@Plasma — the native token of the Plasma blockchain — isn’t just another Layer‑1 launch full of buzzwords about speed and low fees. Over the past several months, the project has taken significant strides toward real‑world adoption and compliance, particularly through its strategic expansion into European markets with formal licensing and regulation, positioning itself as a payments network capable of integrating with existing financial systems.

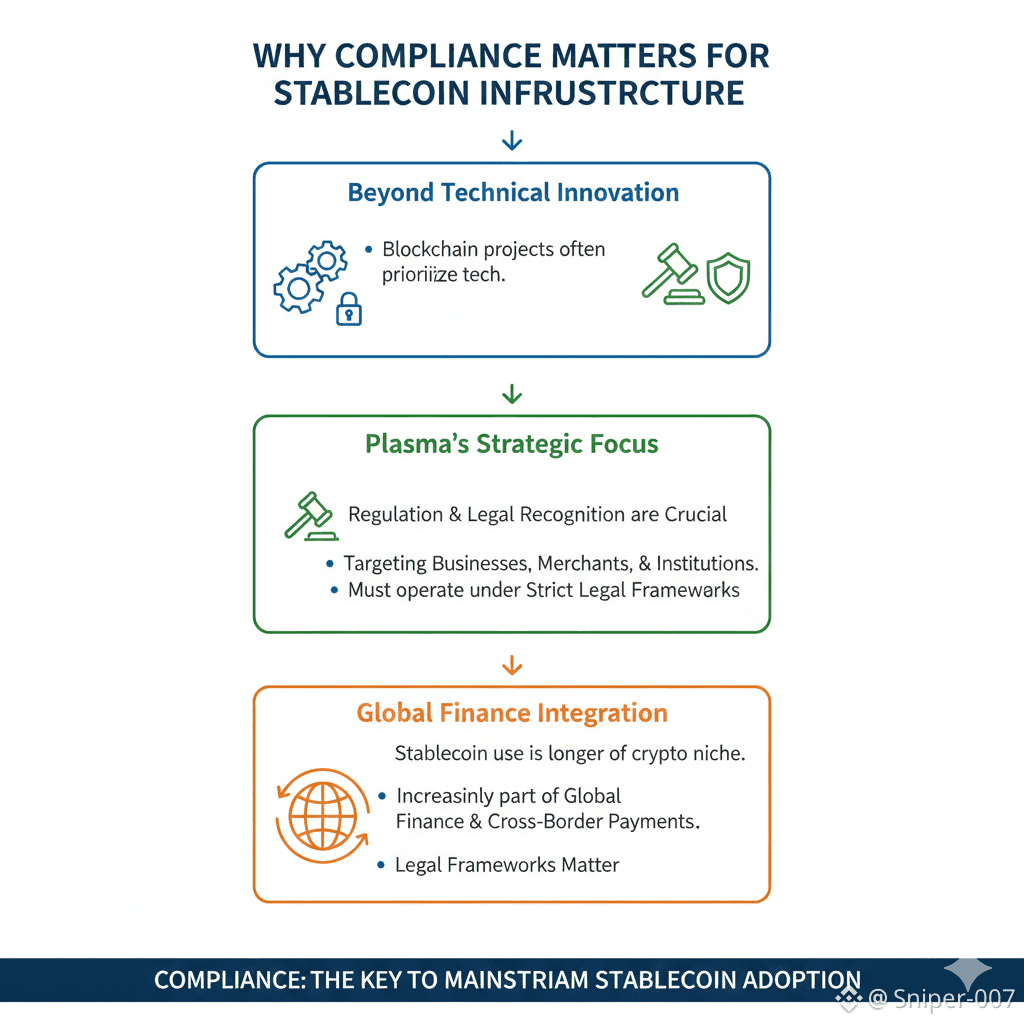

Why Compliance Matters for Stablecoin Infrastructure

While many blockchain projects focus purely on technical innovation, Plasma’s recent moves show that regulation and legal recognition are just as crucial for large‑scale stablecoin settlement — especially when targeting businesses, merchants, and institutions that must operate under strict legal frameworks. Plasma’s focus on compliance is an acknowledgment that stablecoin use isn’t just a crypto niche anymore — it’s increasingly part of global finance and cross‑border payments, where legal frameworks matter.

