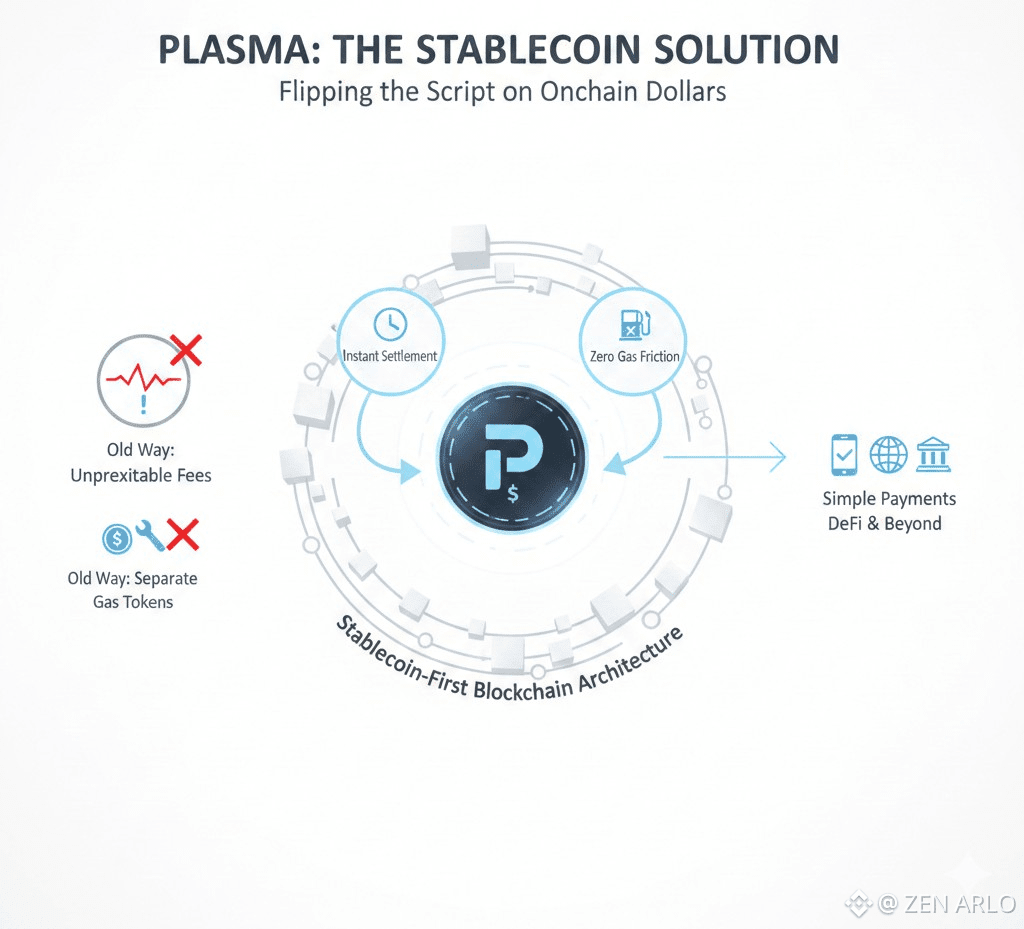

Plasma is trying to solve a very specific problem that keeps showing up everywhere stablecoins are used: moving dollars onchain still feels like crypto plumbing. Fees are unpredictable, finality can be slow, and people often need a separate gas token just to send a simple payment. Plasma flips that around by designing the chain around stablecoin settlement first, and then wrapping everything else around that goal.

