BTC and ETH have noticeably lagged other risk assets. We believe the primary causes are the trading cycle, markets micro structure, and market manipulation by certain exchanges, market makers, or speculative funds.

BTC and ETH have noticeably lagged other risk assets. We believe the primary causes are the trading cycle, markets micro structure, and market manipulation by certain exchanges, market makers, or speculative funds.

Market Background

First, the deleveraging-style decline that began in October caused heavy losses for leveraged participants, especially retail traders. A large portion of speculative capital was wiped out, leaving the market fragile and risk averse.

At the same time, AI-related equities across China, Japan, Korea, and the US surged aggressively. Precious metals experienced a similar FOMO-driven, meme-like rally. These moves absorbed a significant amount of retail capital. This matters because retail investors in Asia and the US remain the primary force in crypto markets.

Another structural issue is that crypto capital is not part of the traditional finance ecosystem. In TradFi, commodities, equities, and FX can all be traded within the same account, making changing asset allocation frictionless. By contrast, moving capital from TradFi into crypto still faces regulatory, operational, and psychological barriers.

Finally, the crypto market has a limited presence of professional institutional investors. Most participants are non-professional, lack independent analytical frameworks, and are easily influenced by speculative funds or exchanges that act as market makers and actively shape sentiment. Narratives such as the “four-year cycle” or the so-called “Christmas curse” are repeatedly promoted despite lacking solid logic or data.

Simplistic linear thinking dominates, for example directly attributing BTC’s moves to events like the July 2024 yen appreciation without deeper analysis. These narratives spread widely and directly influence prices.

Below, we analyze the issue through our own independent thinking rather than short-term narratives.

Time Horizon Matters

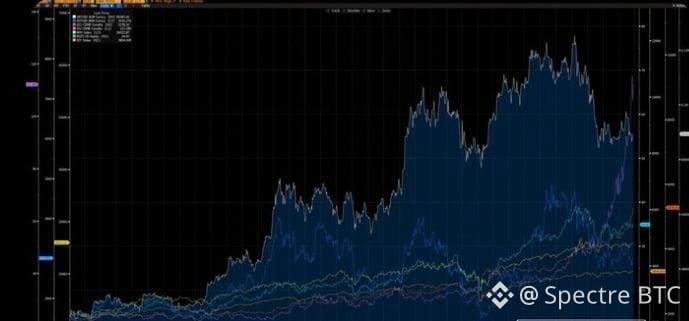

Over a three-year horizon, BTC and ETH have underperformed other major assets, with ETH being the weakest.

Over a six-year horizon (since Mar 12th, 2020), both BTC and ETH have outperformed most assets, and ETH becomes the strongest performer.

When the timeframe is extended and viewed from a macro perspective, the short-term underperformance view is simply a mean reversion within a much longer historical cycle.

Ignoring underlying logic and selectively focusing on short-term price behavior is one of the biggest mistakes in investment analysis.

Rotation Is Normal

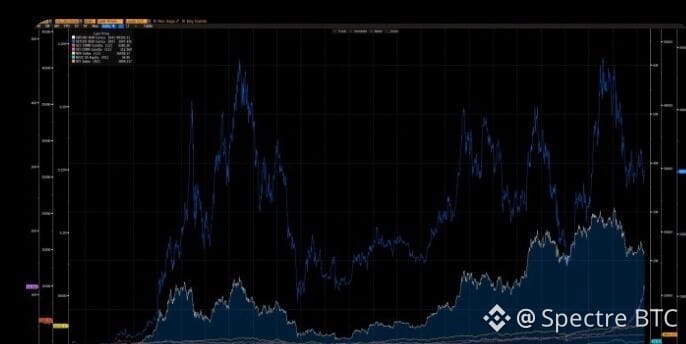

Before the silver short squeezing that began last October, silver was also among the weakest RISK ASSETS. Today, it has become the strongest performer on a three-year basis.

This is directly comparable to BTC and ETH. They remain among the strongest assets over a six-year cycle, even though they are currently underperforming in the short term.

As long as BTC’s narrative as “digital gold” and a store of value has not been fundamentally invalidated, and as long as ETH continues to integrate with the AI wave and serve as core infrastructure for the RWA trend, there is no rational basis for them to become long-term underperformers relative to other assets.

Once again, ignoring fundamentals and cherry-picking short-term price movements is a major analytical error.