrastructure fail when it ignored its limits. I trust designs that acknowledge theirs. Plasma’s difference from Ethereum mainnet isn’t cosmetic. It’s philosophical. And in markets, philosophy quietly shapes outcomes long before price reacts.