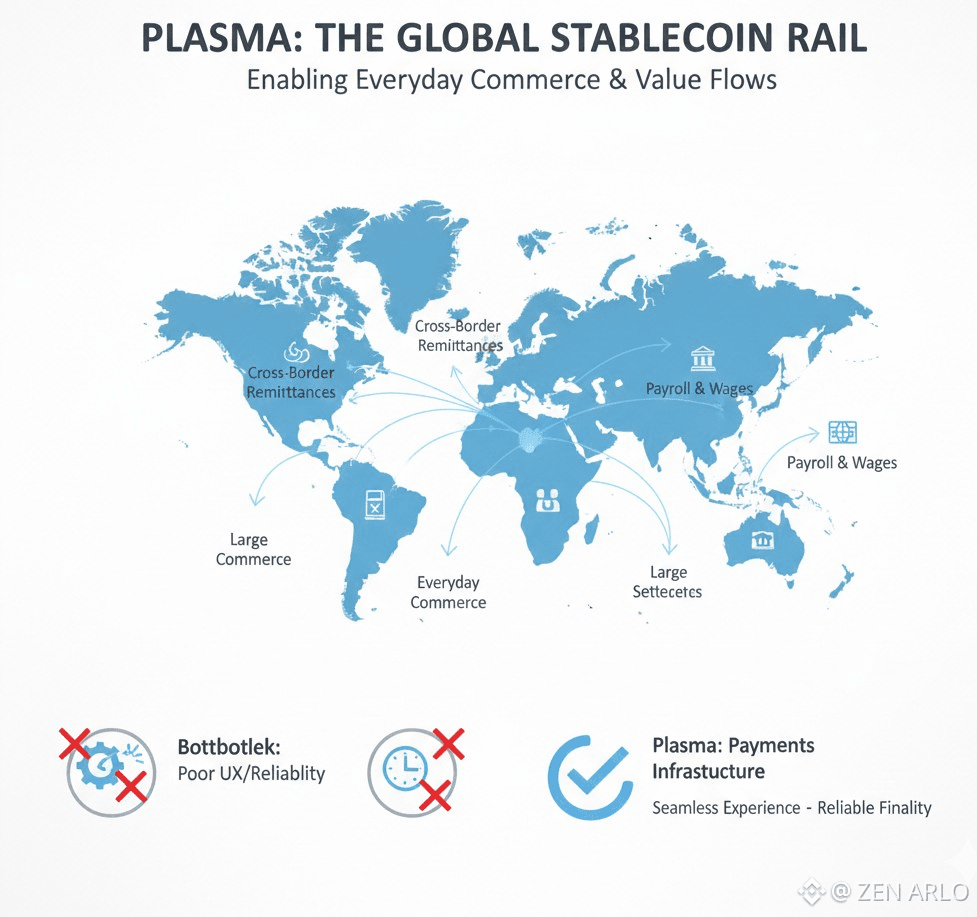

Plasma That focus matters because stablecoins are already behaving like the rails for cross border value. The bottleneck is not demand, it is the experience and the reliability. Plasma is basically saying if stablecoins are going to carry everyday commerce, remittances, payroll, and large settlement flows, the base layer needs to feel like payments infrastructure, not a developer demo.

Plasma leans into what developers already know while changing the performance profile. It is a Layer 1 with PlasmaBFT consensus, described as derived from Fast HotStuff and built to process thousands of transactions per second for fast settlement. On the execution side, Plasma is EVM compatible so Ethereum contracts can deploy without code changes, and the project explicitly says mainnet beta ships with PlasmaBFT for consensus and a modified Reth execution layer for EVM compatibility.

Plasma really separates itself is the stablecoin native layer. The chain design highlights zero fee USDT transfers so a user can send USDT without fees or extra tokens for gas. It also highlights custom gas tokens, meaning fees can be paid in whitelisted assets such as USDT or BTC, which is a direct attempt to remove the awkward step of buying and holding a separate gas asset just to use the network. Then there is confidential payments, positioned as a way to send payments without exposing private transaction details.

Plasma What is live and verifiable right now is that the network exists as a public mainnet beta, with chain ID 9745 and an official public RPC endpoint, plus a public testnet with chain ID 9746. The docs also note that public RPC endpoints are rate limited and intended for lighter use.

Plasma If you want a clean last 24 hours reality check, the explorer makes it easy. On January 29, 2026, the transactions page shows 360,019 transactions in the last 24 hours and total transaction fees of 1,565.35 XPL across that same window.

Plasma The contracts side also shows builders are actively deploying, not just transferring tokens. The verified contracts dashboard shows 262 contracts deployed in the last 24 hours and 27 contracts verified in the last 24 hours. That is the type of signal you look for when you want to see whether an ecosystem is actually wiring up infrastructure.

