Crypto has spent most of the last decade optimizing for spectacle. New chains boast throughput numbers nobody asks for, execution models nobody understands and feature sets that expand faster than developer adoption can keep up. The assumption has always been that more complexity equals more capability and more capability equals more users. Except it never played out that way. Real adoption didn’t stall because features were missing it stalled because the basics never worked cleanly enough to build trust.

Crypto has spent most of the last decade optimizing for spectacle. New chains boast throughput numbers nobody asks for, execution models nobody understands and feature sets that expand faster than developer adoption can keep up. The assumption has always been that more complexity equals more capability and more capability equals more users. Except it never played out that way. Real adoption didn’t stall because features were missing it stalled because the basics never worked cleanly enough to build trust.

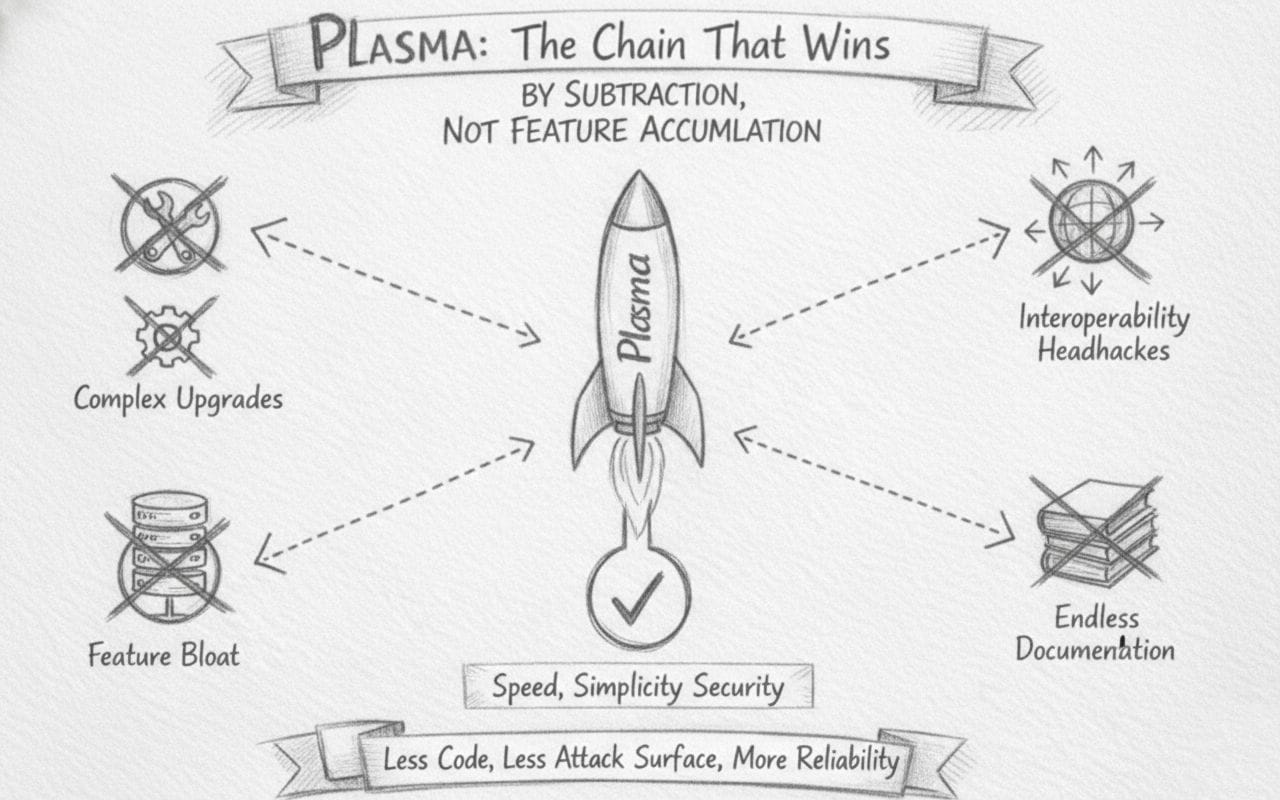

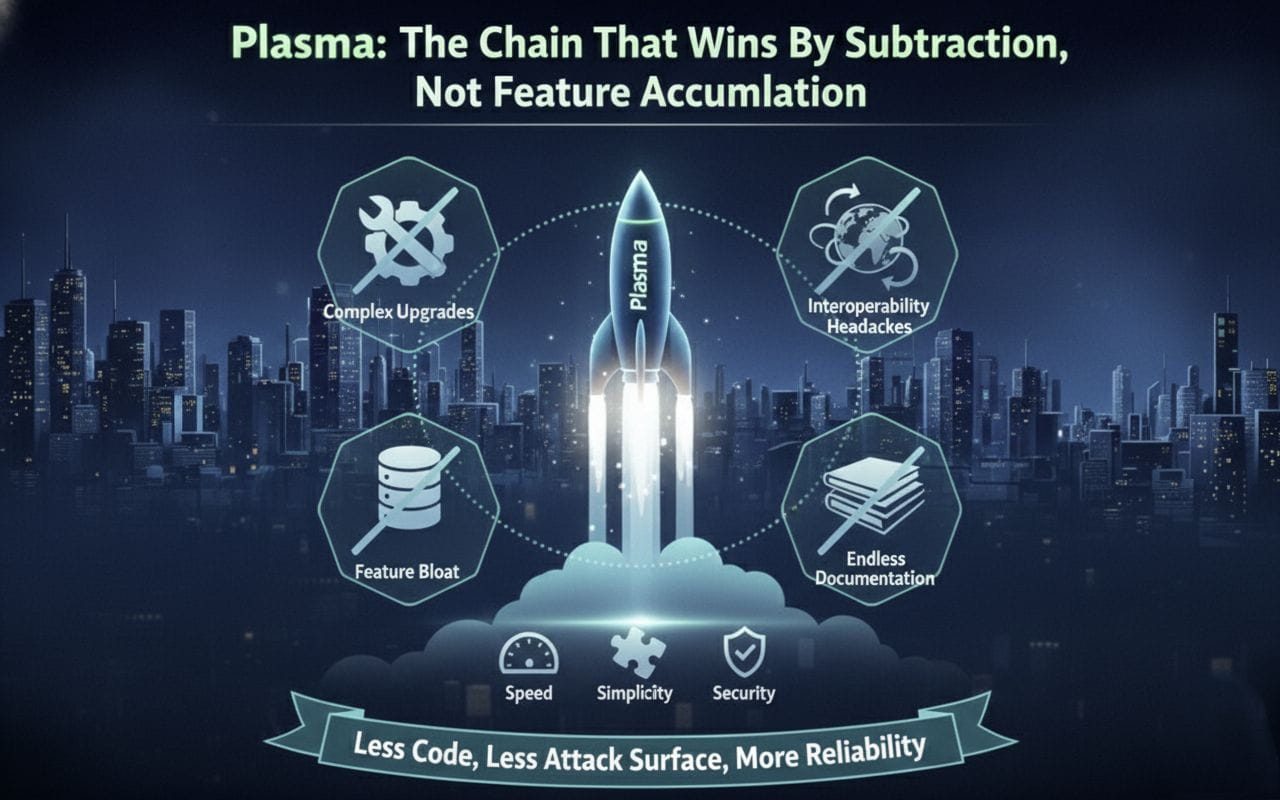

Plasma enters the picture from the opposite direction. It does not try to win the infrastructure race by adding more horsepower or more modules. It wins by removing the parts that make digital money feel fragile. No gas token scavenger hunts. No probabilistic finality. No fee regimes that drift with market noise. No payment UX designed for speculators instead of senders. Instead of stacking features on top of a generic chain, Plasma strips away everything that interferes with the simple act of moving a stablecoin from one party to another reliably.

