@Dusk $DUSK began as a quietly ambitious project in 2018 with a clear, narrow aim: to build a Layer 1 that could sit comfortably at the intersection of regulated finance and modern cryptography, giving institutions the tools to move and manage tokenized assets without surrendering the privacy or auditability those same institutions need. From the start the team framed the work as more than another public ledger it was intended as infrastructure for securities, compliant DeFi, and real-world assets, and that founding purpose has shaped each design choice since

Under the hood Dusk’s architecture reads like a ledger written with institutional priors. The project’s whitepaper and technical documentation describe a modular chain that pivots around research-grade cryptography and a Proof-of-Stake oriented consensus designed to provide fast finality while allowing permissionless participation in validation. Rather than shoehorning traditional account models into a single monolithic runtime, Dusk separates concerns: execution environments, settlement layers, and the cryptographic primitives that protect confidentiality are treated as composable parts. That modular approach is intended to make it easier for regulated actors to apply controls, audits, and selective disclosure where required while still benefiting from blockchain guarantees.

Privacy is not an afterthought for Dusk but a first-class design constraint balanced against the need for compliance. The network builds in confidential ownership and transaction flows so that sensitive economic relationships are not trivially observable on-chain, yet it also includes mechanisms that let authorized parties reveal or verify information when regulators, auditors, or contractual terms demand it. In practice that means relying on advanced cryptographic techniques and protocol workflows that allow parties to demonstrate properties of an asset or transfer without exposing underlying confidential data, a posture the project repeatedly emphasizes in its developer docs and public pieces about bridging TradFi and DeFi. The claim is not that Dusk is an opaque privacy coin; it is that the chain seeks to let privacy and selective auditability coexist.

That tradeoff naturally steers the network  toward tokenizing real-world assets. Dusk’s public materials and blog posts walk through use cases such as tokenized securities, debt instruments, and other regulated instruments where ownership details, investor lists, or trade sizes can be sensitive but where regulators still need provenance and audit trails. The team has published primers on real-world assets and repeatedly framed Dusk as infrastructure to let capital markets, exchanges, and financial institutions put traditionally opaque instruments onto programmable rails without giving away commercially valuable information. Recent ecosystem announcements and writeups indicate active work on application layers and market infrastructure that would support regulated issuance and trading directly onchain.

toward tokenizing real-world assets. Dusk’s public materials and blog posts walk through use cases such as tokenized securities, debt instruments, and other regulated instruments where ownership details, investor lists, or trade sizes can be sensitive but where regulators still need provenance and audit trails. The team has published primers on real-world assets and repeatedly framed Dusk as infrastructure to let capital markets, exchanges, and financial institutions put traditionally opaque instruments onto programmable rails without giving away commercially valuable information. Recent ecosystem announcements and writeups indicate active work on application layers and market infrastructure that would support regulated issuance and trading directly onchain.