Stablecoins themselves are becoming a major asset class. According to financial institutions like Citibank, the stablecoin market — already a substantial portion of the crypto ecosystem — could grow to several trillion dollars in the coming decade as they gain usage in both crypto and traditional finance. Plasma’s compliance push positions it to interact with this expanding market in a legal and trusted way.

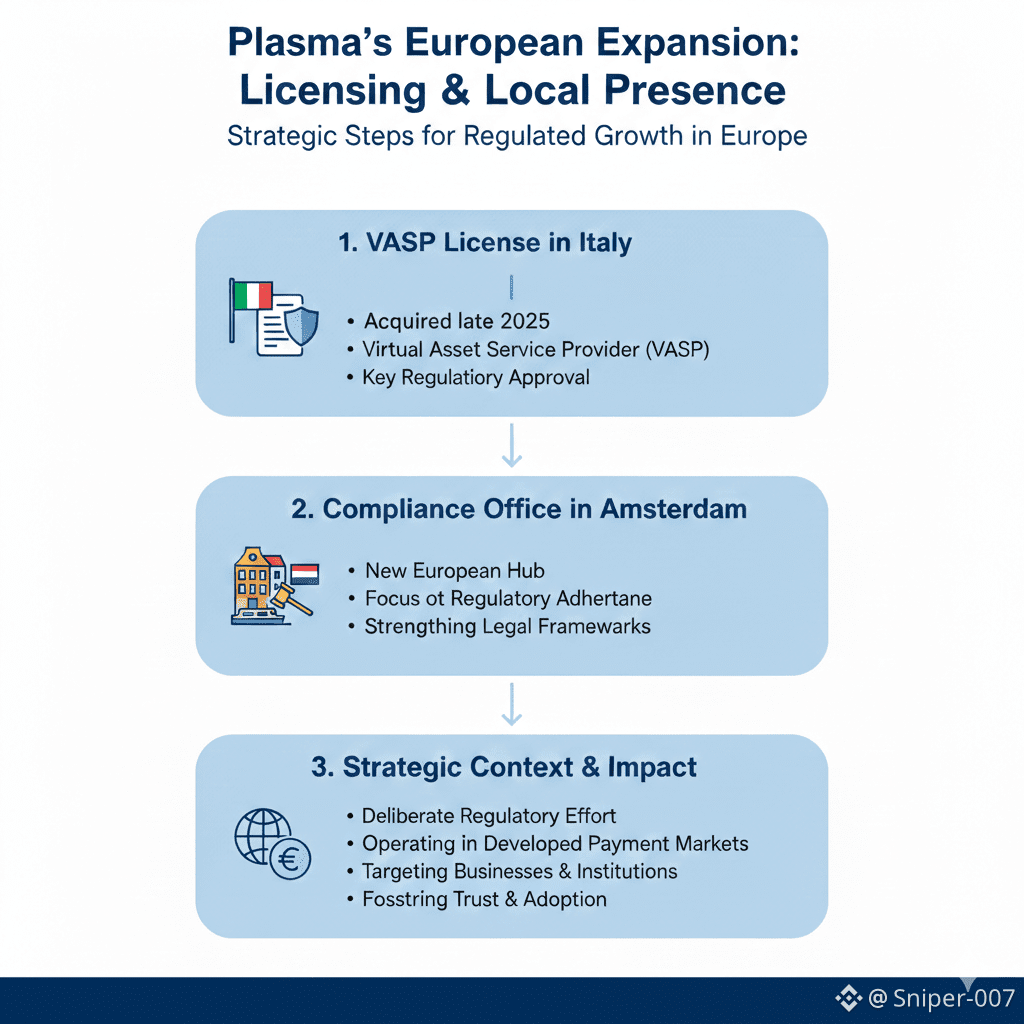

Plasma’s European Expansion: Licensing and Local Presence

In late 2025, Plasma announced a major step in its expansion by acquiring a Virtual Asset Service Provider (VASP) license in Italy and opening a new compliance office in Amsterdam, Netherlands. These are not superficial moves — they reflect a deliberate effort to operate within regulated financial frameworks in one of the most developed payment markets in the world.

