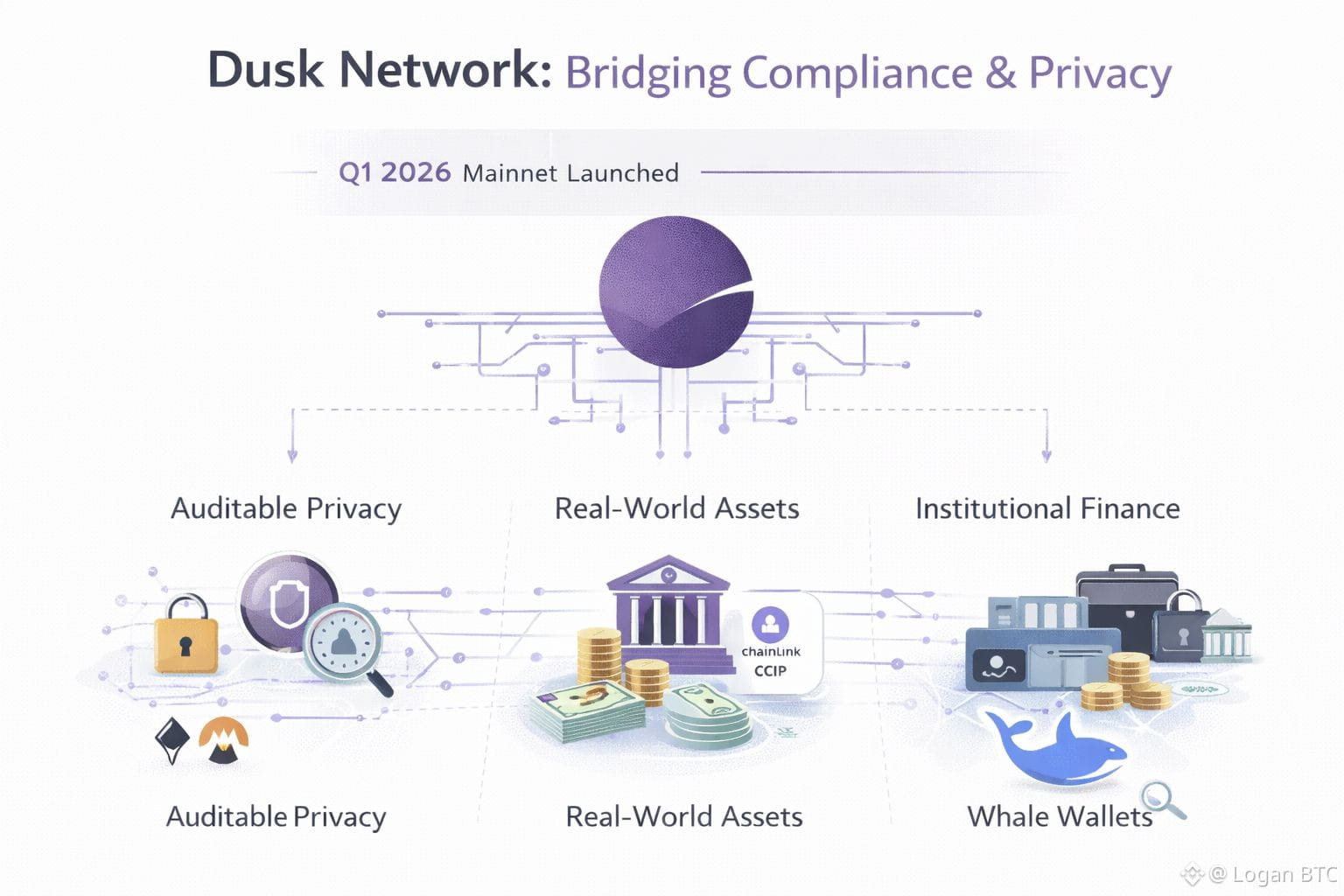

Dusk Network had not spoken to the room in six years. Where other Layer-1s were pursuing meme coin seasons and NFT mania, the Dusk team was keeping their heads down and working on an apparently unglamorous issue regulatory compliance. It is, however, no longer silent as at January 2026. Having successfully launched its Mainnet on January 7, Dusk has shifted to being a hypothetical so-called privacy chain to an operational, industrial-level financial infrastructure.

It was not more accidental a time. With the MiCA regulations of the European Union fully operationalized, the crypto market is divided into two camps, the Wild West of permissionless DeFi, and the Walled Garden of institutional finance. The first blockchain that is, arguably, meant to bridge them is called Dusk, which is a blockchain, making its unique value proposition that retail investors seem to overlook, yet is in such (or more particularly, in desperate need of): Auditable Privacy.

Solving the “Privacy Paradox”

The gist of Dusk is that it finds a solution to the Privacy Paradox. Historically, there were two options available to blockchains: complete transparency (Ether) or anonymity (Monero). The former cannot be used in institutions as they cannot disclose valuable trade plans, and the latter cannot be employed as they should stay in compliance with the Anti-Money Laundering (AML) laws.

The architecture of Dusk (Zero-Knowledge or ZK) can offer a third option. Dusk transactions are confidential in nature- balances and the amount of transfer is encrypted. However, as opposed to privacy coins in which everything is concealed to the rest of the world, Dusk can be selectively disclosed. A regulator would be given a view key in order to audit a particular transaction without making the data publicly known. This functionality makes the blockchain seem an acceptable settlement layer to banks, with whom they can trade on-chain without revealing their order books to their competitors.

The Real-World Asset (RWA) Engine.

Although the abbreviation RWA has turned into a buzzword in 2025, Dusk will be among the few chains that have a real engine behind it. The first product, DuskTrade, which was developed in collaboration with the Dutch regulated exchange NPEX, will transfer more than EUR300 million of tokenized assets on-chain. This is not an experiment of digital collectibles it is a market place where real securities, bonds, and equities are traded.

More so, the latest incorporation with Chainlink’s CCIP ( Cross-Chain Interoperability Protocol ) makes sure that these assets do not end up suddenly isolated. Securities without a tokenized form can also be transferred to Dusk and be returned to another EVM chain and maintain their compliance metadata. This interoperatability is essential towards liquidity that does not occur as in other specialized chains.

Market Sentiment: The Trap of Sell the News.

In spite of such basic wins, in late January 2026, Dusk has been experiencing a volatile price action. A non-hypocrisical jump to 0.30 during the buildup up to the release of the mainnet has been followed by the correction of the token to the 0.1820 area. Retail traders, used to the mechanics of the situation of instant financiers have called this a sell the news event.

But, according to on-chain data, that is not the case. The positions of whale wallets (top 100 holders) have grown almost 14 per cent in this correction. It is an accumulation pattern that suggests that the smart money sees the post-launch dip as a repricing. They know that infrastructure projects such as Dusk have a longer time-span. It is not a hype cycle that gives the value but rather the gradual and gradual process of adopting the institutional capital into the network, which is only beginning.

Conclusion

Dusk is no longer a potential competitor, it is a real challenge to the legacy financial stack. It has created a moat that is hard to traverse by general-purpose chains by implementing compliance as a part of the Layer-1 protocol. To the investors, the present quiet period since the introduction of the mainnet is an uncommon purple view: the technology is functioning, the regulatory bodies are paying attention, and the institutions are sign-on. The boring compliance orientation of Dusk may represent the most exciting thesis proposition of the year in a 2026 market characterized by regulation.