That is a very different thesis for a Layer-1.

For Plasma, the unit of success is not how much a chain can do, it’s how little a user has to think about. A stablecoin transfer that feels like a wire transfer is a failure. A transfer that feels like a credit card authorization is better. A transfer that feels like sending a message immediate, unremarkable, unexpanded is the actual target. Payments do not win culture by being exciting. They win when they disappear.

This is why Plasma’s architectural decisions skew toward subtraction. PlasmaBFT doesn’t exist to brag about throughput; it exists because sub-second deterministic finality eliminates the mental overhead of waiting for safety to materialize. Gasless USD₮ transfers don’t exist to delight technologists; they exist so users don’t have to learn how blockchains fund themselves. Stablecoin-first gas doesn’t exist to be novel; it exists so a merchant isn’t forced to maintain a side-inventory of volatile assets just to accept dollars. Bitcoin anchoring doesn’t exist to win political arguments about security; it exists to remove a category of institutional doubt: “who decides which history is real?”

Every subtraction is an economic subtraction too. Remove the gas token requirement and you remove friction. Remove probabilistic settlement and you remove hedging risk. Remove fee volatility and you remove cost uncertainty for treasuries. Remove UX complexity and you remove user churn. In crypto, complexity always accumulates costs somewhere; the question is just whether you see the bill immediately or whether it shows up disguised as abandonment.

The interesting shift is psychological. Most chains build for crypto-native users who are comfortable tolerating failure states. Plasma builds for everyone else. For people who will never run a validator, never read a governance spec, never swap for gas, never watch mempool health and never adopt an infrastructure that asks them to care about any of those things. These users do not ask for censorship resistance in the abstract; they ask for their transfer to not get stuck. They don’t ask for composability; they ask for funds to settle predictably. They don’t ask for innovation; they ask for reliability.

The interesting shift is psychological. Most chains build for crypto-native users who are comfortable tolerating failure states. Plasma builds for everyone else. For people who will never run a validator, never read a governance spec, never swap for gas, never watch mempool health and never adopt an infrastructure that asks them to care about any of those things. These users do not ask for censorship resistance in the abstract; they ask for their transfer to not get stuck. They don’t ask for composability; they ask for funds to settle predictably. They don’t ask for innovation; they ask for reliability.

What Plasma is silently betting is that the market for stablecoin usage will be won not by the chain with the biggest feature surface, but by the chain with the smallest requirement surface. The winner is not the chain that does the most; it is the chain that demands the least. In other words, adoption is gated by subtraction.

If this framing holds, Plasma’s competitive set changes entirely. Its rivals are not the L1s that brag about performance metrics; its rivals are the payment systems that fail quietly every day in the real economy the remittance rails that lose days to reconciliation, the cross-border corridors that burn money to FX spreads, the merchant networks that block transfers on compliance heuristics that nobody can explain. Against those systems, being invisible is a feature. Being boring is a competitive advantage.

Plasma’s roadmap reflects the same ethos. Nothing about it reads like theater. No metaphors about “world computers.” No claims about totalizing ecosystems. The chain is built to settle stablecoins with financial-grade predictability. Everything else that isn’t strictly necessary either waits or gets cut. There are no vanity features in that posture; there are only constraints.

That posture is rare in crypto. It is also the posture that financial infrastructure historically rewards.

The irony is that if Plasma succeeds, nobody will talk about it. Users won’t describe the chain; they will describe the outcomes. They will say: “money moved instantly,” “the payment cleared,” “the transfer just worked.” That is how infrastructure wins by leaving no trace. And that is what subtraction, executed correctly, actually buys: not minimalism but habit.

Plasma is building for that end state. A world where stablecoins behave like money, not like tokens. A world where settlement doesn’t need an explanation. A world where the chain disappears behind the payment. That is what subtraction wins and nothing in crypto is better positioned to benefit from that shift than a chain that finally stopped trying to impress other chains.