The Italian VASP License

The Italian entity formerly known as GBTC Italia was acquired and rebranded as Plasma Italia SrL. This license allows Plasma to legally handle crypto transactions and custody assets in Italy, which is especially significant for a blockchain that aims to serve stablecoin payments at scale.

Holding a regulated VASP license gives Plasma the credibility needed to work directly with traditional financial institutions, payment processors, and regulated merchants in ways that many other blockchains cannot — or would struggle to do without a regulated on‑the‑ground presence.

Amsterdam Office & EU Strategy

Plasma didn’t stop with Italy — it also opened Plasma Nederland BV in the Netherlands, a country known for its well‑developed payment and financial infrastructure. The new Amsterdam office is staffed with compliance leadership, including a Chief Compliance Officer and a Money Laundering Reporting Officer (MLRO), signaling Plasma’s seriousness about meeting strict EU financial regulations.

Plasma is also working toward additional European regulatory approvals, including Crypto Asset Service Provider (CASP) status under MiCA (Markets in Crypto‑Assets regulation) and Electronic Money Institution (EMI) licensing, which would further solidify its ability to operate payment services under EU law.

These regulatory steps give Plasma the legal foundation to offer a wide range of stablecoin‑related financial services, from settlement rails to merchant payment acceptance and fiat‑on/off ramps — all within compliant frameworks that appeal to institutions and retail users alike.

Plasma One: A Regulatory‑Ready Stablecoin Payments Product

One concrete product that is being shaped by this regulatory push is Plasma One, a stablecoin‑native payment and neobank‑style platform. The VASP license and upcoming MiCA/CASP status are intended to support Plasma One’s regulated operations, including merchant payments, remittance flows, and custodial services for digital dollars.

Plasma One aims to offer regulated payment services with features like instant settlement, lower fees than traditional rails, and compliance with anti–money‑laundering (AML) and know‑your‑customer (KYC) rules — capabilities that are essential for enterprise and institutional use.

By combining blockchain‑native settlement with regulated operations, Plasma is attempting to fill a major gap between unregulated crypto rails and traditional financial payment systems. This could make stablecoin settlement more accessible to ordinary consumers and businesses who have been hesitant to adopt blockchain‑based payments due to regulatory uncertainty.

From Tech Stack to Real Financial Infrastructure

Plasma’s technology — including its Layer‑1 consensus (PlasmaBFT), EVM compatibility, and Bitcoin‑anchored security — makes it strong from a performance and developer perspective. But its regulatory strategy gives it a unique positioning as a blockchain that can legally operate as a payments network, potentially integrating with banks, remittance services, and institutional finance systems.

Stablecoin infrastructure has long been touted as one of the most realistic paths to blockchain adoption at scale because stablecoins solve a core problem: digital value that behaves predictably like fiat money. But technological ability alone isn’t enough — real payments also require legal trust and operational guarantees. Plasma’s licensing moves in Europe directly address this gap, showing that the project is aiming for adoption beyond crypto natives to a broader financial ecosystem.

Why This Matters for XPL and the Broader Ecosystem

Plasma’s compliance drive and regional expansion could accelerate institutional interest in XPL, strengthen its use cases as a settlement token, and increase integration with regulated payment platforms. XPL isn’t just used for gas or staking — its presence in a network that holds regulated payment licenses positions it closer to real financial rails than many competing tokens.

As the stablecoin market continues to grow, potentially reaching multiple trillions in on‑chain value over the coming decade, networks that combine blockchain efficiency with regulatory legitimacy are likely to find broader adoption — and Plasma’s strategy is tailored to exactly that aim.

A Clear Dual Strategy: Technology Plus Compliance

Plasma’s European expansion highlights a holistic approach to building blockchain infrastructure:

Technical excellence, with fast, cheap, and scalable stablecoin settlement.

Regulatory grounding, with licenses that enable compliant payments and financial services.

Real‑world use cases, from merchant acceptance to remittances to regulated payment products like Plasma One.

This combination may make #Plasma $XPL not just another Layer‑1 token, but a pivotal part of the bridge between traditional finance and blockchain‑native payment rails.