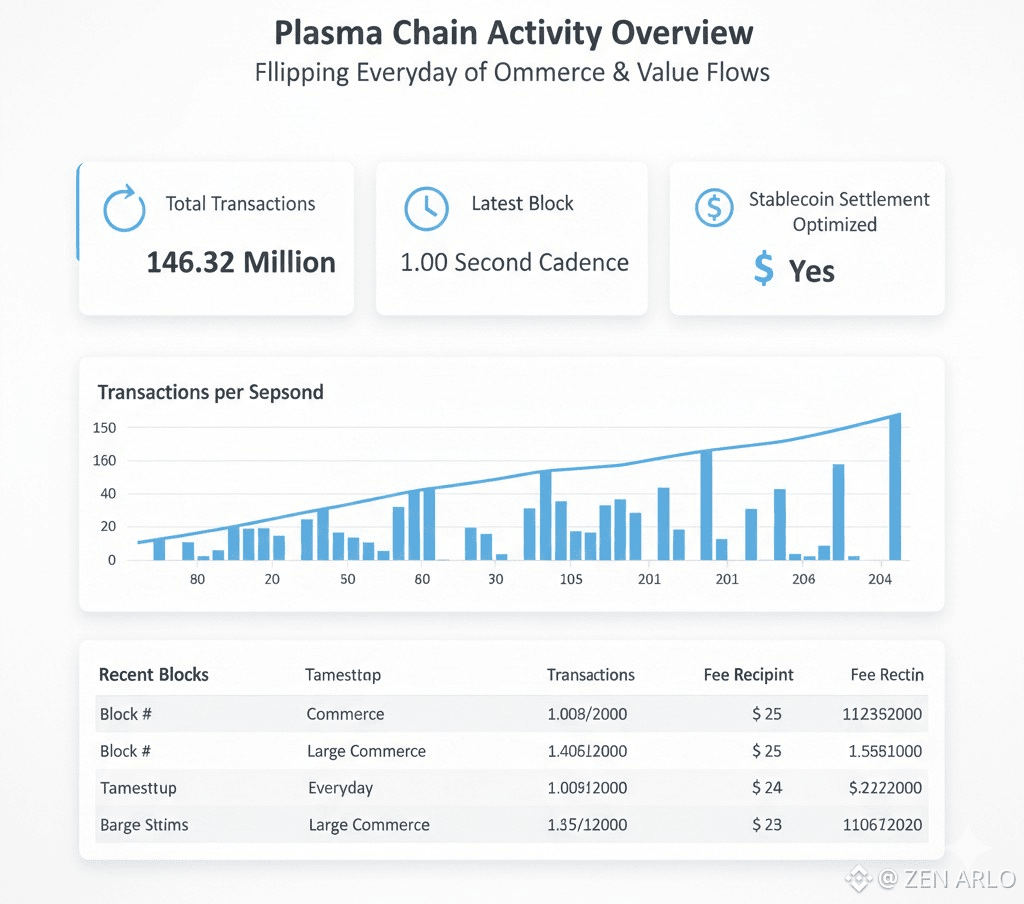

Plasma On overall chain activity, the explorer homepage shows about 146.32 million total transactions and a latest block cadence displayed around 1.00 seconds. That lines up with the whole stablecoin settlement narrative Plasma is pushing.

Plasma frames XPL as the native token that secures the network and supports validator incentives, while stablecoins remain the day to day payment asset. The tokenomics page states an initial supply of 10,000,000,000 XPL at mainnet beta launch, with distribution described as 10 percent public sale, 40 percent ecosystem and growth, 25 percent team, and 25 percent investors. It also states that US public sale purchasers have a 12 month lockup and are fully unlocked on July 28, 2026.

