The issue of technology has never been an isolated problem in regulated finance. Alignment was always the actual challenge. Banking institutions need mechanisms that would have the capability to implement sophisticated agreements and at the same time uphold confidentiality, regulatory and legal responsibility. Part of this equation is only resolved by most public blockchains. They are programmable and transparent, however, at the expense of disclosing information that cannot be disclosed by regulated markets in a structural sense.

That is the issue that @Dusk Foundation was meant to solve in the first place.

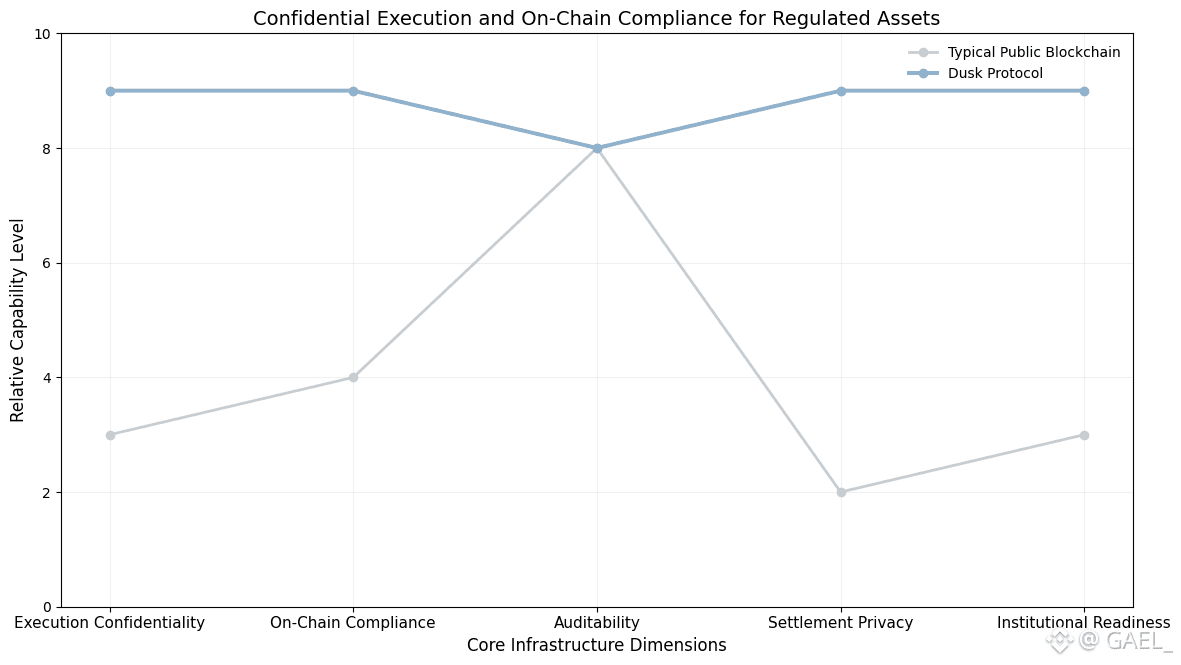

Dusk is not a privacy network designed as a general-purpose, or a version of an existing blockchain with some modifications. The architecture is developed with a particular focus on the needs of regulated assets, in which executions need to be verifiable, compliance enforceable and sensitive financial data is by default confidential. These limitations are being assumed as being foundational, rather than being optional.

Confidential execution is in the core of this design. In Dusk, smart contracts are run in a context where inputs of transactions, internal logic and sensitive state transitions cannot be observed by anyone. The network is still able to prove that it is doing the right thing, and that they are acting in accordance with contractual rules, but it does so without sharing financial information with everyone in the system. This distinction of verification and visibility is a key to those institutions that are unable to publically reveal pricing models, allocation strategies, and counterparty relations.

Regulated finance does not however merely require confidential execution. Regulatory risk is always brought about by a system that conceals information but fails to establish any rules. This is the point at which the on-chain compliance approach adopted by Dusk is critical. Transaction validity itself has compliance logic in it. During execution itself, there are eligibility requirements, transfer restrictions and jurisdictional constraints that are imposed. In case a transaction fails to meet these requirements, it will just be unable to be run through the network.

This level of enforcement at the protocol level removes one of the weaknesses that other blockchain systems have. Compliance on most platforms is also off-chain and operated by intermediaries, authorized gateways or legal terms superimposed on execution. These checks by outsiders cause fragmentation. A transaction can be considered valid by the blockchain and be evaluated individually by regulatory systems. Dusk does not face this disconnect by making sure that compliance is not separate to execution.

The other characteristic factor about the design of Dusk is the manner in which it manages regulated asset lifecycles. Issuance, execution and settlement are not considered as distinct steps that need varied environment or assumptions. The levels of confidentiality and compliance remain throughout the lifecycle. Settlement especially does not reintroduce exposure of the people. Change of ownership and finality is done under the same level of confidentiality that regulates execution and they do not expose any sensitive information at a stage where it is subject to legal ramifications.

To institutions, such a single approach makes their operations less complicated. They do not have to transfer assets across private issuance systems, semi-public execution layers and public settlement networks. The risk and cost of every handoff in a fragmented architecture is augmented. Dusk maintains controlled assets in a single protocol environment whereby the behavior can be controlled and enforced throughout.

This design is also beneficial to the builders. Developers are able to model real world financial processes without having to simplify logic to fit transparency-first assumptions. The protocol itself facilitates confidential execution as well as compliance enforcement without adding any significant layers of custom privacy or compliance infrastructure. This enables applications to be developed in a manner that reflects controlled financial operations as opposed to operating around blockchain constraints.

However, in the end, the value of Dusk is the clarity of purpose. It does not seek to instantiate the regulated finance as a permissionless transparency model. Rather, it offers infrastructure in which confidentiality, compliance, and execution are designed as a combination. This conformity ensures that controlled property can be transferred to the blockchain without breaching the law or making sensitive banking details known.

@Dusk is a type of blockchain infrastructure that does not begin with an adaptive approach to regulatory reality but with it. In case of regulated assets, such a distinction is not philosophical. It is foundational.