In the decentralized crypto-world, technical analysis explains not everything, but part of everything. At present, the technical specifics of Plasma (XPL) are not easy to understand. Supertrend indicator is used by most traders to observe the direction in which the market is moving though the signal has declined. Prices remain below the major resistance levels on a daily basis. The fact that we are not staking until we hit Q1 2026 meant that many short-term traders have sold.

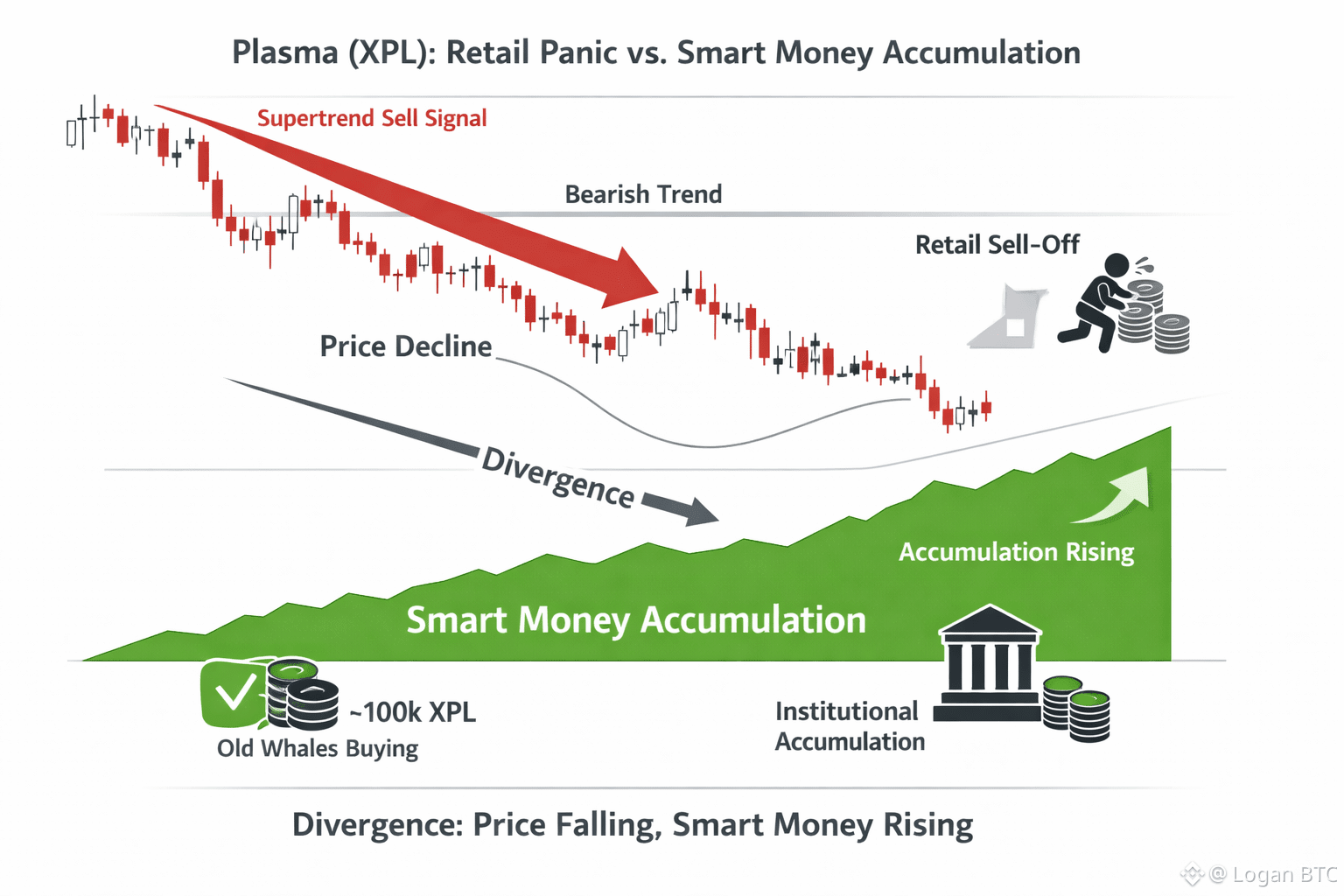

Although the chart may indicate that the only candles are red, another game is being played. Onchain records indicate that small traders are panicking and liquidating, whereas large wallets (more than 100,000 XPL and one year old) are purchasing in large quantities. The failure of the price to equal the buyers does not mean that the fall is their death sentence; it is a chance to the analysts who see further than the charts.

Trap Supertrend Trap: Leading vs. Lagging.

The Supertrend follows a trend well and substantiates previous actions. It occupationally demonstrated the postponement of the sell-off, once it was staked. Yet the large traders do not even rely on the lagging information; they gamble on the next move.

The panic selling of the small traders by the larger players is an opportunity to buy at a low cost. To institutions, bearish Supertrend conceals large purchases that do not raise the price, known as accumulation and distribution. They will purchase not due to the chart, but due to Q1 2026 roadmap.

The Foundational Thesis: Why Buy Now?

Big investors do not tend to use options much, they are betting on the past. In the case of XPL there are three reasons why not to be able to see because of looking at the price.

The NEAR Intents Liquidity Engine.

The collaboration of Plasma and NEAR Protocol might transform everything, but the market is not ready to realize it completely. Plasma will integrate into a $63b cross-chain liquidity network, due to a 1billion-dollar investment that links XPL to NEAR system. XPL will not be an intermediate layer but a convenient, easy to access liquidity centre. Companies assume that when the connection is established, they can leverage on XPL at a speedy rate, adding value to the aggregate value locked.

[The Yield Magnet]: Pendle on Plasma.

The trust in DeFi boon came as sPENDLE staking on Plasma was introduced at the end of January. Pendle is the first to speculate on turning returns on trades in the form of tokens, and on XPL, it is possible to create intricate yield-farms. Big money investors prefer predictable returns, which means that Plasma can contribute to advanced DeFi and not simple remittances.

The “Plasma One” Expansion

Although traders fear even a minor downturn, a neobank called Plasma One was started in the Middle East and Southeast Asia. Money circulation in such regions is giant, and the free of charge stablecoin created by Plasma assists banks significantly. XPL is not just a token, but it is the transportation line of new financial technology of new markets to big investors.

The Staking Supply Shock

Lastly, postponing staking is an ambiguous transformation that benefits the waiters until 2026 in Q1. Upon the launch of staking, the user will have the option to lock XPL and receive rewards through delegation. This will lower the supply of XPL.

This supply cut includes the sale of XPL by big investors. Million units of XPL being locked will reduce the supply to sell. As long as demand remains constant or increases in the presence of NEAR and Pendle, and supply declines, the price will be corrected.

Conclusion

The pessimistic Supertrend on the XPL chart indicates the current mood of the people, but it does not guarantee the future value. There is a large opportunity in the price variations of small and big sales that contrarian traders can take. By the time most individuals buy when the chart is green, which will be likely by a 2030 percent increase, large investors will have already placed their bets that the new infrastructure will make the price tomorrow. The hardest markets to trade in manifest as crypto markets: the best trades are made when the chart is red and the fundamentals are excellent.