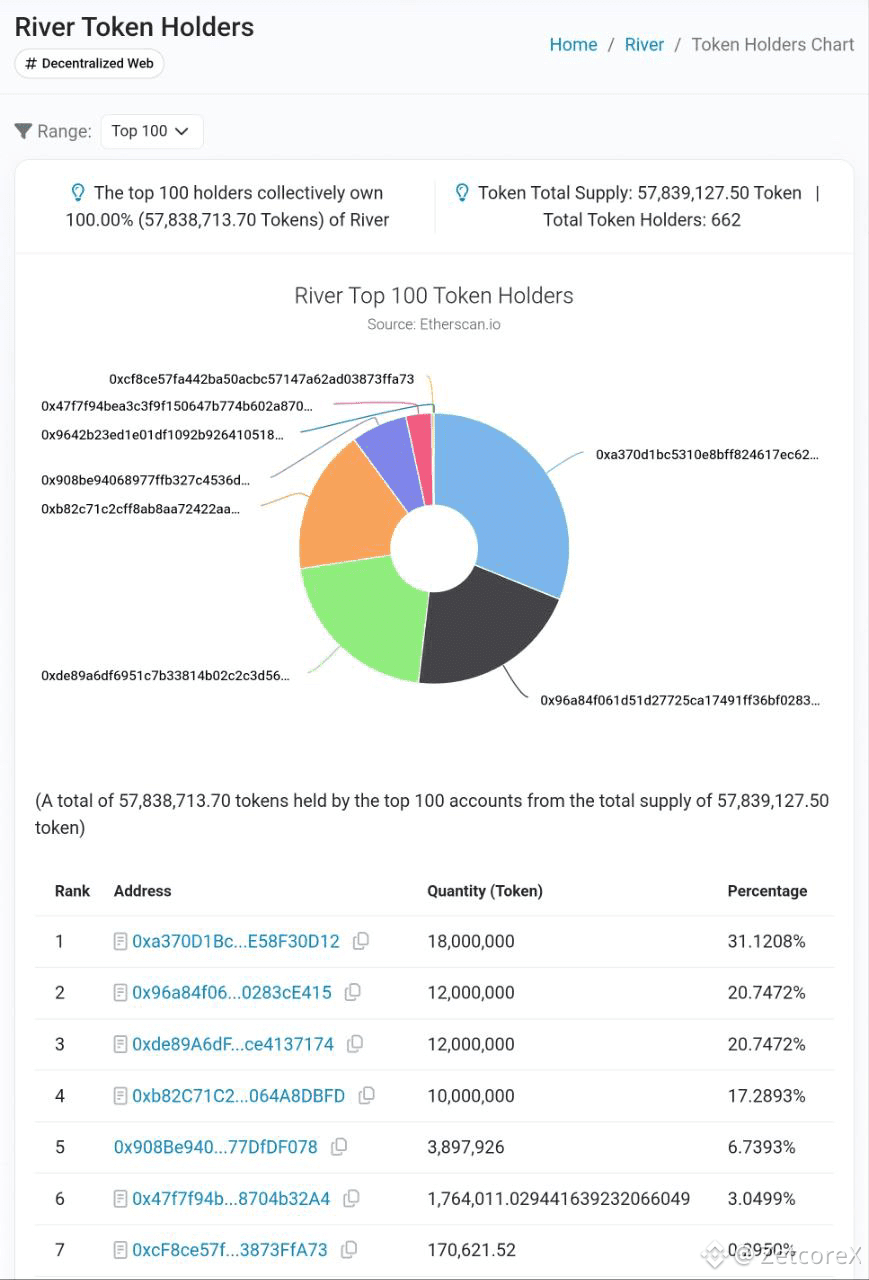

🔍 On-chain & holder structure

Current data shows:

• Total holders are still very low

• A few top wallets control a very large portion of supply

• The top holders can strongly influence price

• Distribution is not yet broad or organic

📌 This means $RIVER is still a concentrated, whale-driven market.

Price is not fully controlled by crowd demand.

It is heavily influenced by wallet behavior.

✅ Why $RIVER attracts attention

• High volatility – Large wallets create fast, aggressive moves

• Strong speculative interest – Big ranges attract traders

• Liquidity-rich behavior – Perfect conditions for squeezes and traps

• Momentum potential – Can deliver extreme percentage moves

This is why $RIVER keeps pulling in short-term capital.