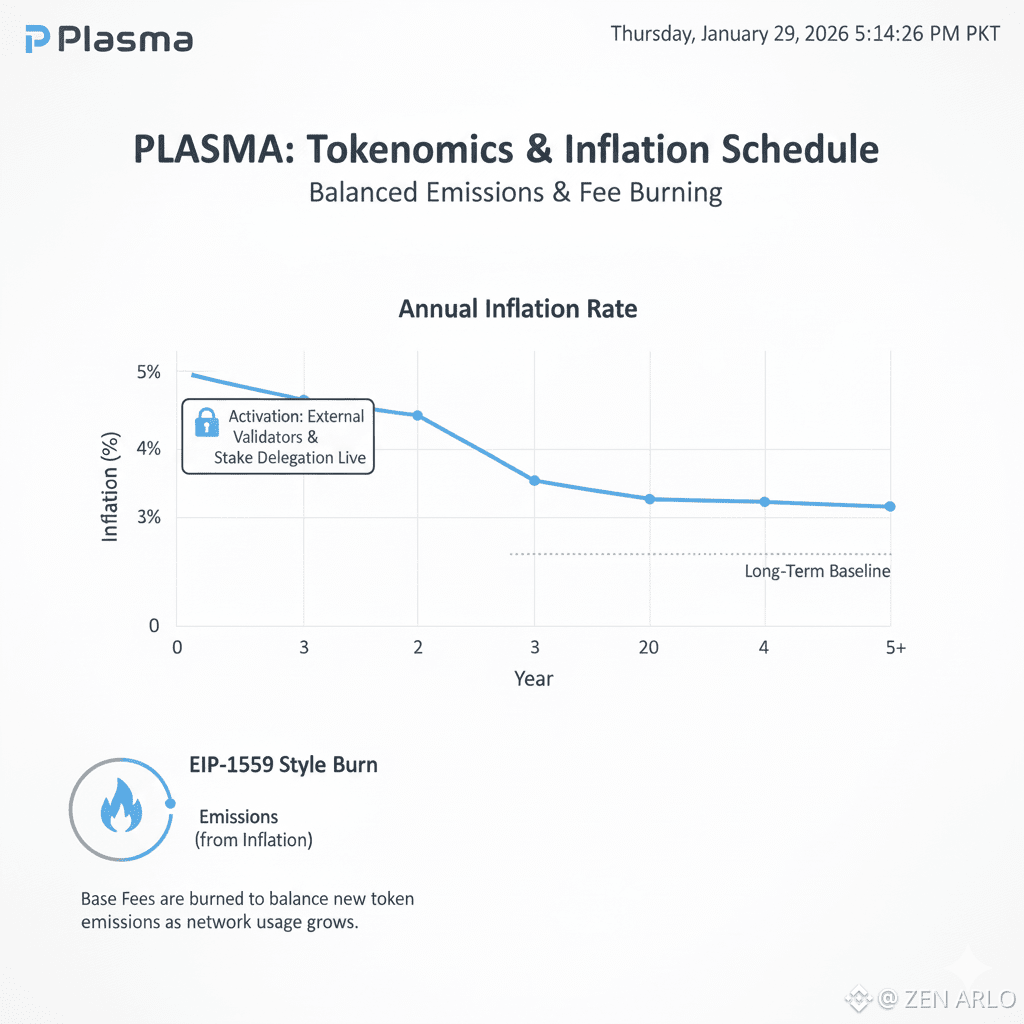

Plasma describes an inflation schedule that starts at 5 percent annual inflation and steps down by 0.5 percent per year until reaching a 3 percent long term baseline. The important part is that Plasma says inflation only activates when external validators and stake delegation go live, not automatically from day one. It also says base fees are burned using an EIP 1559 style approach to help balance emissions as usage grows.

Plasma Benefits are easiest to see when you think in real user journeys. If a network can sponsor USDT transfers at the protocol level, then a normal person can send USDT without first learning gas mechanics. If fees can be paid in whitelisted assets like USDT or BTC, then the friction of holding a separate gas token drops dramatically for most payment flows. For builders, EVM compatibility plus protocol level payment UX features can reduce the amount of custom glue code apps usually need to make stablecoin payments feel smooth.

Plasma When you asked about exits, the clean way to interpret that inside the project is liquidity and usability pathways, not promises. Plasma publishes an ecosystem directory and points users to the official explorer and RPC endpoints, which are the practical routes for moving assets, deploying contracts, and interacting with apps that choose to build there.

Plasmaitself. The project says mainnet beta launches with the core architecture, and that other features such as confidential transactions and the Bitcoin bridge roll out incrementally as the network matures. So the next stretch is not about proving the chain exists, it is about proving the differentiators can scale safely while keeping the stablecoin experience simple.

Plasmais trying to win by narrowing the mission: make stablecoin settlement feel native, fast, and low friction, while staying EVM compatible enough to attract builders quickly. The strongest tell is that the product decisions keep pointing back to the same thing, eliminate gas complexity for stablecoin users, keep finality tight, and build the rest of the stack around that. The main things I would watch next are how quickly external validators and delegation roll out, how the sponsored transfer model holds up at scale, and the pacing of the Bitcoin bridge and confidential payments rollout.