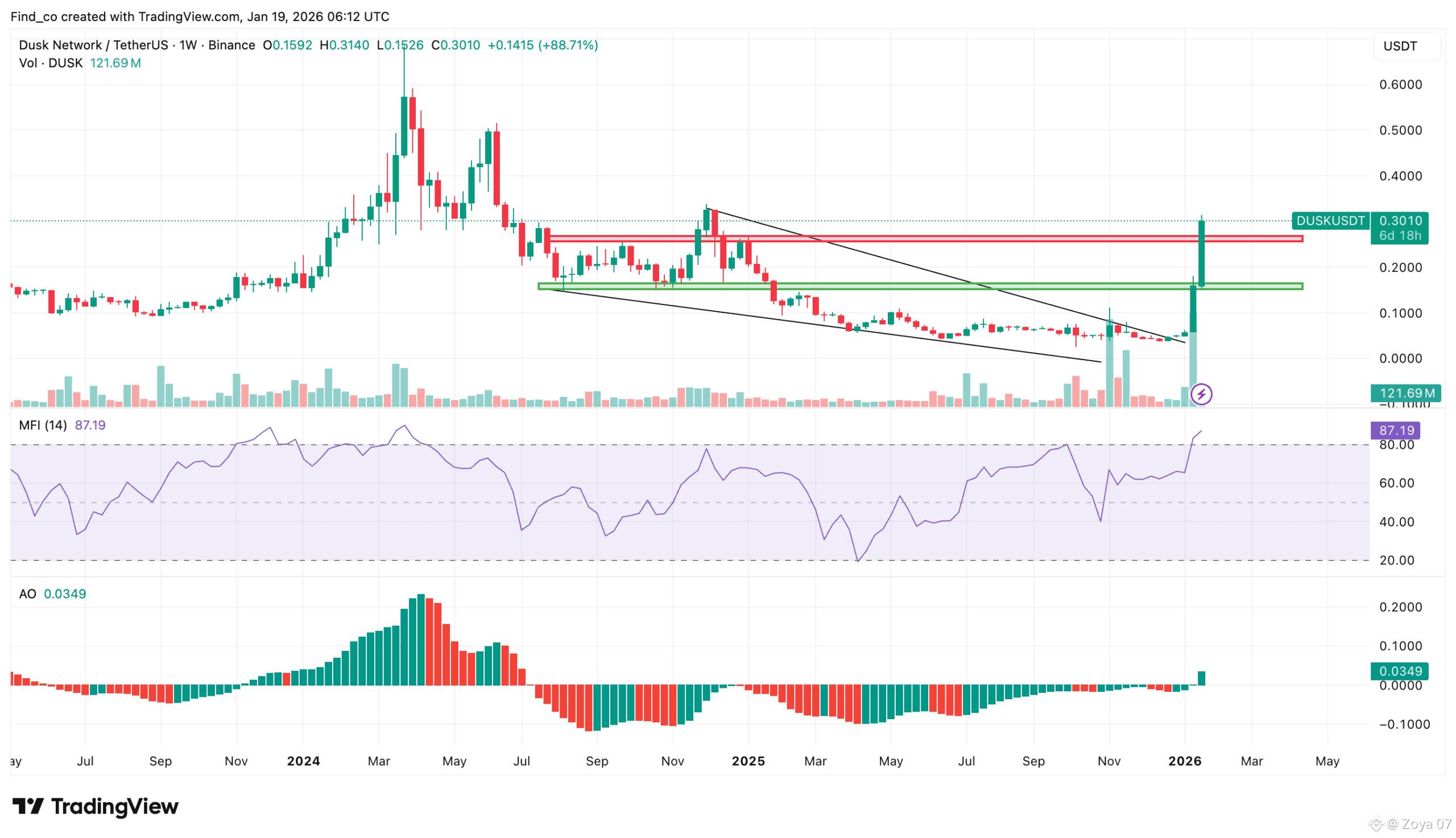

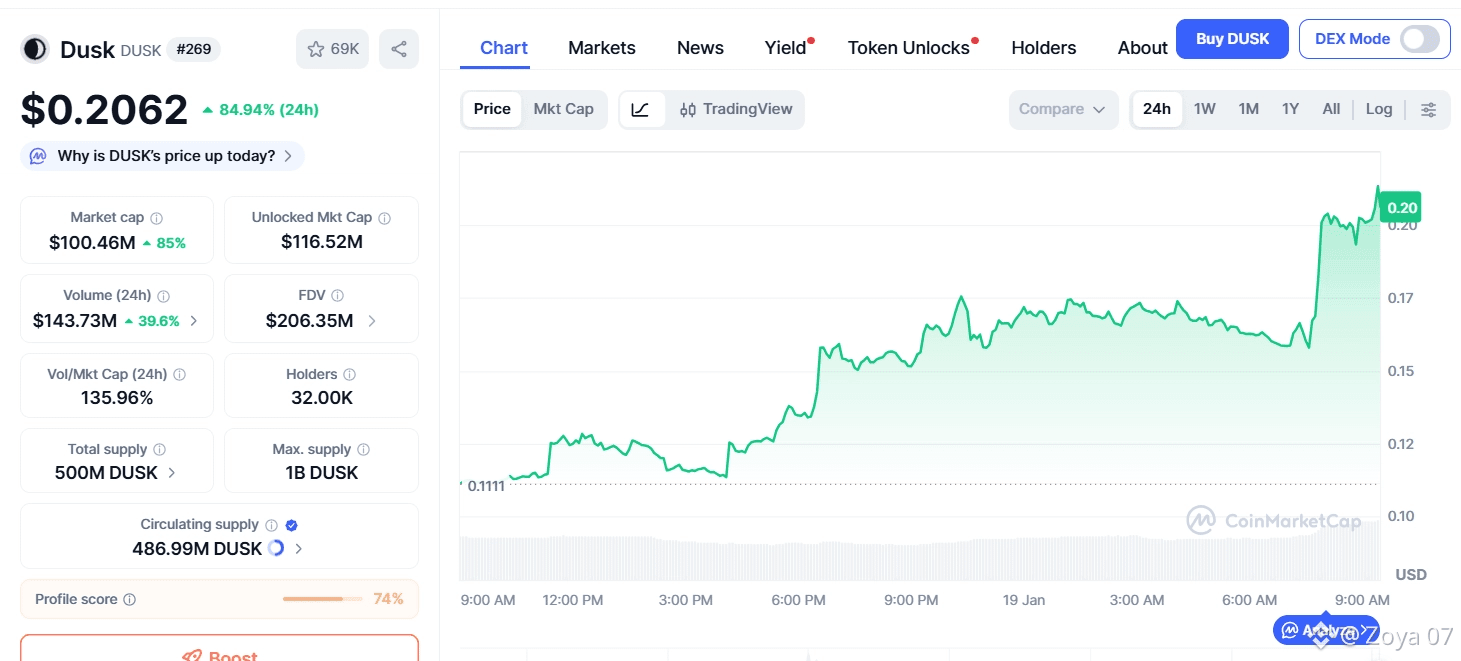

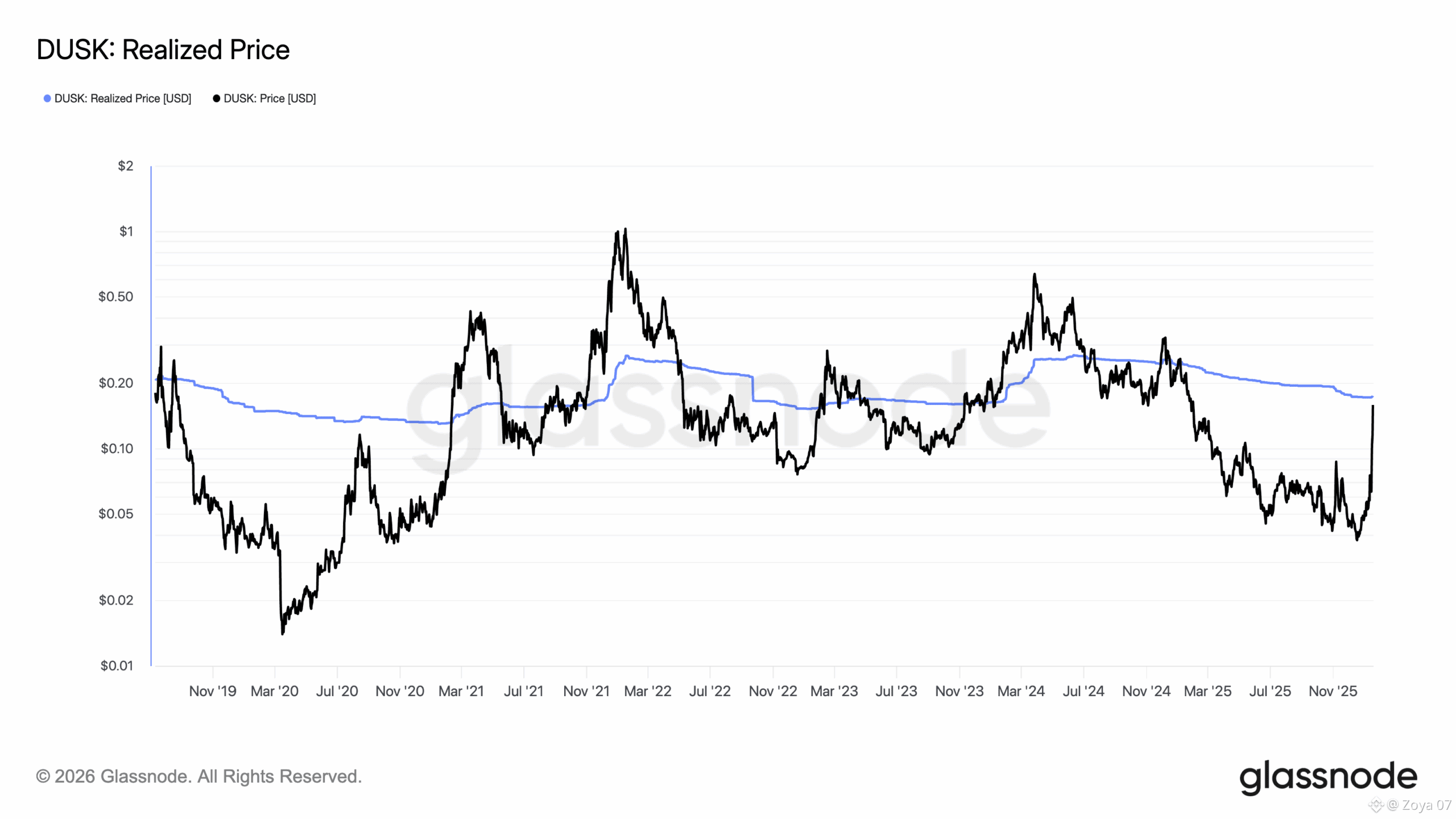

Like every Layer 1 that hopes to serve institutional flows, Dusk pairs its design story with token economics and market plumbing. The native token, DUSK, is used for staking, fees, and economic security, and public market trackers show a circulating supply on the order of hundreds of millions of tokens with a broader maximum supply figure often reported as one billion tokens figures you’ll find on standard aggregators alongside live market-cap and volume snapshots. Those listings also reflect that DUSK is available on centralized exchanges and liquidity venues, which matters because institutional use cases rely on accessible on- and off-ramps as much as on protocol features.

The project has been evolving toward broader smart-contract capabilities and real-world integrations. Roadmap discussions and recent coverage point to work on an EVM-compatible execution layer and application rollouts aimed at tokenized securities trading, often framed as the next phase of bringing regulated markets onchain. Those efforts an EVM layer and specialized dApps for securities are