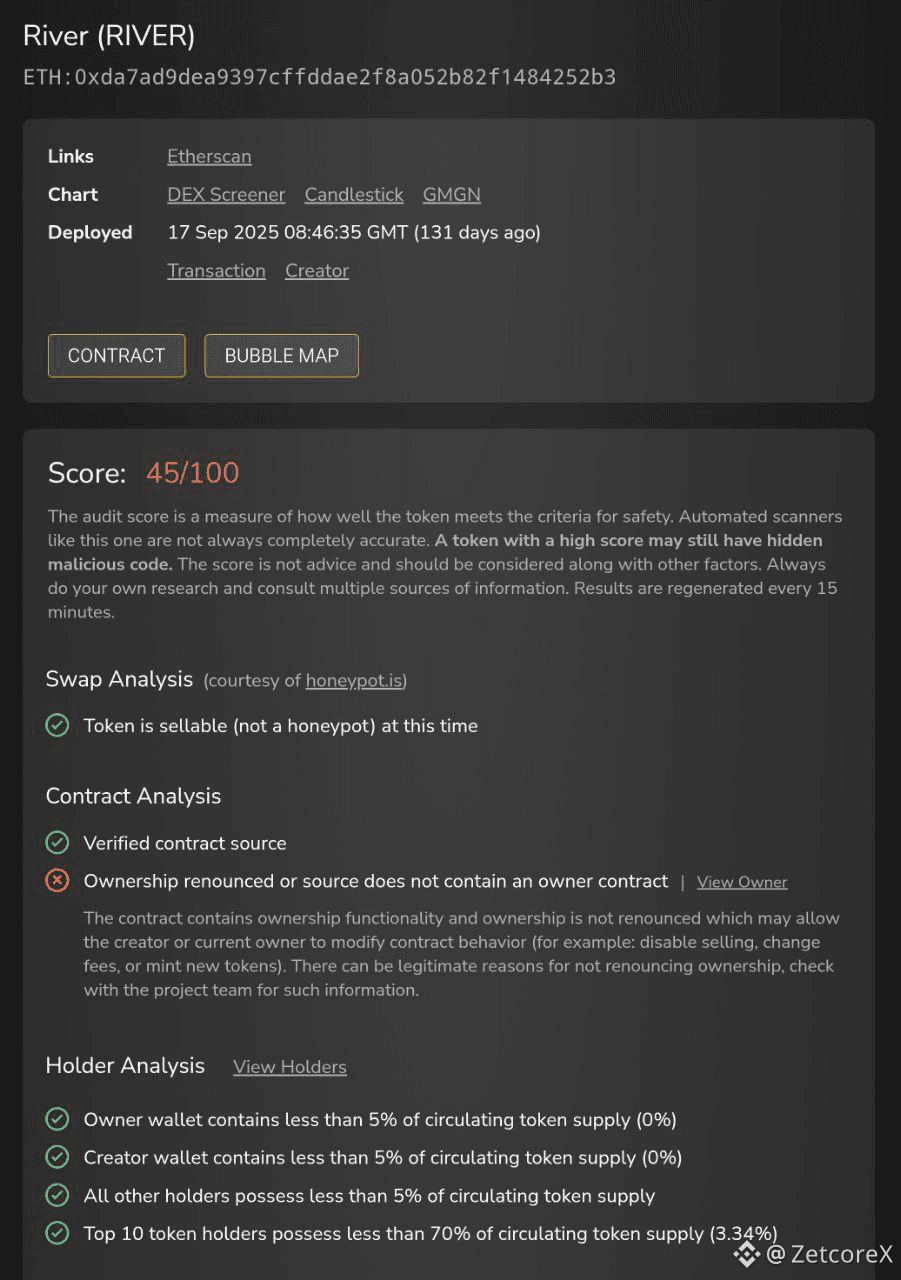

⚠️ Risks that must be respected

• Extreme concentration risk

A few wallets can change the entire market in minutes.

• Sudden exit danger

Any large distribution can cause a violent collapse.

• Contract control not renounced

This adds an additional layer of uncertainty.

• Not decentralized yet

This is not a community-controlled asset at this stage.

🧠 Professional trader perspective

A professional does not ask:

“Will it go up?”

A professional asks:

“Who controls supply?”

“Where is liquidity?”

“What breaks the structure?”

From a professional view, $River is not an investment-grade asset right now.

It is a high-risk trading market.

This type of structure is built for:

✔ volatility

✔ engineered moves

✔ liquidity traps

Not for blind holding.

Not for emotional decisions.

🎯 Final assessment

$River has explosive upside potential.

But it also carries structural risk.

This is an opportunity market, not a safety market.

High reward — high responsibility.

What’s your view on $River ?

👇

Do you see it as a short-term trading weapon

or a future decentralized project?

#RIVER #OnChainAnalysis #CryptoMarket #ProfessionalTrading #RiskManagement #BinanceSquare #DYOR