There are moments in crypto when you can feel a network before you measure it. Plasma gives me that feeling every time I look closer. Not excitement from charts or hype cycles, but that quiet confidence that comes from seeing something designed around how people actually move value. When I interact with Plasma, it feels amazing because it treats stablecoins not as an afterthought, but as the center of the system. That single design choice changes the entire narrative of what a Layer 1 should be doing in this phase of the market.

Plasma positions itself clearly as a Layer 1 tailored for stablecoin settlement, and that clarity matters. Most chains try to be everything at once. Plasma is focused. It asks a simple question: how should a blockchain behave if its primary job is moving dollars at scale, globally, reliably, and without friction. From that question, every architectural decision flows naturally, and you can feel that coherence when you study the platform behavior.

At the execution layer, Plasma keeps full EVM compatibility using Reth, which immediately lowers cognitive and technical friction for developers. This is important because real adoption does not wait for new tooling. It builds where familiarity already exists. On top of that, PlasmaBFT delivers sub second finality, which psychologically changes how users perceive settlement. Trades feel finished, payments feel done, and there is no lingering anxiety about confirmations. That shift in user psychology is subtle but powerful.

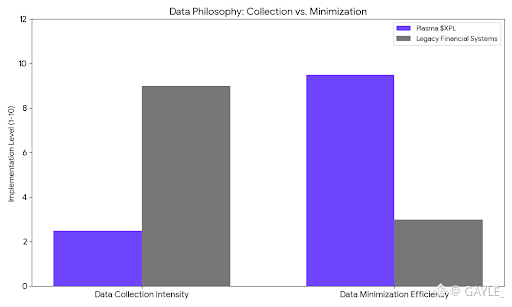

Where Plasma really breaks the pattern is in its stablecoin first features. Gasless USDT transfers and stablecoin first gas are not just conveniences. They rewrite the mental model of using a blockchain. Users stop thinking about holding volatile assets just to move money. They stop calculating fees in something unfamiliar. This lowers emotional resistance, which is one of the biggest hidden barriers to mass adoption. When friction disappears, behavior changes.

From a trading and market psychology perspective, Plasma introduces a new layer of narrative intelligence. Stablecoins are usually treated as passive liquidity tools. Plasma turns them into active infrastructure assets. That reframing matters. It encourages traders and builders to think in terms of flow, settlement velocity, and reliability rather than pure speculation. Over time, this kind of narrative attracts a different class of capital, more patient, more operational, more aligned with real usage.

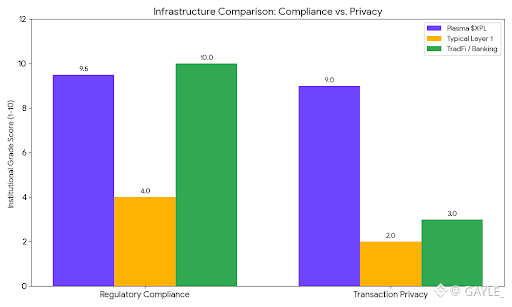

Security and neutrality are handled with similar intentionality. Bitcoin anchored security is not a marketing tagline here. It is a statement about censorship resistance and long term credibility. By anchoring to Bitcoin, Plasma borrows from the most battle tested trust layer in the industry. For institutions and payment providers, this matters deeply. It signals that the chain is designed to survive political pressure, regulatory shifts, and market cycles.

Plasma’s target users tell another important story.

• Retail users in high adoption markets who need fast, cheap, reliable dollar transfers

• Businesses that want predictable settlement without volatility risk

• Institutions operating in payments and finance that care about neutrality and uptime

This is not a speculative audience. It is a usage driven audience. That distinction changes how value accrues over time.

What impresses me most is how Plasma treats the user relationship. The chain does not ask users to adapt to it. It adapts to them. Stablecoin native gas, familiar EVM tooling, fast finality, and intuitive settlement flows all signal respect for the user’s time and attention. In a market where many platforms still optimize for narrative hype, Plasma quietly optimizes for trust.

In the broader market context, Plasma challenges the idea that Layer 1 success must come from competing throughput numbers or flashy innovation. Instead, it competes on relevance. As global stablecoin volumes grow and regulation pushes demand for transparent, neutral settlement layers, Plasma feels positioned ahead of the curve. It aligns with where behavior is going, not where speculation has been.

Plasma does not try to impress loudly. It earns attention through coherence, restraint, and respect for how money actually moves. Every time I revisit its design, I feel that same calm confidence. It feels amazing because it feels inevitable. In a market learning to value reliability over noise, Plasma represents a mature shift in crypto’s narrative, from experimentation toward infrastructure that quietly works.