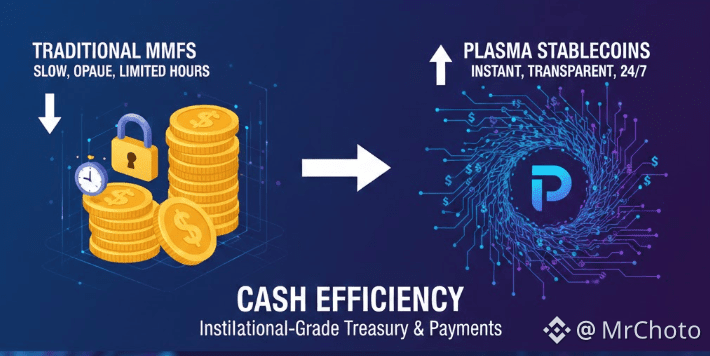

Although money market funds (MMFs) depend on banking rails, settlement windows, custodians, and middlemen, they are intended to protect capital and provide a moderate yield from a traditional finance perspective. As a result, they are slow to move, opaque in real time, and unavailable after regular business hours. Stablecoins, on the other hand, promise instantaneous digital currency, but they are unable to serve as actual cash equivalents on the majority of current blockchains due to excessive fees, congestion, and unpredictable finality.

Here, #Plasma adopts a radically different strategy. Instead of being a general-purpose chain that views dollars as just another token, Plasma was created especially for stablecoins. Stablecoins can behave more like real-time cash than speculative cryptocurrency assets because of their architecture, which places a premium on high throughput, deterministic settlement, and extremely low fees.

From @Plasma 's point of view, the comparison is about cash efficiency rather than just yield. Plasma allows for instantaneous, round-the-clock settlement with complete on-chain transparency, whereas MMFs batch settlements and reconcile balances with delays. Every transfer is definitive and instantly verifiable, eliminating the need to wait for redemptions, NAV ambiguity, and hidden exposure.

Stablecoins don't have to mimic money market funds, according to Plasma, which reframes the argument. With the correct infrastructure, they can enable institutional-grade treasury and payment use cases while outperforming them in terms of speed, accessibility, and transparency. $XPL $BNB #USIranStandoff #StrategyBTCPurchase