designed to make it easier for existing DeFi tooling and developer skillsets to plug into Dusk’s privacy-aware settlement fabric while giving regulated actors the controls they require. Public commentary around these developments stresses that the immediate priorities are onboarding compliant assets, launching the application layer, and enabling cross-chain movement for regulated tokens.

Operationally, the network’s validator and staking model follows the expected logic of PoS ecosystems but with additional attention to anti-sybil measures, fast finality, and resistance to privacy-targeted attacks; those are technical claims the team defends with research papers and protocol notes. Governance and the cadence of upgrades have leaned toward iterative, research-backed improvements rather than rapid feature-creep, a pattern that fits a product aimed at custodians, exchanges, and regulated issuers who prefer stability and predictable upgrade paths.

Putting all of this together, Dusk occupies a thoughtful niche: it is neither a public-first maximalist ledger nor a closed, permissioned database; it is an attempt to bring the cryptographic and transparency benefits of blockchains into financial workflows that cannot tolerate full public exposure. That positioning brings obvious strengths for tokenizing and trading regulated assets where confidentiality and auditability must coexist, and it also brings real challenges. Designing selective disclosure systems that are both secure and operationally practical is hard, getting market-level liquidity and custody integrations takes time, and persuading traditional financial players to trust novel cryptographic proofs in place of legacy reconciliations is a multi-year endeavor. The coming months and quarters will reveal whether the planned EVM compatibility and the suite of application layer integrations can move Dusk from an architectural promise into the kind of market infrastructure institutions will actively depend on.

If you want, I can pull together a tighter technical explainer that walks through the consensus rounds, the exact cryptographic primitives Dusk uses for confidential transfers, and how their Rusk/EVM execution environments differ in practice, or assemble a timeline of major protocol releases, token unlocks, and exchange listings with dates and source links. Which of those would help you next?@Dusk #Dusk. $DUSK #dusk