Technical key levels

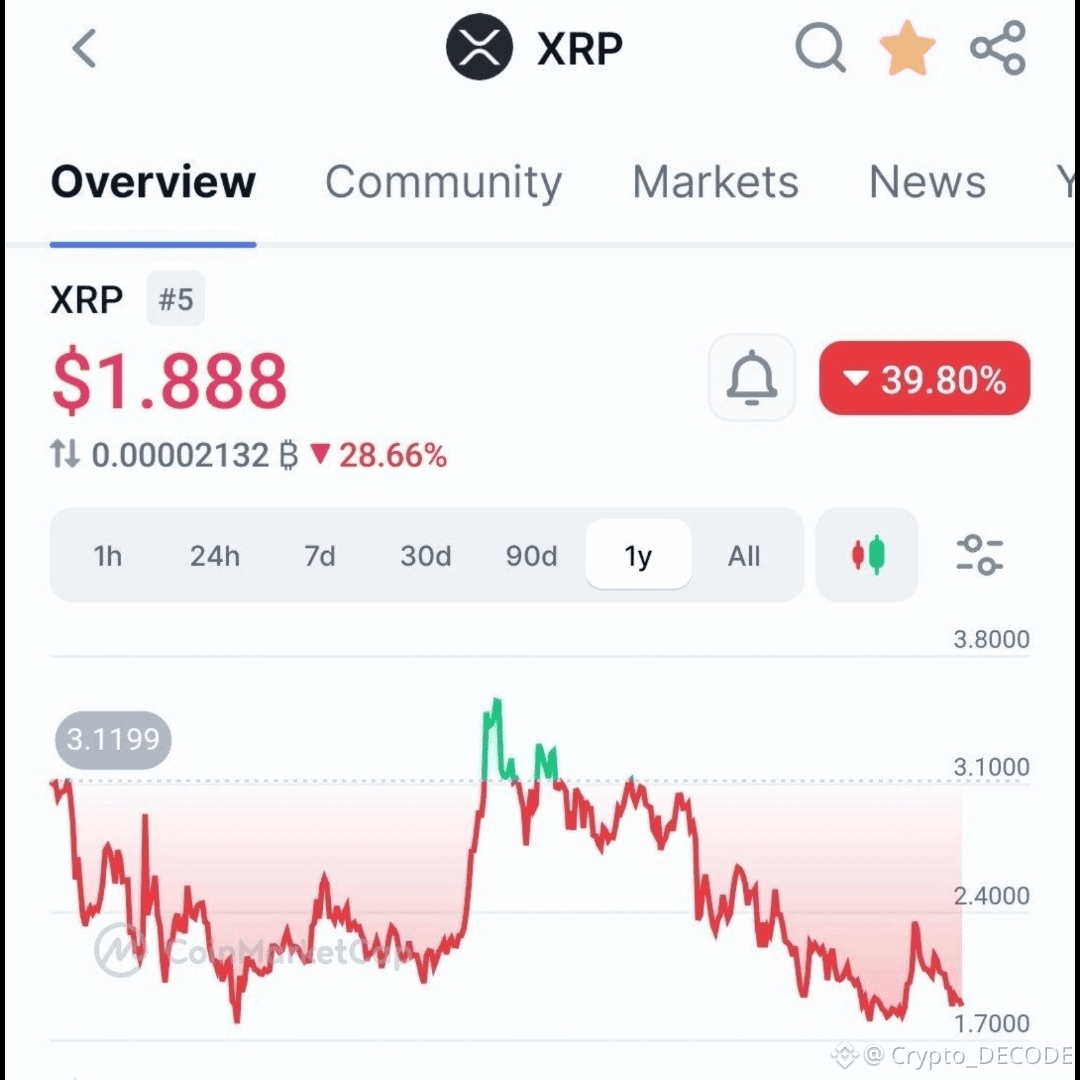

Immediate support: $1.88–$1.90 (15m/15–60m support cluster; orderbook bids concentrated ~1.883–1.884). Evidence: 15m support 1.8778, recent closes holding ~1.88–1.90. cryptonews

Next structural support: $1.80–$1.85 (previous lower-range liquidity zone and potential buyers). If broken, vulnerability to deeper correction increases.

Near-term resistance / supply wall: $1.91–$1.92 (15m Bollinger upper & short-term fib R23.6 ~1.888–1.892; immediate sellers listed ~1.891). cryptonews

Clear bullish pivot / invalidation for shorts: $1.95–$2.00 (closing and holding above this opens larger intraday recovery and reduces short pressure).

Key higher-timeframe breakout to resume uptrend: $2.30 (monthly/4H structural breakout level referenced by market commentators; monthly close above $1.91 noted as important). coinspeaker

What the indicators and on-chain/fund flows say

Short-term indicators show oversold readings on 1H (KDJ/RSI) but 15m/15–60m RSI/KDJ have oscillated; 15m shows mixed momentum with recent net buying in short windows (15m net flow positive) while 24h net flow is negative (large outflows). Orderbook imbalance slight ask-heavy at top (imbalance_5 negative). These signals mean tactical bounces are likely but follow-through depends on larger flows. cryptonews

Immediate next steps / trade map

If you are a spot trader looking to accumulate:

Consider staggered buys on weakness around $1.88–$1.90 (add) and $1.80–$1.85 (core accumulation). Place safety buffer below $1.78.

Reduce exposure or tighten sizing if price breaches $1.75–$1.80 (deeper structural risk).

If you are a short-term trader (scalp/swing):

Look for intraday long entries when price holds $1.88–$1.90 with confirmation: rising 15m net flow, shrinking ask volume, or rejection wick off support. Target first take-profit near $1.91–$1.93, next at $1.95–$2.00.

For momentum short setups, aggression increases after failure to reclaim $1.95 and clear break below $1.80 — use tight stops and size to leverage possible short-squeeze dynamics (funding negative / OI elevated).

If trading derivatives:

Be aware funding/open interest dynamics: open interest sizable but OI/market-cap modest (~1.81%). Average funding shows elevated positive (0.547% weighted) implying cost pressures for one side — monitor funding swings before using leverage.

Prefer entries above $1.95–$2.00 for directional longs; consider short setups if price decisively breaks below $1.80 with increased OI and outflows.

Risk triggers to watch (could change the plan)

Sustained 24h net outflow and rising large-sell orders into bids (will push toward $1.75–$1.60).

Macro or crypto-wide deleveraging (BTC weakness) that increases liquidation cascades.

Positive regulatory / on-chain news or institutional flows (ETFs, partnerships) that flip sentiment quickly — recent Ripple partnership and network activity remain bullish context and can trap shorts. criptofacil

Concise playbook

Accumulate small on $1.88–$1.90; add on $1.80–$1.85; protect below $1.75.

Short-term target ladder: 1) $1.91–$1.93 2) $1.95–$2.00 3) beyond $2.30 for trend continuation.

If price closes and holds > $1.95–$2.00, reduce defensive posture; if price breaks and holds < $1.80, shift to defensive / risk-off.